Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7206

Pages:89

Published On:December 2025

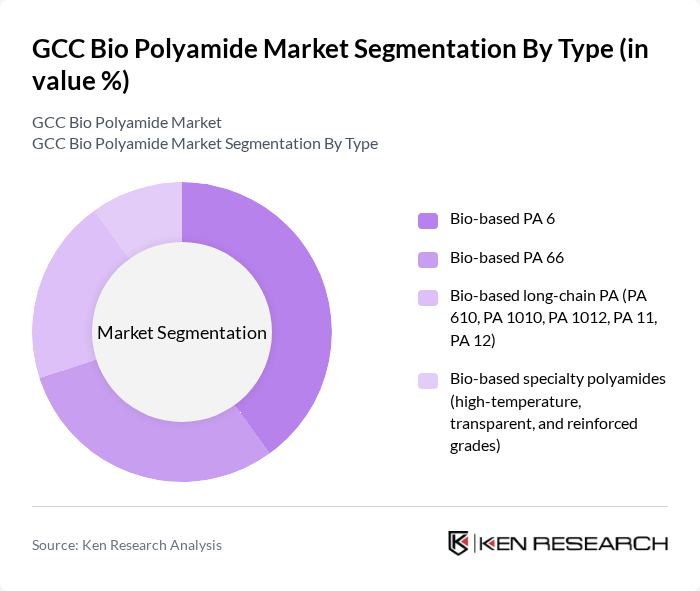

By Type:The bio polyamide market can be segmented into various types, including bio-based PA 6, bio-based PA 66, bio-based long-chain PA (PA 610, PA 1010, PA 1012, PA 11, PA 12), and bio-based specialty polyamides (high-temperature, transparent, and reinforced grades). Among these, bio-based PA 6 and bio-based PA 66 are leading the market due to their widespread applications in automotive and textile industries, driven by their excellent mechanical properties and sustainability credentials.

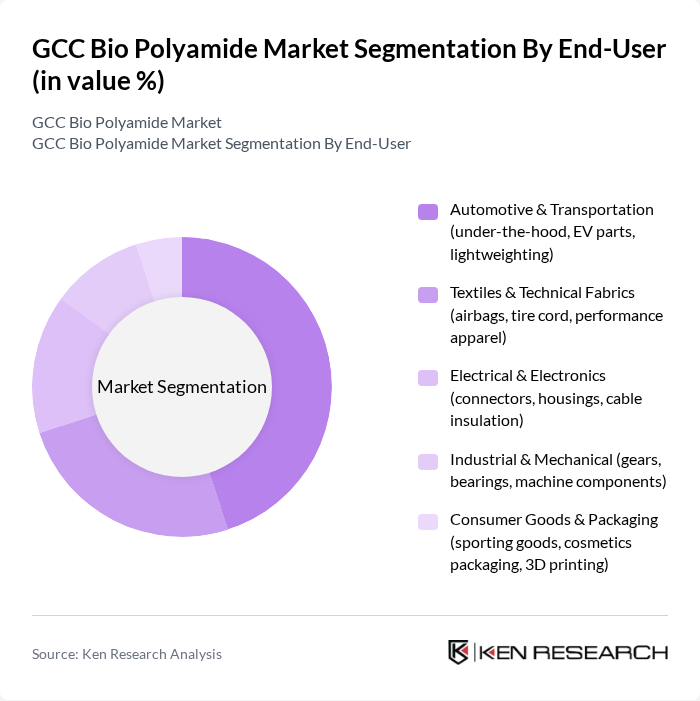

By End-User:The end-user segmentation of the bio polyamide market includes automotive & transportation, textiles & technical fabrics, electrical & electronics, industrial & mechanical, consumer goods & packaging, and others. The automotive & transportation sector is the dominant end-user, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions in vehicles.

The GCC Bio Polyamide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arkema S.A. (Rilsan and Rilsamid bio-based polyamides), Evonik Industries AG, BASF SE, DSM Engineering Materials (d/b/a Envalior), Solvay S.A., Lanxess AG, RadiciGroup, DOMO Chemicals, EMS-CHEMIE Holding AG, SABIC, QatarEnergy / QatarEnergy Renewable Solutions, Saudi Basic Industries Corporation (SABIC Specialties & Ventures in bio-based polymers), UBE Corporation, Toray Industries, Inc., Mitsubishi Chemical Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC bio-polyamide market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As technological advancements continue to lower production costs, the market is likely to expand significantly. Additionally, the growing emphasis on circular economy practices will encourage manufacturers to innovate and develop new applications for bio-polyamides, further enhancing their market presence. The collaboration between industries and eco-friendly brands will also play a crucial role in shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-based PA 6 Bio-based PA 66 Bio-based long-chain PA (PA 610, PA 1010, PA 1012, PA 11, PA 12) Bio-based specialty polyamides (high?temperature, transparent, and reinforced grades) |

| By End-User | Automotive & Transportation (under?the?hood, EV parts, lightweighting) Textiles & Technical Fabrics (airbags, tire cord, performance apparel) Electrical & Electronics (connectors, housings, cable insulation) Industrial & Mechanical (gears, bearings, machine components) Consumer Goods & Packaging (sporting goods, cosmetics packaging, 3D printing) Others (oil & gas, building & construction) |

| By Application | Fibers & Filaments Engineering Plastics & Compounds Films, Coatings & Barrier Materials D Printing Powders and Specialty Applications |

| By Geography | Saudi Arabia UAE Qatar Kuwait Oman |

| By Distribution Channel | Direct Sales to Converters and OEMs Regional Distributors and Traders Online / E-commerce Platforms Strategic Supply & Licensing Agreements |

| By Product Form | Pellets / Granules Compounded Grades (glass?filled, mineral?filled, flame?retardant) Fibers & Yarns Films, Sheets & Molded Parts |

| By Industry Standards | ISO & ASTM Mechanical / Thermal Performance Standards REACH & RoHS Compliance Automotive Standards (e.g., OEM material specs, ISO/TS 16949) Environmental Certifications (bio?content, LCA, ecolabels) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Bio Polyamide Applications | 100 | Product Development Managers, Procurement Specialists |

| Textile Industry Usage | 80 | Textile Engineers, Sustainability Coordinators |

| Consumer Goods Packaging | 70 | Packaging Designers, Brand Managers |

| Electronics Component Manufacturing | 60 | Manufacturing Engineers, Quality Assurance Managers |

| Research Institutions and Academia | 50 | Research Scientists, Academic Professors |

The GCC Bio Polyamide Market is valued at approximately USD 230 million, reflecting a significant growth trend driven by the increasing demand for sustainable materials across various industries, particularly automotive and textiles.