Region:Global

Author(s):Geetanshi

Product Code:KRAC8292

Pages:98

Published On:November 2025

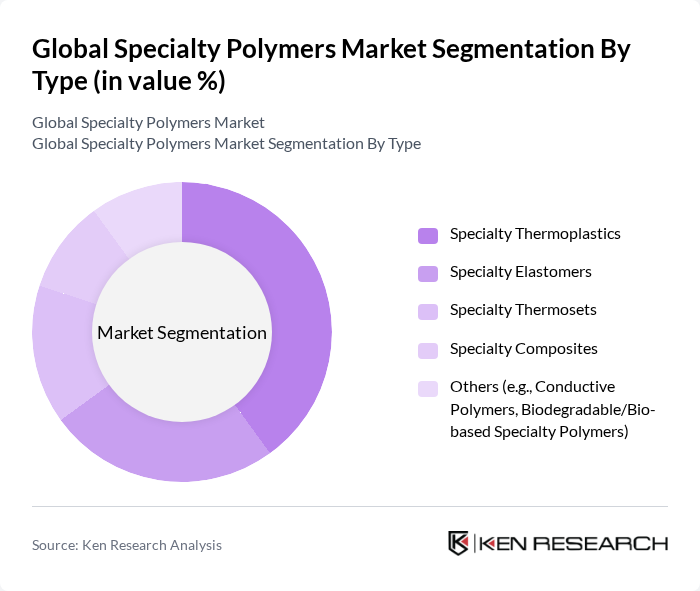

By Type:The specialty polymers market is segmented into specialty thermoplastics, specialty elastomers, specialty thermosets, specialty composites, and others such as conductive and biodegradable polymers. Specialty thermoplastics remain the leading segment due to their versatility, ease of processing, and broad application in automotive, electronics, and packaging. The market is also witnessing rapid growth in bio-based and biodegradable specialty polymers, driven by sustainability initiatives and regulatory pressures. Specialty elastomers are widely used in automotive and electronics for their flexibility and durability, while specialty thermosets and composites are essential for high-performance, structural, and lightweight applications .

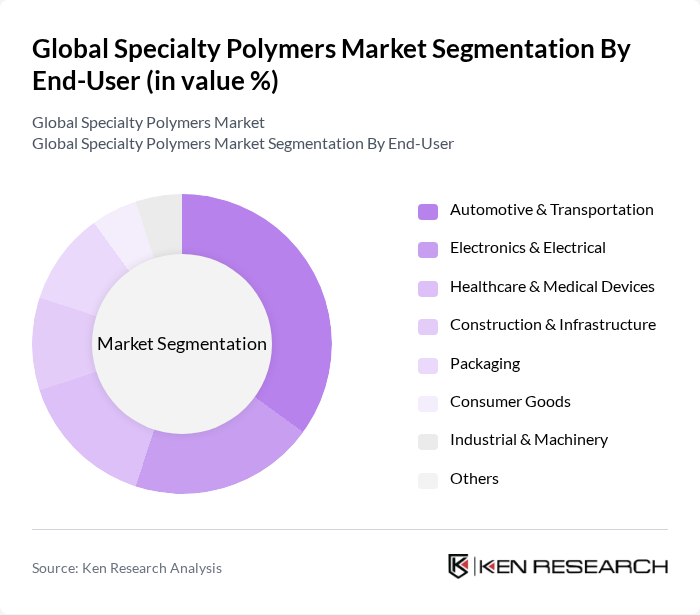

By End-User:The end-user segmentation includes automotive & transportation, electronics & electrical, healthcare & medical devices, construction & infrastructure, packaging, consumer goods, industrial & machinery, and others. The automotive & transportation sector is the dominant end-user, fueled by the need for lightweight, durable, and fuel-efficient vehicle components. Electronics & electrical applications are expanding rapidly, driven by miniaturization and the proliferation of advanced consumer devices. Healthcare & medical devices represent a significant growth area, with specialty polymers used in implants, drug delivery, and diagnostic equipment. Packaging and construction sectors are also adopting specialty polymers for improved performance and sustainability .

The Global Specialty Polymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., DuPont de Nemours, Inc., Evonik Industries AG, Covestro AG, Mitsubishi Chemical Group Corporation, Solvay S.A., Huntsman Corporation, LyondellBasell Industries N.V., SABIC (Saudi Basic Industries Corporation), Arkema S.A., Eastman Chemical Company, 3M Company, Celanese Corporation, INEOS Group Holdings S.A., DSM-Firmenich AG, Lubrizol Corporation, Wacker Chemie AG, RTP Company, and Tosoh Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the specialty polymers market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of smart technologies and the shift towards bio-based polymers are expected to reshape product offerings. Additionally, the focus on sustainability will likely lead to increased investments in recycling initiatives and circular economy practices. As industries adapt to these trends, the market is poised for significant transformation, fostering innovation and growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Specialty Thermoplastics Specialty Elastomers Specialty Thermosets Specialty Composites Others (e.g., Conductive Polymers, Biodegradable/Bio-based Specialty Polymers) |

| By End-User | Automotive & Transportation Electronics & Electrical Healthcare & Medical Devices Construction & Infrastructure Packaging Consumer Goods Industrial & Machinery Others |

| By Application | Coatings Adhesives Sealants Films and Sheets Fibers Membranes Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) |

| By Product Form | Granules Powders Liquids Films Others |

| By Performance Characteristics | High-Temperature Resistance Chemical Resistance Electrical Conductivity/Insulation Mechanical Strength Biodegradability Others |

| By Processing Method | Injection Molding Extrusion Blow Molding Compression Molding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Specialty Polymers | 60 | Product Engineers, R&D Managers |

| Electronics Applications | 50 | Design Engineers, Procurement Specialists |

| Healthcare Polymer Solutions | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Construction and Coatings | 45 | Project Managers, Material Scientists |

| Consumer Goods and Packaging | 55 | Marketing Managers, Product Development Leads |

The Global Specialty Polymers Market is valued at approximately USD 185 billion, reflecting a robust growth trajectory driven by increasing demand for high-performance materials across various industries, including automotive, electronics, healthcare, and packaging.