Region:Middle East

Author(s):Dev

Product Code:KRAD7685

Pages:93

Published On:December 2025

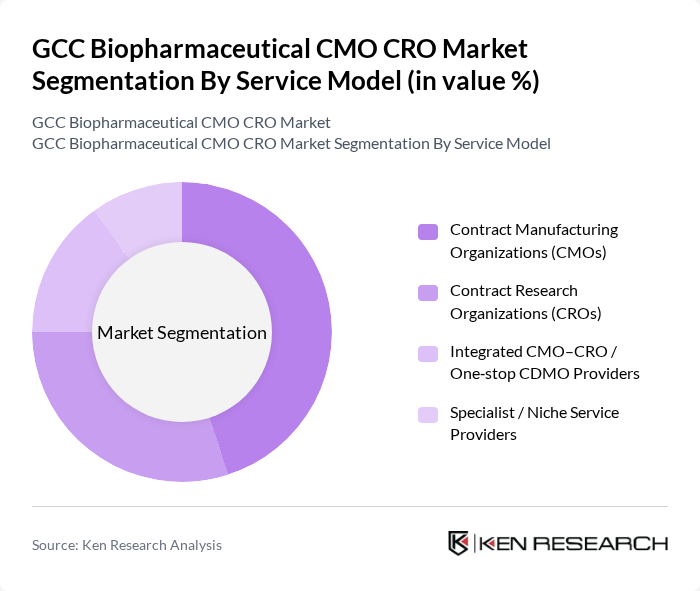

By Service Model:The service model segmentation includes various types of organizations that provide contract manufacturing and research services. The dominant sub-segment is Contract Manufacturing Organizations (CMOs), which are increasingly preferred by biopharmaceutical companies for their ability to scale production efficiently and reduce costs. Contract Research Organizations (CROs) also play a significant role, particularly in clinical trial management, as they offer specialized expertise and resources that enhance the speed and quality of research outcomes. Integrated CMO–CRO providers are gaining traction due to their comprehensive service offerings, while specialist service providers cater to niche markets, ensuring high-quality and tailored solutions.

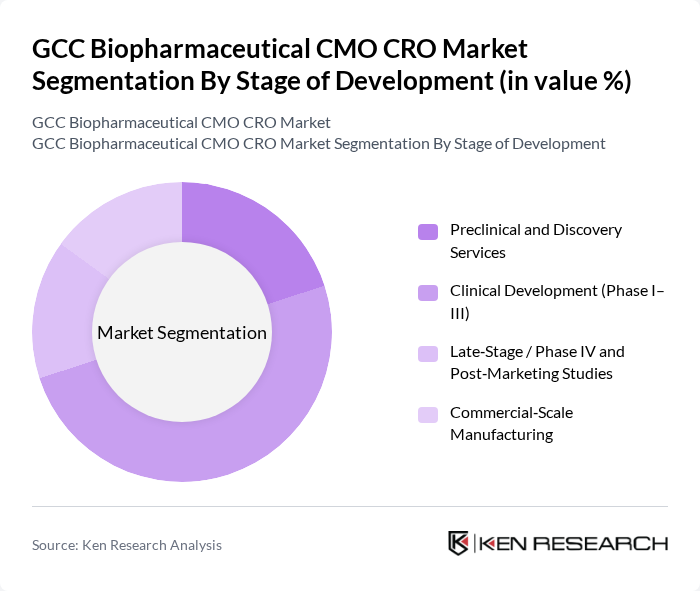

By Stage of Development:The stage of development segmentation encompasses various phases of biopharmaceutical product development. The leading sub-segment is Clinical Development (Phase I–III), which is critical for assessing the safety and efficacy of new drugs. This phase attracts significant investment due to the high stakes involved in bringing a product to market. Preclinical and Discovery Services are also vital, as they lay the groundwork for successful clinical trials. Late-Stage / Phase IV and Post-Marketing Studies are essential for monitoring long-term effects and ensuring ongoing compliance, while Commercial-Scale Manufacturing is crucial for meeting market demand once products are approved.

The GCC Biopharmaceutical CMO CRO Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Biotech Manufacturing Company (Saudi Arabia), SPIMACO Addwaeih Contract Services (Saudi Arabia), Gulf Biotech Company B.S.C. (Bahrain), Julphar – Gulf Pharmaceutical Industries (UAE), Pharmax Pharmaceuticals – Contract Services (UAE), Neopharma – Contract Manufacturing Division (UAE), Globalpharma Co. LLC – Sanofi Company (UAE), Lifecare Hospital & Research CRO Services (UAE), King Faisal Specialist Hospital & Research Centre – Research and Clinical Trials Unit (Saudi Arabia), King Abdulaziz City for Science and Technology (KACST) – Biopharmaceutical R&D and GMP Facilities (Saudi Arabia), Qatar Biobank & Qatar Genome Programme – Clinical Research Infrastructure (Qatar), Sidra Medicine – Clinical Research and Trials Office (Qatar), Dasman Diabetes Institute – Clinical Research Operations (Kuwait), Dubai Clinical Research Centre (DCRC) (UAE), G42 Healthcare / M42 – Biopharma CRO and Clinical Trials Platform (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC biopharmaceutical CMO and CRO market appears promising, driven by the increasing integration of digital technologies and a focus on sustainability. Companies are expected to adopt more eco-friendly practices, aligning with global trends towards environmental responsibility. Additionally, the rise of personalized medicine is anticipated to create new avenues for growth, as tailored therapies become more prevalent. This evolving landscape will likely foster innovation and collaboration among industry players, enhancing the region's competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Service Model | Contract Manufacturing Organizations (CMOs) Contract Research Organizations (CROs) Integrated CMO–CRO / One?stop CDMO Providers Specialist / Niche Service Providers |

| By Stage of Development | Preclinical and Discovery Services Clinical Development (Phase I–III) Late?Stage / Phase IV and Post?Marketing Studies Commercial?Scale Manufacturing |

| By Modality | Monoclonal Antibodies and Recombinant Proteins Vaccines (Conventional and mRNA) Cell and Gene Therapies Biosimilars and Other Biologics |

| By Service Type | Process Development and Analytical Services Fill?Finish, Packaging, and Labelling Clinical Trial Management and Monitoring Regulatory, Pharmacovigilance, and Data Management |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Client Type | Multinational Pharmaceutical Companies Regional and Local Biopharmaceutical Companies Academic and Research Institutions Government and Public Health Agencies |

| By Project Type | Single?Service Projects Functional / Multi?Service Outsourcing Full?Service / End?to?End Outsourcing Strategic Partnerships and Long?Term Alliances |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical CMO Services | 120 | Operations Managers, Business Development Executives |

| Biopharmaceutical CRO Services | 100 | Clinical Research Managers, Regulatory Affairs Specialists |

| Market Trends in Biopharmaceuticals | 90 | Market Analysts, Strategy Directors |

| Emerging Therapeutics and Outsourcing | 80 | R&D Heads, Product Managers |

| Regulatory Compliance in Biopharmaceuticals | 70 | Compliance Officers, Quality Assurance Managers |

The GCC Biopharmaceutical CMO CRO Market is valued at approximately USD 2.8 billion, reflecting significant growth driven by increasing demand for biopharmaceuticals, advancements in biotechnology, and the rising prevalence of chronic diseases.