Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3778

Pages:94

Published On:November 2025

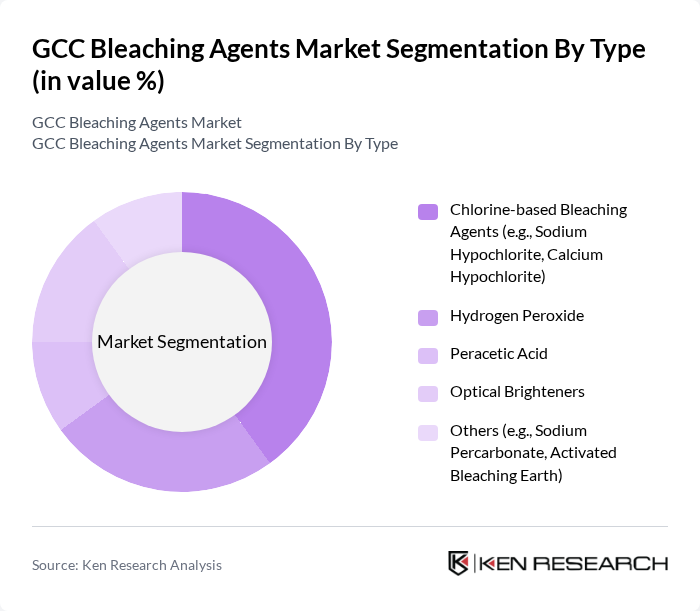

By Type:The market is segmented into chlorine-based agents, hydrogen peroxide, peracetic acid, optical brighteners, and others. Chlorine-based agents are widely used for water treatment and textile processing, hydrogen peroxide is preferred for eco-friendly and food-grade applications, peracetic acid is utilized in high-performance disinfection, optical brighteners are applied in textile and paper industries, and other agents such as sodium percarbonate and activated bleaching earth serve specialized industrial and consumer needs .

The dominant sub-segment in the bleaching agents market is chlorine-based bleaching agents, notably sodium hypochlorite and calcium hypochlorite. These agents are preferred for their cost-effectiveness and strong bleaching properties, especially in water treatment, textile processing, and household cleaning. Hydrogen peroxide is gaining traction due to its environmentally friendly profile and suitability for food and beverage applications .

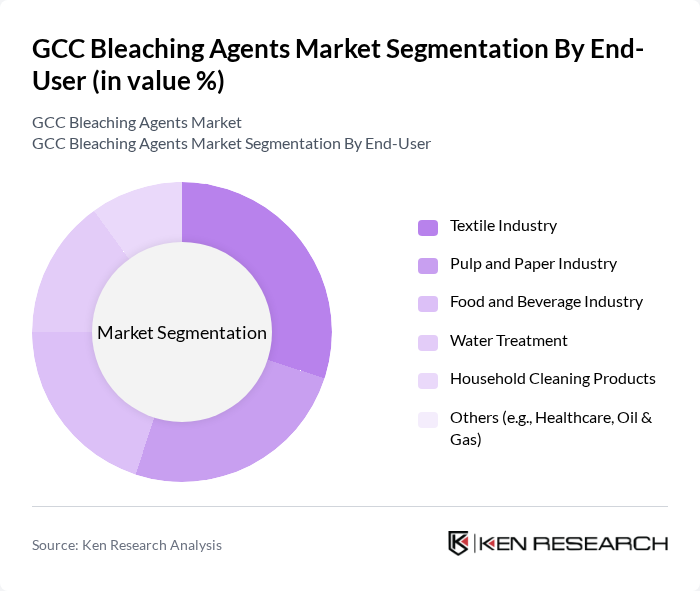

By End-User:The market is segmented by end-users: textile industry, pulp and paper industry, food and beverage industry, water treatment, household cleaning products, and others. The textile industry demands bleaching agents for fabric whitening and quality enhancement, pulp and paper utilize agents for brightness and cleanliness, food and beverage require food-grade agents for safety, water treatment uses agents for disinfection, and household cleaning relies on effective and safe bleaching products. Other segments include healthcare and oil & gas, which require specialized formulations .

The textile industry remains the leading end-user segment for bleaching agents, driven by the demand for high-quality, bright fabrics and the adoption of sustainable production practices. The shift toward eco-friendly and biodegradable bleaching agents is influencing purchasing decisions, with manufacturers increasingly investing in green chemistry solutions to meet consumer and regulatory expectations .

The GCC Bleaching Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), National Chlorine Industries (Jordan/GCC presence), Arabian Alkali Company (SODA, subsidiary of SABIC), Modern Chemicals & Services Company (MCSC, Saudi Arabia), Gulf Chlorine (Qatar), United Chlorine Industries (Saudi Arabia), BASF SE, Solvay S.A., Evonik Industries AG, Dow Chemical Company, AkzoNobel N.V., Clariant AG, Huntsman Corporation, Nouryon, Aditya Birla Chemicals, PeroxyChem LLC, Chemours Company, Arkema S.A., Olin Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The GCC bleaching agents market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt innovative bleaching technologies, efficiency and environmental compliance will improve. Additionally, the rising consumer demand for eco-friendly products will encourage companies to invest in research and development, fostering the creation of biodegradable bleaching agents. This evolving landscape presents opportunities for growth, particularly in emerging markets where awareness of sustainable practices is increasing.

| Segment | Sub-Segments |

|---|---|

| By Type | Chlorine-based Bleaching Agents (e.g., Sodium Hypochlorite, Calcium Hypochlorite) Hydrogen Peroxide Peracetic Acid Optical Brighteners Others (e.g., Sodium Percarbonate, Activated Bleaching Earth) |

| By End-User | Textile Industry Pulp and Paper Industry Food and Beverage Industry Water Treatment Household Cleaning Products Others (e.g., Healthcare, Oil & Gas) |

| By Application | Industrial Cleaning Water Treatment & Disinfection Laundry Services Food Processing Pulp & Paper Processing Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Supermarkets and Hypermarkets Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Product Form | Liquid Bleaching Agents Powder Bleaching Agents Granular Bleaching Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Bleaching Agents | 60 | Production Managers, Quality Control Supervisors |

| Pulp and Paper Sector Applications | 50 | Process Engineers, Procurement Managers |

| Household Cleaning Products | 40 | Product Development Managers, Marketing Directors |

| Food Industry Sanitization | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Industrial Cleaning Solutions | 50 | Operations Managers, Supply Chain Coordinators |

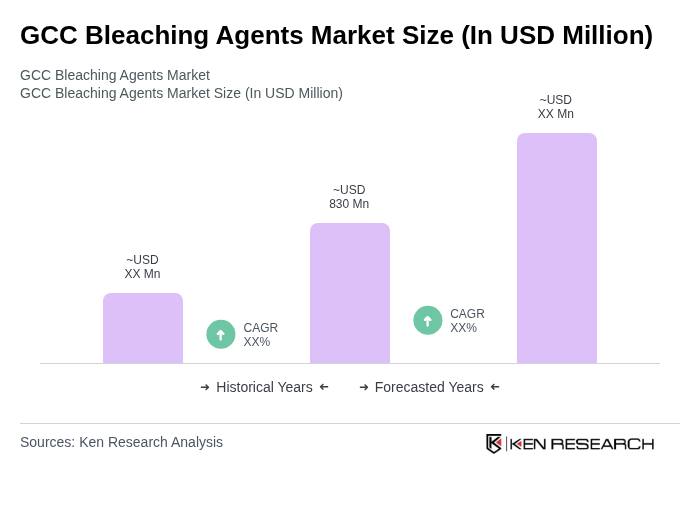

The GCC Bleaching Agents Market is valued at approximately USD 830 million, driven by increasing demand across various industries such as textiles, pulp and paper, water treatment, and food processing, alongside rising environmental awareness and stricter hygiene standards.