Region:Middle East

Author(s):Shubham

Product Code:KRAD5540

Pages:93

Published On:December 2025

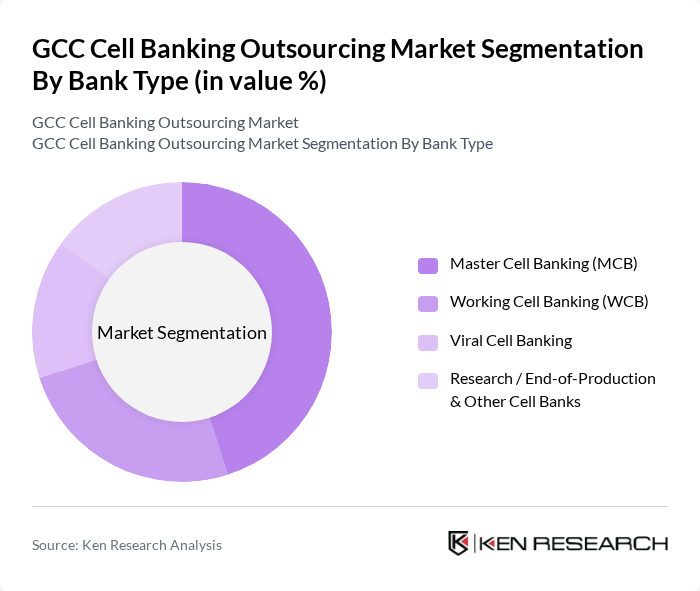

By Bank Type:The segmentation of the market by bank type includes Master Cell Banking (MCB), Working Cell Banking (WCB), Viral Cell Banking, and Research / End-of-Production & Other Cell Banks. Among these, Master Cell Banking (MCB) is the leading sub-segment due to its critical role in providing a reliable source of high-quality cells for research and therapeutic applications. The increasing focus on personalized medicine and the growing number of clinical trials are driving the demand for MCB services.

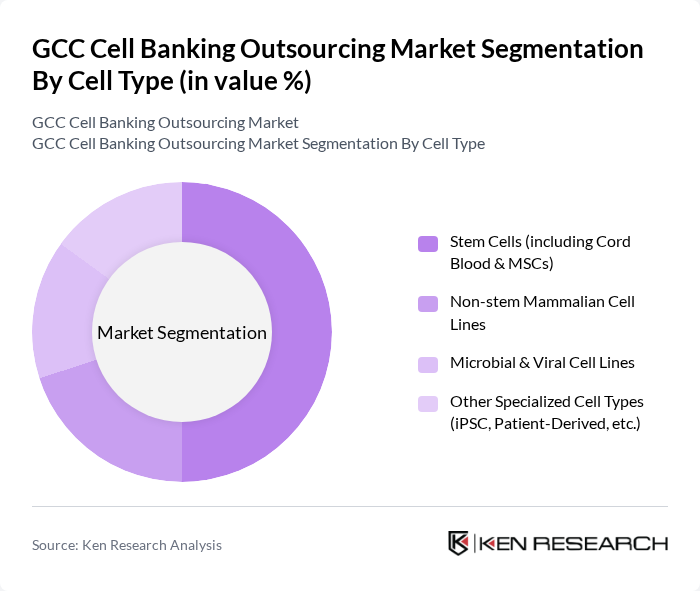

By Cell Type:The market is also segmented by cell type, which includes Stem Cells (including Cord Blood & MSCs), Non-stem Mammalian Cell Lines, Microbial & Viral Cell Lines, and Other Specialized Cell Types (iPSC, Patient-Derived, etc.). Stem Cells, particularly those derived from cord blood, dominate this segment due to their extensive applications in regenerative medicine and the increasing number of stem cell therapies being developed. The growing awareness of the benefits of stem cell banking among parents is also contributing to its market leadership.

The GCC Cell Banking Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Stem Cell Donor Registry (SSCDR), Dubai Cord Blood and Research Centre (DCRC), Abu Dhabi Stem Cells Center (ADSCC), CryoSave Arabia (Dubai, UAE), Cells4Life (GCC Service Operations), Biovault Family / Biovault Technical (Gulf Partner Networks), Biosafe Arabia (Regional Cell Processing & Storage Services), LabCorp Drug Development / Covance (Cell Banking Outsourcing), Charles River Laboratories, Lonza Group Ltd. (Bioscience Solutions & Cell Banking), WuXi AppTec Co., Ltd. (Global CDMO with GCC Outreach), Merck KGaA (MilliporeSigma – Cell Banking Services), Thermo Fisher Scientific Inc. (Patheon & Cell Banking Solutions), Cytiva (Global Cell Banking and Bioprocessing Partner), Eurofins Scientific SE (Bioanalytical & Cell Bank Testing Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cell banking outsourcing market appears promising, driven by technological innovations and evolving consumer preferences. As banks increasingly adopt cloud-based solutions and mobile applications, the demand for outsourcing services is expected to rise. Additionally, the integration of AI and machine learning technologies will enhance operational efficiency, allowing banks to provide better customer experiences. The focus on digital transformation will further accelerate growth, positioning the GCC as a leader in the banking outsourcing sector.

| Segment | Sub-Segments |

|---|---|

| By Bank Type | Master Cell Banking (MCB) Working Cell Banking (WCB) Viral Cell Banking Research / End-of-Production & Other Cell Banks |

| By Cell Type | Stem Cells (including Cord Blood & MSCs) Non-stem Mammalian Cell Lines Microbial & Viral Cell Lines Other Specialized Cell Types (iPSC, Patient-Derived, etc.) |

| By Outsourced Service | Cell Line Development & Bank Preparation Bank Characterization & Testing Long-term Storage & Cryopreservation Logistics & Cold-Chain Management |

| By Application | Biologics & Biosimilar Manufacturing Vaccine Production Cell & Gene Therapy and Regenerative Medicine Research & Clinical Trial Support |

| By End-User | Biopharmaceutical & Biotechnology Companies Contract Development & Manufacturing Organizations (CDMOs) Academic & Research Institutes Hospitals, Clinics & Cell Therapy Centers |

| By Geography (GCC) | United Arab Emirates Saudi Arabia Qatar Kuwait, Oman & Bahrain |

| By Compliance & Quality Standard | GMP-compliant Cell Banking Services GLP / Research-grade Cell Banking Services GCP-supportive Clinical Trial Cell Banking Other Regional & International Accreditation Levels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Companies | 100 | R&D Directors, Product Managers |

| Research Institutions | 80 | Laboratory Managers, Principal Investigators |

| Cell Banking Service Providers | 70 | Operations Managers, Quality Control Specialists |

| Healthcare Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Clinical Research Organizations | 60 | Clinical Operations Managers, Project Leads |

The GCC Cell Banking Outsourcing Market is valued at approximately USD 9 billion, driven by the demand for advanced therapeutic solutions, particularly in regenerative medicine and personalized healthcare, along with the adoption of GMP-compliant and automated cell banking systems.