Region:Middle East

Author(s):Dev

Product Code:KRAA9512

Pages:93

Published On:November 2025

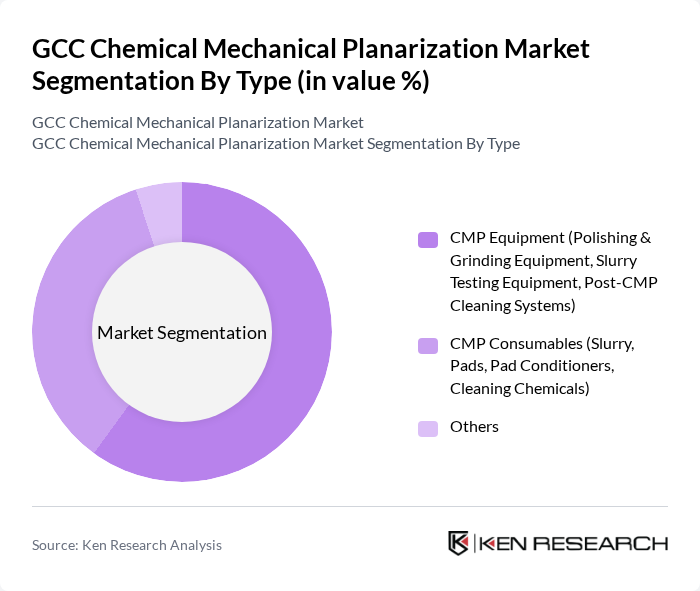

By Type:The market is segmented into CMP Equipment, CMP Consumables, and Others. CMP Equipment includes polishing and grinding equipment, slurry testing equipment, and post-CMP cleaning systems, which are essential for achieving the desired surface finish in semiconductor manufacturing. CMP Consumables consist of slurries, pads, pad conditioners, and cleaning chemicals, which are critical for the CMP process. The Others category encompasses various ancillary products and services that support CMP operations .

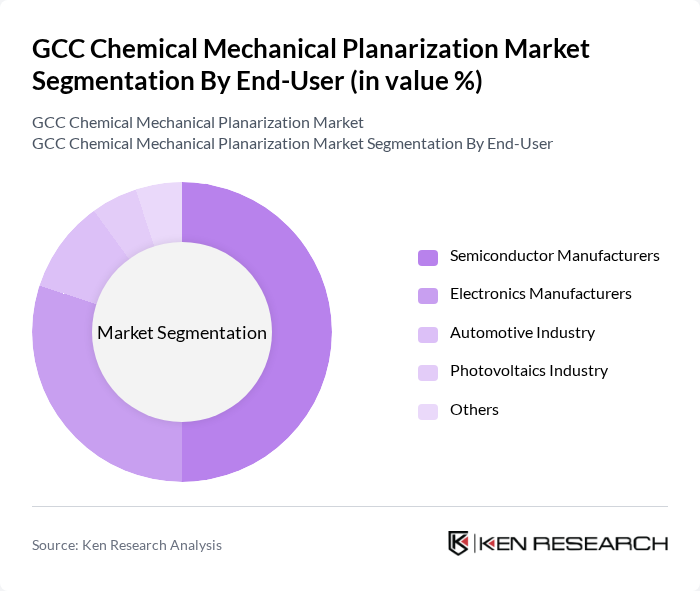

By End-User:The end-user segmentation includes semiconductor manufacturers, electronics manufacturers, the automotive industry, the photovoltaics industry, and others. Semiconductor manufacturers are the largest consumers of CMP technologies due to their need for high-precision components. Electronics manufacturers also significantly contribute to the demand, driven by the increasing production of consumer electronics. The automotive and photovoltaics industries are emerging as key users, leveraging CMP for advanced applications .

The GCC Chemical Mechanical Planarization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Lam Research Corporation, KLA Corporation, Tokyo Electron Limited, Entegris, Inc., Merck KGaA, CMC Materials, Inc. (formerly Cabot Microelectronics Corporation), DuPont de Nemours, Inc., BASF SE, 3M Company, Hitachi Chemical Co., Ltd. (now Showa Denko Materials Co., Ltd.), Shin-Etsu Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., GlobalWafers Co., Ltd., Wacker Chemie AG contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Chemical Mechanical Planarization market is poised for significant growth, driven by technological advancements and increasing demand for high-performance semiconductors. As the region invests in automation and AI integration, manufacturers will enhance efficiency and reduce operational costs. Furthermore, the focus on sustainability will lead to the development of eco-friendly CMP materials, aligning with global environmental standards. These trends indicate a dynamic market landscape, fostering innovation and collaboration among industry players in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | CMP Equipment (Polishing & Grinding Equipment, Slurry Testing Equipment, Post-CMP Cleaning Systems) CMP Consumables (Slurry, Pads, Pad Conditioners, Cleaning Chemicals) Others |

| By End-User | Semiconductor Manufacturers Electronics Manufacturers Automotive Industry Photovoltaics Industry Others |

| By Application | Integrated Circuits (Logic, Memory) MEMS Devices Photovoltaics Advanced Packaging (3D NAND, Wafer Level Packaging) Others |

| By Material | Silicon Gallium Nitride Silicon Carbide Compound Semiconductors (e.g., III-V materials) Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Technology | Conventional CMP Advanced CMP Techniques (Dry CMP, Non-contact Planarization, AI-driven CMP) Others |

| By Market Dynamics | Supply Chain Dynamics Demand Fluctuations Competitive Landscape Regulatory Impact Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing Facilities | 100 | Production Managers, Process Engineers |

| Chemical Suppliers for CMP | 60 | Sales Directors, Product Managers |

| Research Institutions Focused on CMP Technologies | 40 | Research Scientists, Academic Professors |

| End-Users in Electronics Manufacturing | 80 | Quality Assurance Managers, Operations Directors |

| Consultants in Semiconductor Industry | 50 | Industry Analysts, Market Researchers |

The GCC Chemical Mechanical Planarization Market is valued at approximately USD 180 million, driven by the increasing demand for advanced semiconductor manufacturing processes and the expansion of various industries such as electronics and automotive.