Region:Middle East

Author(s):Shubham

Product Code:KRAD3688

Pages:99

Published On:November 2025

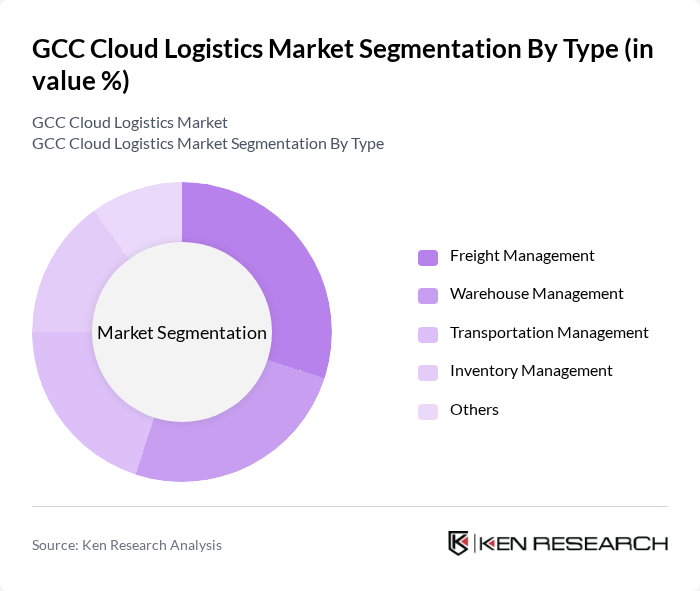

By Type:The market is segmented into various types, including Freight Management, Warehouse Management, Transportation Management, Inventory Management, and Others. Each of these segments plays a crucial role in the overall logistics process, with specific functionalities that cater to different operational needs.

The Freight Management segment is currently leading the market due to the increasing demand for efficient shipping solutions and the rise of e-commerce. Companies are focusing on optimizing their freight operations to reduce costs and improve delivery times. The integration of advanced technologies such as AI and big data analytics in freight management is enhancing decision-making processes, thereby driving growth in this segment.

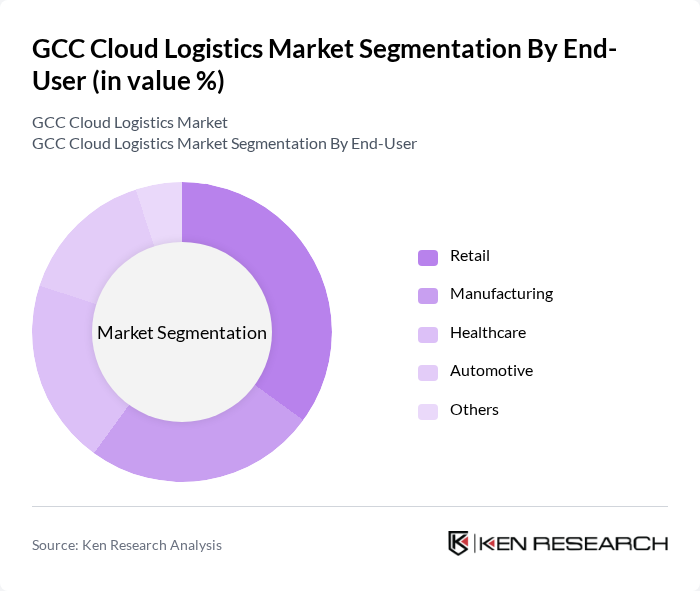

By End-User:The market is segmented by end-users, including Retail, Manufacturing, Healthcare, Automotive, and Others. Each sector has unique logistics requirements, influencing the demand for cloud logistics solutions.

The Retail sector is the dominant end-user in the market, driven by the rapid growth of e-commerce and the need for efficient supply chain management. Retailers are increasingly adopting cloud logistics solutions to enhance order fulfillment, manage inventory effectively, and improve customer satisfaction. The shift towards omnichannel retailing is further propelling the demand for cloud-based logistics services.

The GCC Cloud Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, Agility Logistics, DB Schenker, Kuehne + Nagel, CEVA Logistics, XPO Logistics, FedEx Logistics, UPS Supply Chain Solutions, Maersk Logistics, Panalpina, DSV, Hellmann Worldwide Logistics, Yusen Logistics, Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The GCC cloud logistics market is poised for significant evolution, driven by technological advancements and increasing consumer expectations. As companies embrace automation and real-time data analytics, operational efficiencies will improve, leading to enhanced service delivery. Furthermore, the integration of AI and machine learning will enable predictive analytics, optimizing supply chain management. The focus on sustainability will also shape logistics strategies, as firms seek to reduce their carbon footprint while meeting regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Warehouse Management Transportation Management Inventory Management Others |

| By End-User | Retail Manufacturing Healthcare Automotive Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Technology | Cloud Computing Big Data Analytics Artificial Intelligence Blockchain Technology Others |

| By Application | Order Fulfillment Last-Mile Delivery Supply Chain Visibility Fleet Management Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies for Cloud Adoption Tax Incentives Grants for Technology Development Regulatory Support for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cloud Logistics Solutions | 150 | Logistics Managers, IT Directors |

| Manufacturing Supply Chain Integration | 100 | Operations Managers, Supply Chain Analysts |

| Healthcare Logistics Management | 80 | Pharmaceutical Logistics Coordinators, IT Managers |

| E-commerce Fulfillment Strategies | 120 | eCommerce Operations Managers, Customer Experience Leads |

| Government and Regulatory Compliance | 70 | Compliance Officers, Policy Makers |

The GCC Cloud Logistics Market is valued at approximately USD 15 billion, driven by the increasing adoption of cloud-based solutions that enhance operational efficiency and reduce costs for logistics providers, particularly in the context of rising e-commerce demands.