GCC Cocktail Mixers Market Overview

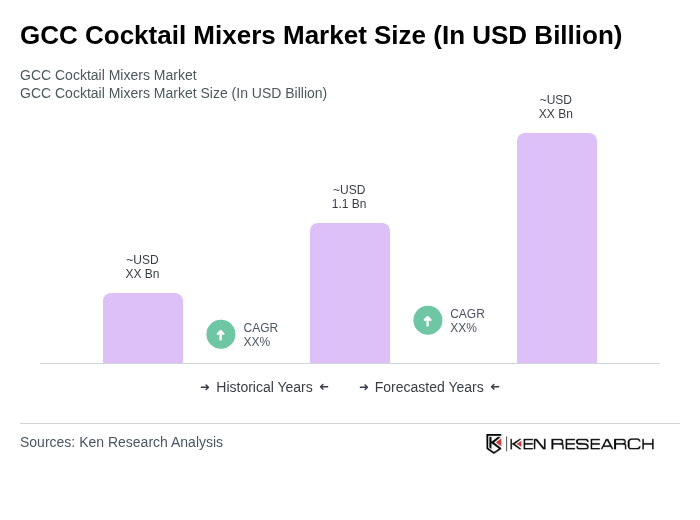

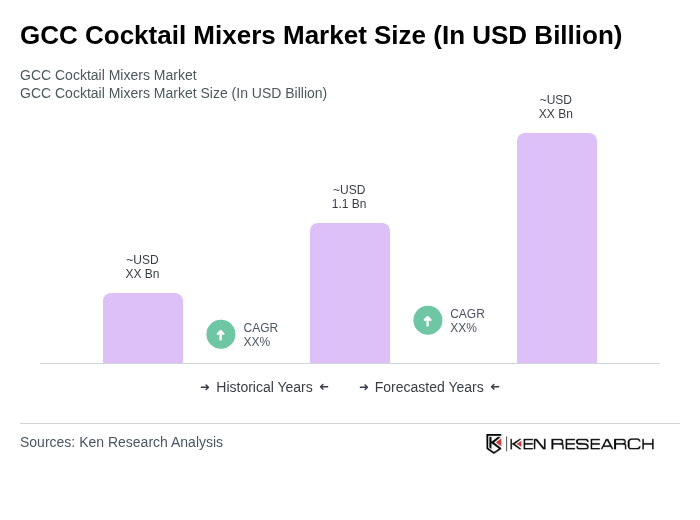

- The GCC Cocktail Mixers Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by the rising popularity of cocktail culture, increased consumer spending on premium beverages, and the expansion of the hospitality sector across the region. The market has witnessed a surge in demand for innovative and diverse mixer options, catering to the evolving preferences of consumers. The global cocktail mixers market was valued at USD 11.88 billion in 2024, with the GCC region representing a significant and rapidly growing share due to its vibrant hospitality industry and premiumization trends .

- Key players in this market include the United Arab Emirates and Saudi Arabia, which dominate due to their vibrant nightlife, extensive hospitality infrastructure, and a growing expatriate population. The UAE, particularly Dubai, is known for its luxury bars and restaurants, while Saudi Arabia is experiencing a gradual shift towards more liberal consumption patterns, further boosting the cocktail mixers market. The region’s hospitality sector recovery and the influx of international tourism have further accelerated demand for premium mixers in on-trade venues .

- In 2023, the UAE government implemented regulations to promote responsible drinking and the responsible sale of alcoholic beverages. This includes mandatory training for staff in establishments serving alcohol, aimed at ensuring compliance with local laws and promoting safe consumption practices among patrons. The operational framework is outlined in the “Alcoholic Beverage Control Law, Federal Law No. 15 of 2020,” issued by the UAE Cabinet, which mandates licensing for sale and service, age restrictions, and staff training for responsible service .

GCC Cocktail Mixers Market Segmentation

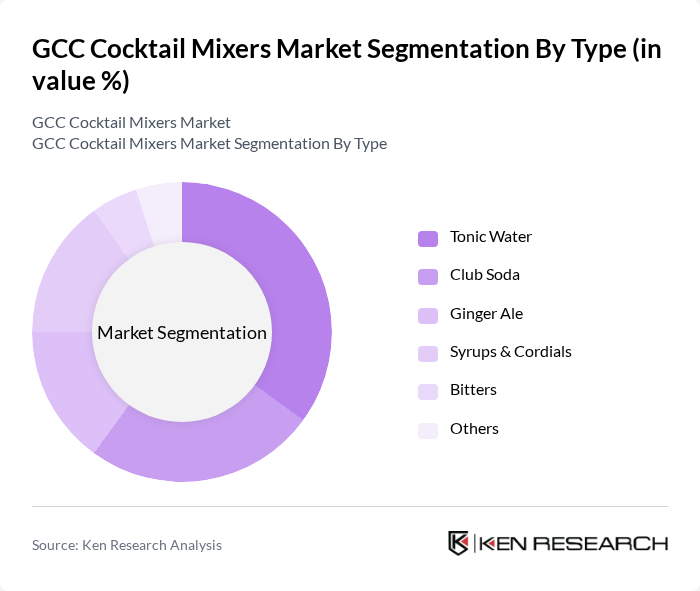

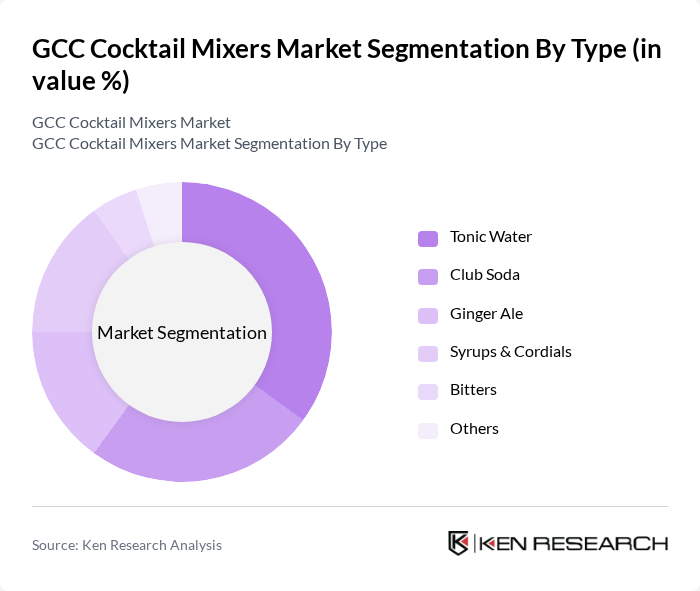

By Type:The market is segmented into various types of cocktail mixers, including tonic water, club soda, ginger ale, syrups & cordials, bitters, and others. Among these, tonic water has emerged as the leading sub-segment due to its versatility and popularity in classic cocktails like gin and tonic. The increasing trend of craft cocktails and mixology has further propelled the demand for tonic water, making it a staple in bars and restaurants. Tonic water accounted for approximately 25% of global revenue in 2024, and its share in the GCC region is higher due to the strong gin and tonic culture in premium hospitality venues .

By End-User:The end-user segmentation includes bars and nightclubs, hotels, restaurants, retail consumers, events and catering services, and others. Bars and nightclubs are the dominant segment, driven by the high demand for cocktail mixers in social settings. The vibrant nightlife and the increasing number of bars and clubs in the GCC region contribute significantly to the growth of this segment. The on-trade channel (bars, hotels, restaurants) accounts for the majority of market share, reflecting the region’s focus on premium hospitality experiences and social dining .

GCC Cocktail Mixers Market Competitive Landscape

The GCC Cocktail Mixers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fever-Tree, Fentimans, Q Mixers, Monin, East Imperial, Thomas Henry, The London Essence Company, Britvic, Three Cents, 6 Degrees, Mr. Perkins, Double Dutch, The Artisan Drinks Company, Franklin & Sons, Barakat Group (UAE), Al Ain Food & Beverages (UAE), Almarai (Saudi Arabia), Agthia Group (UAE), Rani (Aujan Coca-Cola, GCC), PepsiCo (GCC Operations) contribute to innovation, geographic expansion, and service delivery in this space.

GCC Cocktail Mixers Market Industry Analysis

Growth Drivers

- Increasing Demand for Premium Cocktails:The GCC region has witnessed a significant rise in the consumption of premium cocktails, with the market valued at approximately $1.5 billion. This growth is driven by a 17% increase in disposable income among millennials, who are increasingly seeking unique and high-quality drinking experiences. The trend is further supported by the rise of upscale bars and restaurants, which are focusing on craft cocktails, thus enhancing the demand for premium mixers.

- Rise in Social Gatherings and Nightlife Culture:The GCC's nightlife culture has expanded, with over 70% of residents participating in social gatherings at bars and clubs. This shift is reflected in the hospitality sector, which has seen a 25% increase in nightlife venues. The growing acceptance of nightlife activities, particularly in urban areas, has led to a higher demand for cocktail mixers, as consumers seek to recreate bar experiences at home and during events.

- Growth of the Hospitality Industry:The hospitality industry in the GCC is projected to grow by 12% annually, reaching a value of $60 billion. This expansion is fueled by increased tourism, with visitor numbers expected to exceed 35 million. As hotels and restaurants enhance their beverage offerings, the demand for diverse cocktail mixers is expected to rise, providing a significant boost to the market as establishments aim to attract discerning customers.

Market Challenges

- Regulatory Restrictions on Alcohol Consumption:The GCC region has stringent regulations regarding alcohol consumption, which can hinder market growth. For instance, countries like Saudi Arabia impose a complete ban on alcohol, affecting mixer sales. Additionally, licensing requirements for establishments serving alcohol can limit the number of venues, thereby restricting the potential market size for cocktail mixers in certain areas, impacting overall sales.

- Competition from Non-Alcoholic Beverage Alternatives:The rise of health-conscious consumers has led to increased competition from non-alcoholic beverages, which have seen a 30% growth in sales in the GCC. This trend is particularly pronounced among younger demographics who prefer healthier options. As a result, cocktail mixers face challenges in maintaining market share, as consumers opt for alternatives that align with their wellness goals, impacting overall mixer consumption.

GCC Cocktail Mixers Market Future Outlook

The GCC cocktail mixers market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As the trend towards craft cocktails continues, manufacturers are likely to invest in unique flavor profiles and premium ingredients. Additionally, the rise of e-commerce platforms will facilitate greater accessibility for consumers, allowing for a wider range of mixer options. Sustainability initiatives will also play a crucial role, as brands increasingly focus on eco-friendly packaging and organic ingredients to meet consumer demand for responsible products.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in the GCC presents a significant opportunity for cocktail mixers, with online sales projected to increase by 35%. This shift allows brands to reach a broader audience, particularly younger consumers who prefer online shopping. Enhanced distribution channels can lead to increased sales and brand visibility in a competitive market.

- Development of Organic and Natural Mixers:The rising consumer interest in health and wellness is driving demand for organic and natural cocktail mixers. With the organic beverage market in the GCC expected to grow by 25%, brands that focus on natural ingredients can capitalize on this trend. This shift not only meets consumer preferences but also positions brands favorably in a market increasingly concerned with health-conscious choices.