Region:Middle East

Author(s):Rebecca

Product Code:KRAA9446

Pages:94

Published On:November 2025

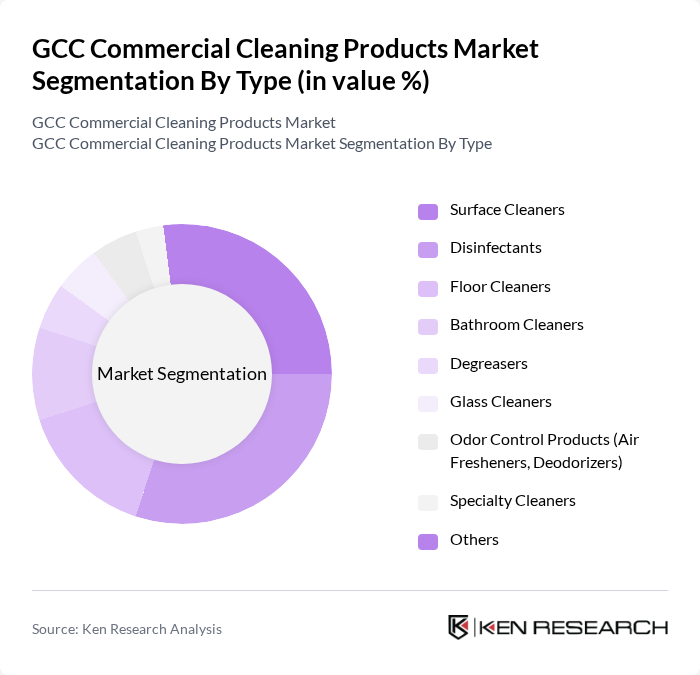

By Type:The market is segmented into Surface Cleaners, Disinfectants, Floor Cleaners, Bathroom Cleaners, Degreasers, Glass Cleaners, Odor Control Products (Air Fresheners, Deodorizers), Specialty Cleaners, and Others. Each sub-segment addresses distinct cleaning requirements across commercial, healthcare, hospitality, and industrial environments. Recent trends highlight rising demand for multi-surface and concentrated cleaning solutions, as well as plant-based and biodegradable agents for sustainability compliance .

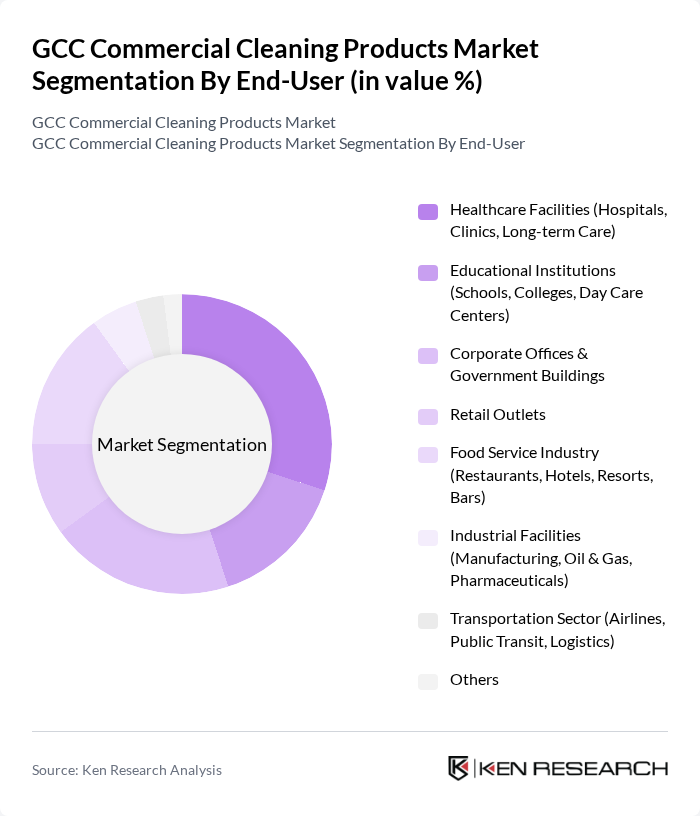

By End-User:The end-user segmentation includes Healthcare Facilities (Hospitals, Clinics, Long-term Care), Educational Institutions (Schools, Colleges, Day Care Centers), Corporate Offices & Government Buildings, Retail Outlets, Food Service Industry (Restaurants, Hotels, Resorts, Bars), Industrial Facilities (Manufacturing, Oil & Gas, Pharmaceuticals), Transportation Sector (Airlines, Public Transit, Logistics), and Others. Each segment has unique cleaning requirements that drive demand for specialized products, with healthcare and hospitality sectors showing the highest adoption of advanced disinfection and eco-friendly solutions .

The GCC Commercial Cleaning Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diversey Holdings, Ltd., Ecolab Inc., SC Johnson Professional, Reckitt Benckiser Group plc, Procter & Gamble Co., Unilever PLC, 3M Company, Henkel AG & Co. KGaA, The Clorox Company, Kimberly-Clark Corporation, P&G Professional, Spartan Chemical Company, Inc., Zep Inc., Al Bayader International, Chemex Hygiene Concepts, Intercare Limited, Cleanco Trading & Importing, Daitona General Trading LLC, Al Kifah Cleaning Materials, Al Mas Cleaning Mat. LLC contribute to innovation, geographic expansion, and service delivery in this space .

The GCC commercial cleaning products market is poised for transformative growth, driven by evolving consumer preferences and regulatory frameworks. As sustainability becomes a core focus, companies are likely to innovate with eco-friendly products, aligning with government initiatives aimed at reducing environmental footprints. Additionally, the rise of e-commerce platforms will facilitate broader distribution channels, enhancing accessibility for consumers. The integration of automation in cleaning processes will further streamline operations, improving efficiency and effectiveness in service delivery across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Surface Cleaners Disinfectants Floor Cleaners Bathroom Cleaners Degreasers Glass Cleaners Odor Control Products (Air Fresheners, Deodorizers) Specialty Cleaners Others |

| By End-User | Healthcare Facilities (Hospitals, Clinics, Long-term Care) Educational Institutions (Schools, Colleges, Day Care Centers) Corporate Offices & Government Buildings Retail Outlets Food Service Industry (Restaurants, Hotels, Resorts, Bars) Industrial Facilities (Manufacturing, Oil & Gas, Pharmaceuticals) Transportation Sector (Airlines, Public Transit, Logistics) Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets and Hypermarkets Specialty Stores Direct Sales/Distributors Others |

| By Formulation | Liquid Cleaners Powder Cleaners Aerosol Cleaners Wipes Concentrates Others |

| By Packaging Type | Bottles Bulk Containers/Drums Sachets Spray Cans Others |

| By Brand Type | National Brands Private Labels Local/Regional Brands Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Cleaning Services | 100 | Operations Managers, Service Supervisors |

| Hospitality Sector Cleaning Products | 60 | Facility Managers, Procurement Officers |

| Healthcare Cleaning Solutions | 50 | Healthcare Administrators, Infection Control Officers |

| Industrial Cleaning Applications | 40 | Plant Managers, Safety Officers |

| Retail Cleaning Product Usage | 45 | Store Managers, Cleaning Staff Supervisors |

The GCC Commercial Cleaning Products Market is valued at approximately USD 1.2 billion, reflecting a robust growth driven by urbanization, increased hygiene awareness, and the expansion of sectors like hospitality and healthcare.