Region:Europe

Author(s):Shubham

Product Code:KRAB6279

Pages:83

Published On:October 2025

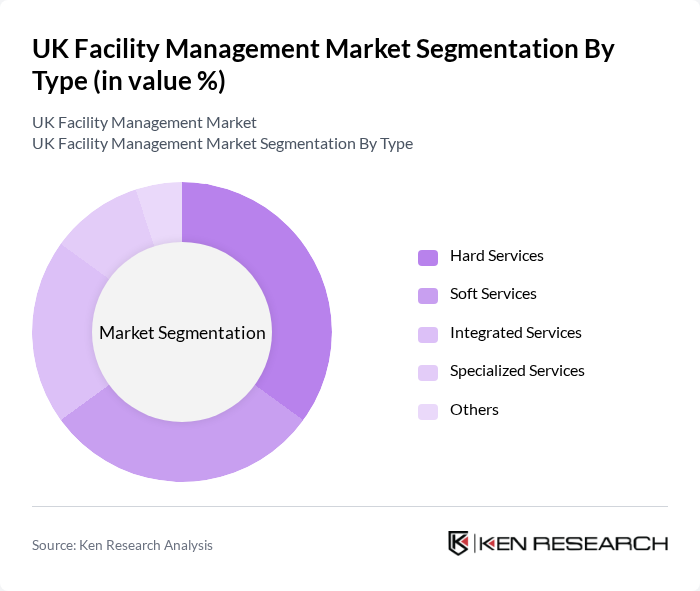

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different operational needs and client requirements.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance, repair, and operational services required for buildings and facilities. This includes mechanical, electrical, and plumbing services, which are critical for ensuring the functionality and safety of facilities. The increasing focus on compliance with safety regulations and the need for regular maintenance in commercial and industrial sectors further bolster the demand for hard services.

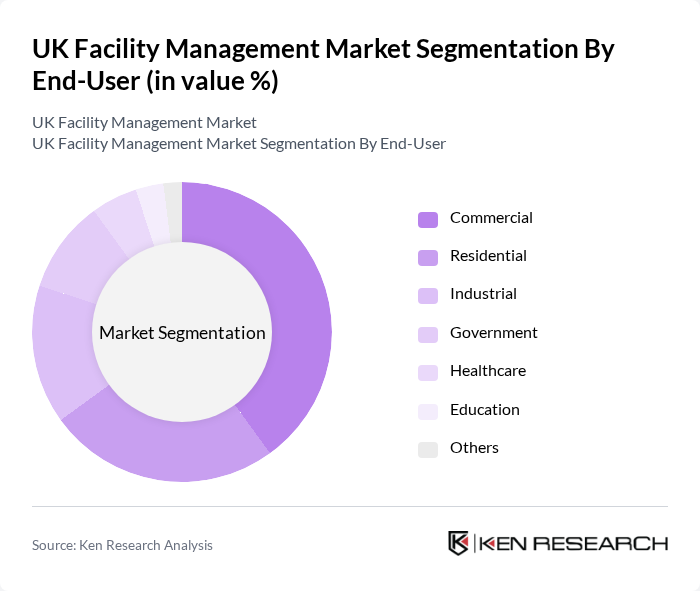

By End-User:The facility management market is segmented by end-user into Commercial, Residential, Industrial, Government, Healthcare, Education, and Others. Each end-user category has distinct requirements and influences the demand for various facility management services.

The Commercial segment leads the market, driven by the high demand for facility management services in office buildings, retail spaces, and corporate environments. The need for efficient space management, maintenance, and compliance with health and safety regulations in commercial properties significantly contributes to the growth of this segment. Additionally, the trend towards flexible workspaces and the integration of technology in facility management further enhance the demand in this sector.

The UK Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Mitie Group PLC, CBRE Group, Inc., Sodexo S.A., G4S plc, OCS Group UK Ltd., Bouygues Energies & Services, Vinci Facilities, Servest Group Ltd., Mitie Group PLC, Engie Services UK, Amey plc, Buro Happold Group, JLL (Jones Lang LaSalle), Aramark Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UK facility management market is poised for transformative growth, driven by technological advancements and a heightened focus on sustainability. As businesses increasingly adopt smart technologies, the demand for integrated facility management services will rise, enhancing operational efficiency. Additionally, the emphasis on health and safety will continue to shape service offerings, ensuring compliance with evolving regulations. The market is expected to adapt to these trends, fostering innovation and creating new opportunities for service providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Commercial Residential Industrial Government Healthcare Education Others |

| By Service Model | Outsourced In-House Hybrid |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Region | England Scotland Wales Northern Ireland |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Policy Support | Subsidies Tax Incentives Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 150 | Facility Managers, Operations Directors |

| Healthcare Facility Services | 100 | Healthcare Administrators, Facility Coordinators |

| Educational Institution Management | 80 | Campus Facility Managers, Procurement Officers |

| Retail Facility Management | 70 | Store Managers, Regional Facility Directors |

| Public Sector Facility Services | 60 | Government Facility Managers, Policy Advisors |

The UK Facility Management Market is valued at approximately USD 120 billion, reflecting significant growth driven by the demand for integrated services, technological advancements, and a focus on sustainability in facility operations.