Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8244

Pages:94

Published On:November 2025

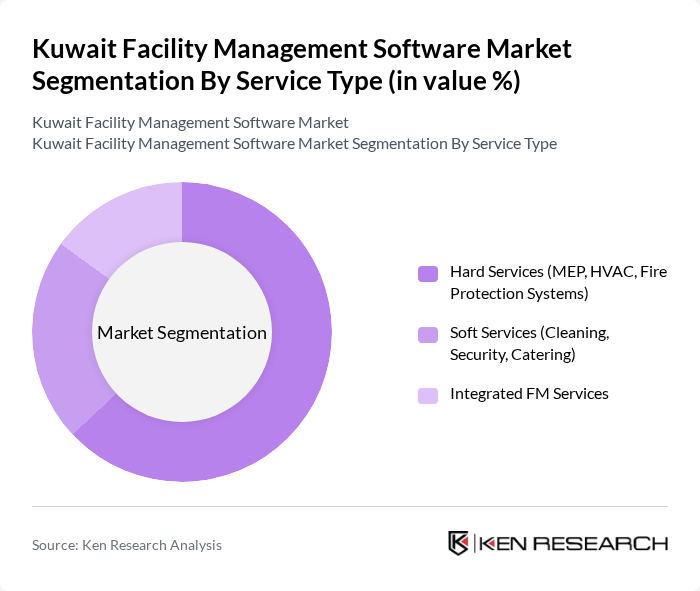

By Service Type:The service type segmentation includes Hard Services, Soft Services, and Integrated FM Services. Hard Services encompass essential maintenance tasks such as MEP, HVAC, and fire protection systems, which are critical for operational continuity and asset reliability, especially in large-scale infrastructure and commercial projects. Soft Services include cleaning, security, and catering, focusing on occupant comfort, safety, and experience. Integrated FM Services combine both hard and soft services, delivering a comprehensive solution that streamlines operations, enhances efficiency, and supports sustainability goals .

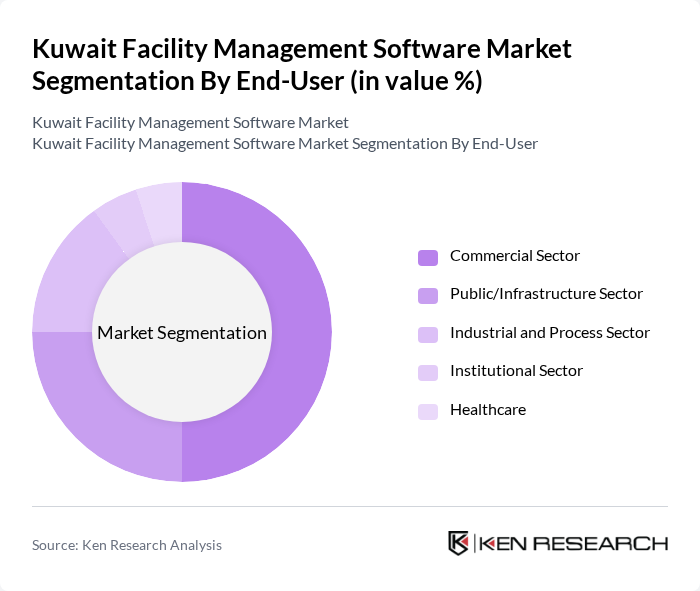

By End-User:The end-user segmentation includes the Commercial Sector, Public/Infrastructure Sector, Industrial and Process Sector, Institutional Sector, and Healthcare. The Commercial Sector is the largest end-user, driven by extensive office, retail, and mixed-use developments requiring advanced facility management. The Public/Infrastructure Sector follows, with government and municipal buildings increasingly adopting digital FM solutions. The Industrial and Process Sector is expanding, supported by ongoing investments in oil, gas, and manufacturing. Institutional and Healthcare sectors remain significant, with stringent compliance and operational standards .

The Kuwait Facility Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mulla Group, Alghanim International, Archibus, Planon, iOffice, Accruent, Axxerion, eMaint, UpKeep, FacilityDude, Hippo CMMS, Maintenance Connection, MCS Solutions, SpaceIQ, and FMX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait facility management software market appears promising, driven by technological advancements and increasing government support for smart city initiatives. As organizations prioritize operational efficiency and sustainability, the demand for integrated software solutions is expected to rise. Furthermore, the growing emphasis on predictive maintenance and customer experience will shape the development of innovative tools. Companies that adapt to these trends and invest in training their workforce will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Hard Services (MEP, HVAC, Fire Protection Systems) Soft Services (Cleaning, Security, Catering) Integrated FM Services |

| By End-User | Commercial Sector Public/Infrastructure Sector Industrial and Process Sector Institutional Sector Healthcare |

| By Deployment Model | Cloud-Based Solutions On-Premises Hybrid |

| By Functionality | Maintenance Management Energy Management Systems Asset Management Predictive Maintenance Space Utilization Optimization |

| By Technology Integration | IoT and Smart Building Technologies AI and Machine Learning Solutions CAFM (Computer-Aided Facility Management) Mobile Applications |

| By Delivery Model | Outsourced Facility Management In-House Facility Management |

| By Geographic Distribution | Urban Areas Suburban Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 100 | Property Managers, Facility Directors |

| Healthcare Facility Management | 80 | Healthcare Administrators, Operations Managers |

| Educational Institutions Facility Management | 70 | Campus Facility Managers, IT Directors |

| Government Buildings Management | 60 | Public Sector Facility Managers, Procurement Officers |

| Retail Space Management | 90 | Retail Operations Managers, Store Managers |

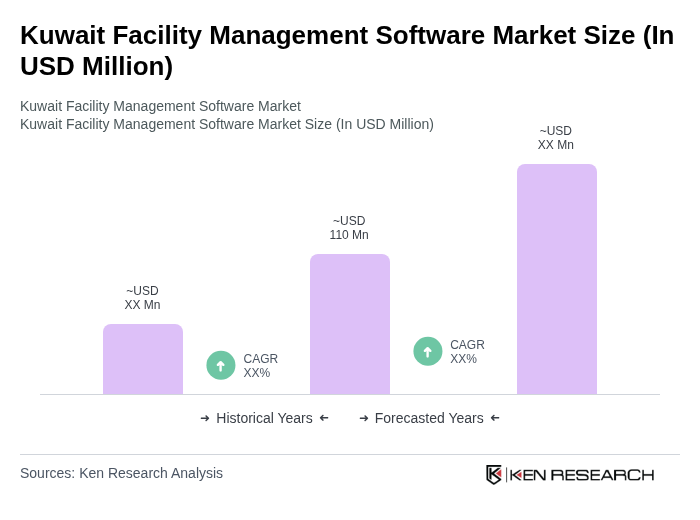

The Kuwait Facility Management Software Market is valued at approximately USD 110 million, reflecting a significant growth driven by urbanization, infrastructure development, and the adoption of advanced technologies like IoT and AI.