Region:Middle East

Author(s):Dev

Product Code:KRAB7053

Pages:96

Published On:October 2025

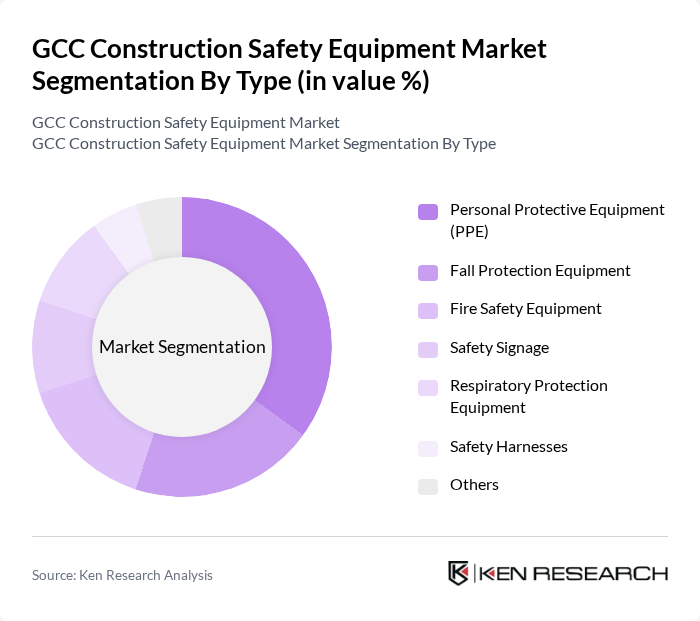

By Type:The market is segmented into various types of safety equipment, including Personal Protective Equipment (PPE), Fall Protection Equipment, Fire Safety Equipment, Safety Signage, Respiratory Protection Equipment, Safety Harnesses, and Others. Among these, Personal Protective Equipment (PPE) is the leading sub-segment due to its essential role in ensuring worker safety across various construction sites. The increasing awareness of occupational health and safety regulations has significantly boosted the demand for PPE, making it a critical component in the construction safety equipment market.

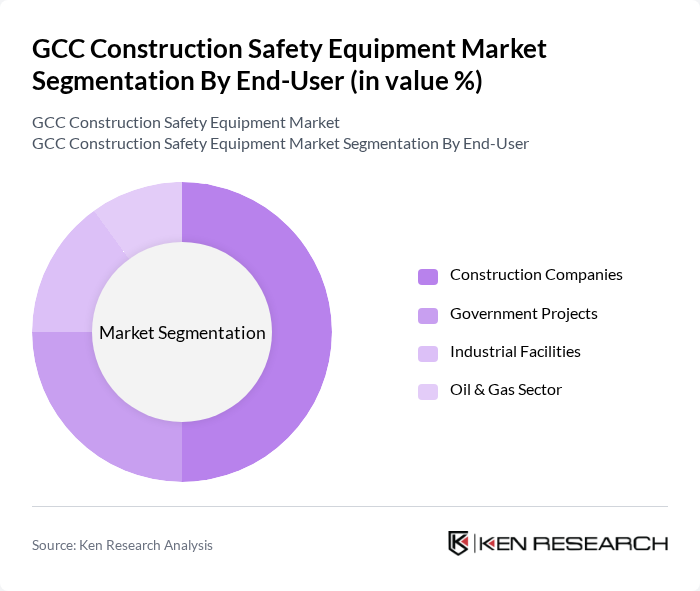

By End-User:The end-user segmentation includes Construction Companies, Government Projects, Industrial Facilities, and the Oil & Gas Sector. Construction Companies are the dominant end-user segment, driven by the increasing number of construction projects and the need for compliance with safety regulations. The growing emphasis on worker safety and the implementation of safety protocols in construction activities have led to a significant rise in the demand for safety equipment among construction companies.

The GCC Construction Safety Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., DuPont de Nemours, Inc., MSA Safety Incorporated, Ansell Limited, Kimberly-Clark Corporation, Lakeland Industries, Inc., Bullard Company, Radians, Inc., JSP Limited, Delta Plus Group, Uvex Safety Group, Ergodyne Corporation, PIP Global, CLC Work Gear contribute to innovation, geographic expansion, and service delivery in this space.

The GCC construction safety equipment market is poised for significant growth, driven by ongoing infrastructure investments and a heightened focus on worker safety. As governments continue to enforce stringent safety regulations, the demand for innovative safety solutions will rise. Additionally, the integration of smart technologies will enhance safety measures, making them more effective. The market is expected to adapt to evolving needs, with a strong emphasis on sustainability and customization, ensuring that safety equipment meets the diverse requirements of the construction industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Protective Equipment (PPE) Fall Protection Equipment Fire Safety Equipment Safety Signage Respiratory Protection Equipment Safety Harnesses Others |

| By End-User | Construction Companies Government Projects Industrial Facilities Oil & Gas Sector |

| By Application | Residential Construction Commercial Construction Infrastructure Development Renovation Projects |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Brand Preference | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Safety Equipment Suppliers | 100 | Sales Managers, Product Development Heads |

| Construction Project Managers | 80 | Site Managers, Safety Officers |

| Regulatory Compliance Experts | 50 | Safety Inspectors, Compliance Managers |

| End-users of Safety Equipment | 70 | Construction Workers, Foremen |

| Industry Consultants | 60 | Market Analysts, Safety Advisors |

The GCC Construction Safety Equipment Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased construction activities and a heightened focus on workplace safety regulations across the region.