Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7149

Pages:87

Published On:October 2025

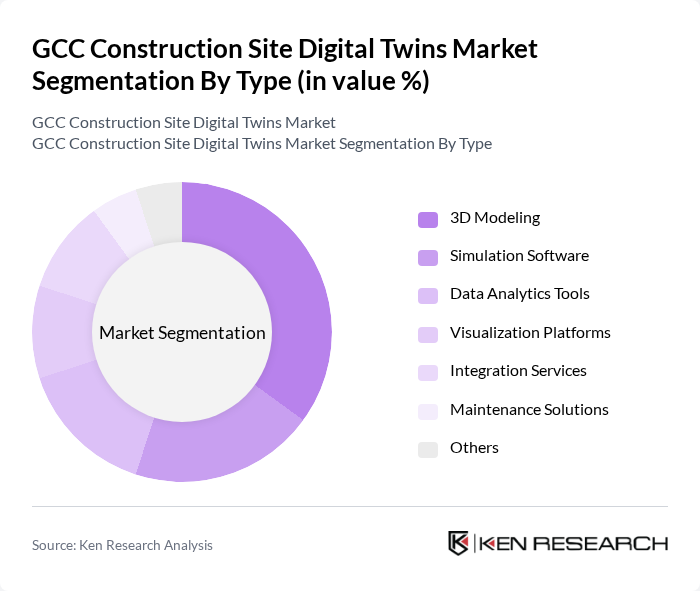

By Type:The market is segmented into various types, including 3D Modeling, Simulation Software, Data Analytics Tools, Visualization Platforms, Integration Services, Maintenance Solutions, and Others. Among these, 3D Modeling is the leading sub-segment, driven by its critical role in visualizing construction projects and facilitating collaboration among stakeholders. The increasing demand for accurate and detailed project representations has made 3D Modeling essential in the construction process.

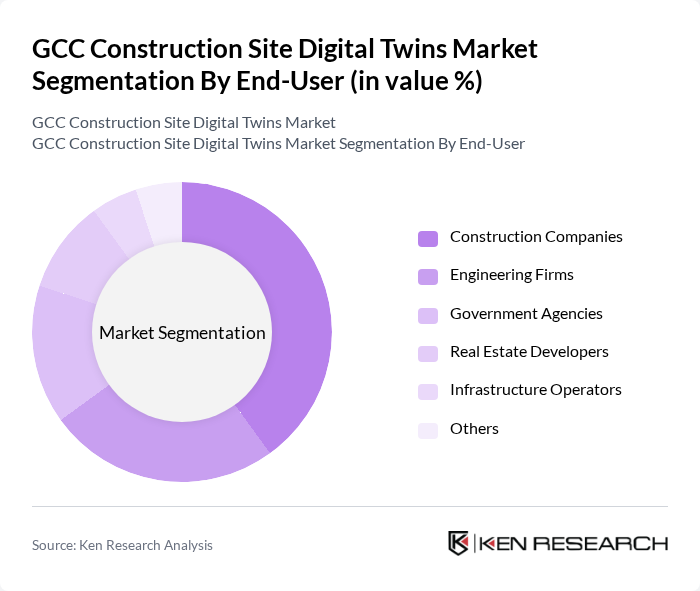

By End-User:The end-user segmentation includes Construction Companies, Engineering Firms, Government Agencies, Real Estate Developers, Infrastructure Operators, and Others. Construction Companies are the dominant end-user segment, as they are the primary adopters of digital twin technologies to enhance project management and operational efficiency. The growing trend of digital transformation in the construction industry has led to increased investments by construction firms in digital twin solutions.

The GCC Construction Site Digital Twins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autodesk Inc., Bentley Systems, Incorporated, Siemens AG, Trimble Inc., Dassault Systèmes SE, Hexagon AB, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, PTC Inc., Ansys, Inc., Esri, Aconex Limited, Procore Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC construction site digital twins market appears promising, driven by technological advancements and increasing investments in smart infrastructure. As governments in the region prioritize digital transformation, the integration of AI and machine learning into digital twin applications is expected to enhance predictive analytics capabilities. Furthermore, the growing emphasis on sustainability will likely lead to innovative solutions that optimize resource use and minimize environmental impact, positioning digital twins as essential tools for future construction projects.

| Segment | Sub-Segments |

|---|---|

| By Type | D Modeling Simulation Software Data Analytics Tools Visualization Platforms Integration Services Maintenance Solutions Others |

| By End-User | Construction Companies Engineering Firms Government Agencies Real Estate Developers Infrastructure Operators Others |

| By Application | Project Planning Asset Management Risk Management Quality Control Safety Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Others |

| By Investment Source | Private Investments Public Funding Joint Ventures Government Grants |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Architects, Construction Managers |

| Infrastructure Projects (Roads, Bridges) | 70 | Infrastructure Planners, Civil Engineers |

| Digital Twin Technology Providers | 60 | Product Managers, Technical Directors |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

The GCC Construction Site Digital Twins Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of advanced technologies like IoT and AI, which enhance project efficiency and reduce costs in construction management.