Region:Middle East

Author(s):Shubham

Product Code:KRAB7288

Pages:95

Published On:October 2025

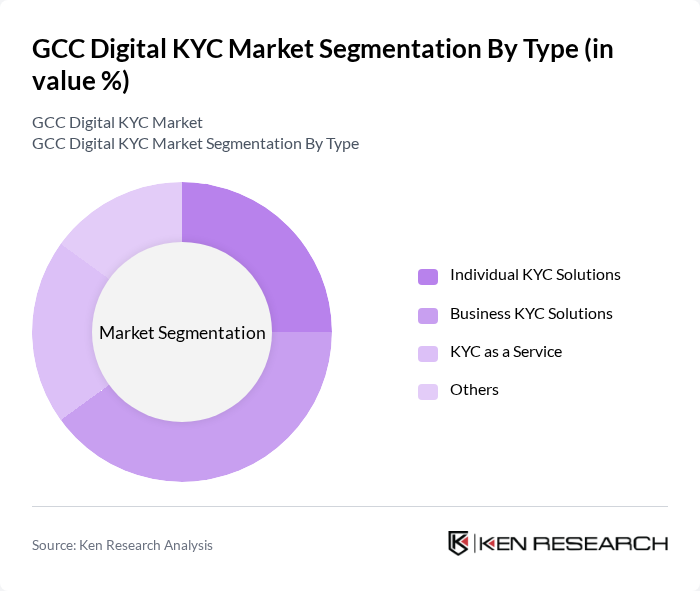

By Type:The segmentation of the market by type includes Individual KYC Solutions, Business KYC Solutions, KYC as a Service, and Others. Among these, Business KYC Solutions are leading due to the increasing number of businesses requiring robust verification processes to comply with regulatory standards and mitigate risks associated with fraud. The demand for tailored solutions that cater to specific business needs is driving this segment's growth.

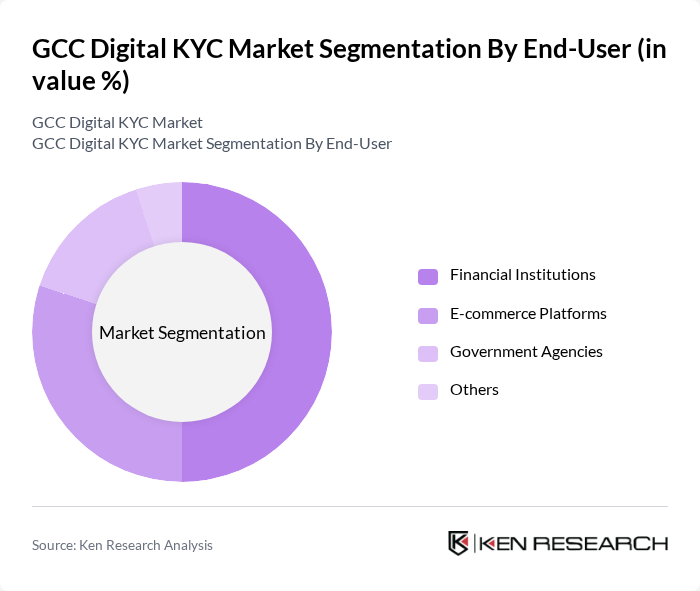

By End-User:This segmentation includes Financial Institutions, E-commerce Platforms, Government Agencies, and Others. Financial Institutions dominate this segment as they are the primary users of KYC solutions to comply with anti-money laundering (AML) regulations and to enhance customer onboarding processes. The increasing digitalization of banking services is further driving the demand for effective KYC solutions in this sector.

The GCC Digital KYC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumio Corporation, Onfido, Trulioo, IDnow, Veriff, LexisNexis Risk Solutions, Experian, Equifax, KYC Portal, ComplyAdvantage, Amlify, Signicat, Yoti, Authenteq, IDology contribute to innovation, geographic expansion, and service delivery in this space.

The GCC Digital KYC market is poised for significant evolution, driven by technological advancements and changing consumer expectations. By future, the integration of AI and machine learning in KYC processes is expected to enhance efficiency and accuracy, reducing fraud rates. Additionally, the shift towards biometric authentication will likely redefine identity verification standards. As regulatory frameworks continue to evolve, businesses that prioritize compliance and customer-centric solutions will be better positioned to thrive in this dynamic landscape, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual KYC Solutions Business KYC Solutions KYC as a Service Others |

| By End-User | Financial Institutions E-commerce Platforms Government Agencies Others |

| By Industry Vertical | Banking Insurance Telecommunications Others |

| By Deployment Mode | Cloud-Based On-Premises |

| By Geography | UAE Saudi Arabia Qatar Others |

| By Compliance Type | AML Compliance CFT Compliance GDPR Compliance |

| By Policy Support | Government Initiatives Financial Incentives Regulatory Frameworks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector KYC Implementation | 150 | Compliance Officers, Risk Managers |

| Fintech KYC Solutions | 100 | Product Managers, Technology Leads |

| Insurance Industry KYC Practices | 80 | Underwriters, Compliance Analysts |

| Regulatory Compliance Insights | 70 | Regulatory Affairs Specialists, Legal Advisors |

| Consumer Perspectives on Digital KYC | 90 | End-users, Customer Experience Managers |

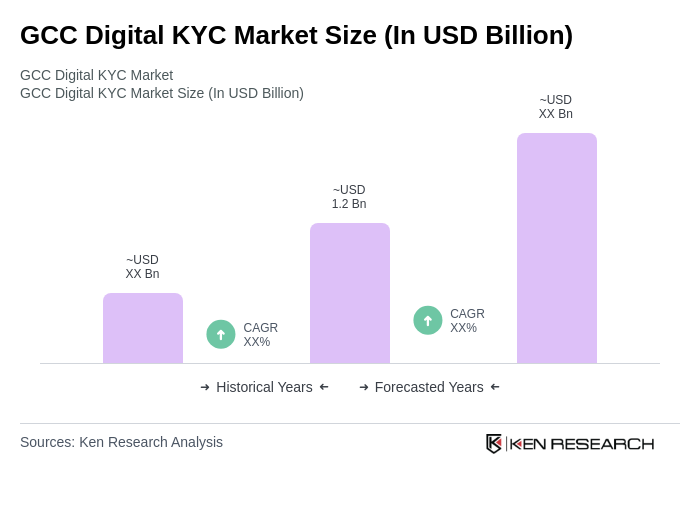

The GCC Digital KYC Market is valued at approximately USD 1.2 billion, driven by the increasing demand for secure customer verification processes, particularly in the financial services sector, and the rise in digital transactions across the region.