Region:Middle East

Author(s):Dev

Product Code:KRAA9559

Pages:93

Published On:November 2025

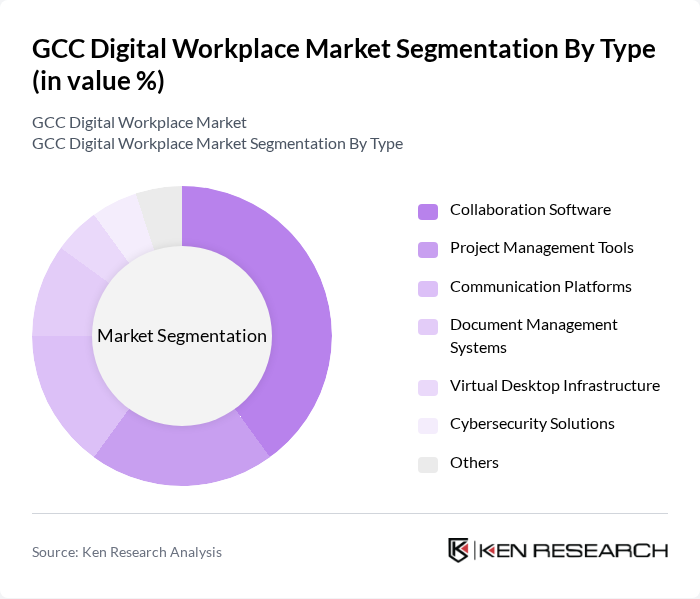

By Type:The digital workplace market is segmented into collaboration software, project management tools, communication platforms, document management systems, virtual desktop infrastructure, cybersecurity solutions, and others. Collaboration software and communication platforms are currently the leading sub-segments, driven by the increasing need for teams to work together effectively, especially in remote and hybrid work environments. The demand for tools that facilitate real-time collaboration, secure communication, and project tracking has surged, making these segments focal points for businesses seeking to enhance productivity and operational agility.

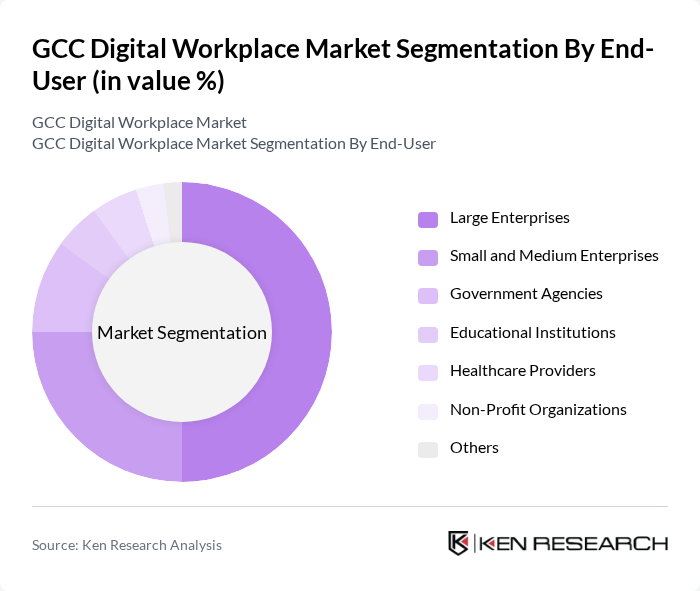

By End-User:The end-user segmentation includes large enterprises, small and medium enterprises, government agencies, educational institutions, healthcare providers, non-profit organizations, and others. Large enterprises are currently the dominant segment, as they have the resources to invest in comprehensive digital workplace solutions. These organizations are increasingly adopting advanced technologies to improve operational efficiency, enhance employee engagement, and drive innovation, making them key players in the digital workplace market. The growing trend of digital transformation across sectors further strengthens the position of large enterprises in this market.

The GCC Digital Workplace Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft, Cisco Systems, Google Workspace (Google LLC), IBM, Oracle, SAP, Slack Technologies (Salesforce, Inc.), Zoom Video Communications, Atlassian, ServiceNow, Box, Inc., Trello (Atlassian), Monday.com, Asana, Dropbox, Zoho Corporation, Tata Consultancy Services (TCS), STC Solutions (Saudi Telecom Company), Injazat (UAE), and Etisalat Digital contribute to innovation, geographic expansion, and service delivery in this space.

The GCC digital workplace market is poised for transformative growth, driven by technological advancements and evolving work models. As organizations increasingly adopt hybrid work environments, the integration of AI and automation will enhance operational efficiency. Furthermore, the focus on employee-centric solutions will reshape workplace dynamics, fostering collaboration and innovation. In future, the emphasis on sustainability in digital tools will also gain traction, aligning with global trends and regulatory frameworks aimed at promoting eco-friendly practices in the workplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Collaboration Software Project Management Tools Communication Platforms Document Management Systems Virtual Desktop Infrastructure Cybersecurity Solutions Others |

| By End-User | Large Enterprises Small and Medium Enterprises Government Agencies Educational Institutions Healthcare Providers Non-Profit Organizations Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | IT and Telecommunications Financial Services Retail Manufacturing Energy and Utilities Transportation and Logistics Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| By User Size | Small Businesses Medium Enterprises Large Corporations Others |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Pay-As-You-Go Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Digital Transformation Initiatives | 100 | Chief Information Officers, IT Managers |

| Employee Engagement with Digital Tools | 60 | HR Managers, Employee Experience Leaders |

| Adoption of Collaboration Platforms | 50 | Team Leaders, Project Managers |

| Remote Work Technology Utilization | 70 | Remote Work Coordinators, IT Support Staff |

| Digital Workplace Satisfaction Surveys | 40 | End-users, Department Heads |

The GCC Digital Workplace Market is valued at approximately USD 5 billion, reflecting significant growth driven by the adoption of cloud-based solutions, remote work models, and advanced collaboration tools among businesses in the region.