Region:Middle East

Author(s):Rebecca

Product Code:KRAD6232

Pages:90

Published On:December 2025

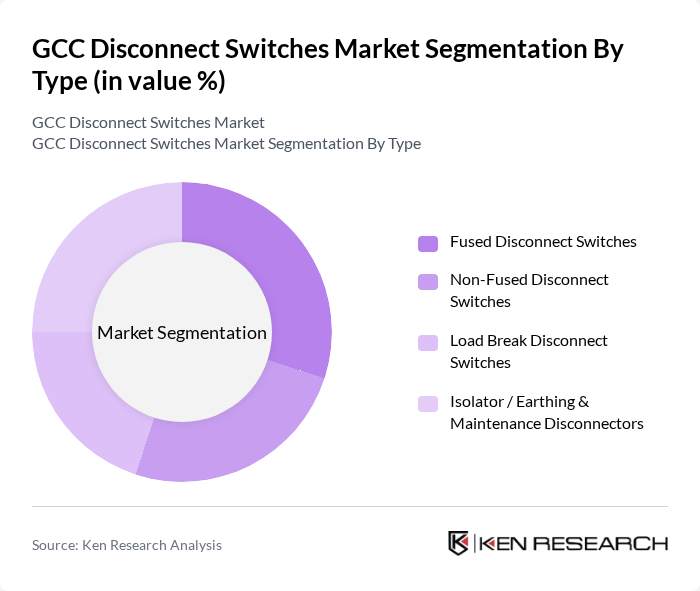

By Type:The disconnect switches market can be segmented into four main types: Fused Disconnect Switches, Non-Fused Disconnect Switches, Load Break Disconnect Switches, and Isolator / Earthing & Maintenance Disconnectors. Each type serves specific applications and industries, catering to varying voltage and operational requirements.

The Fused Disconnect Switches segment is currently dominating the market due to their widespread use in industrial applications where safety and reliability are paramount. These switches provide an additional layer of protection against overloads and short circuits, making them a preferred choice for many utilities and industrial facilities. The increasing focus on safety regulations and standards further drives the demand for fused disconnect switches, as they are essential for ensuring compliance and operational safety.

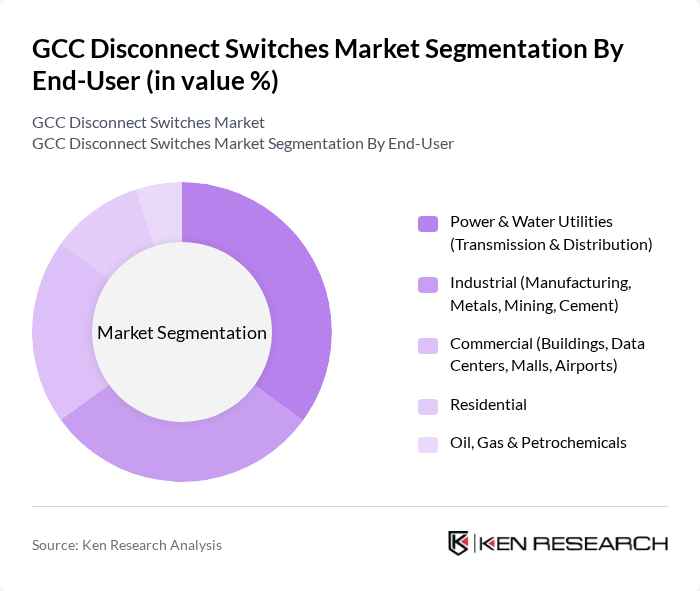

By End-User:The market can also be segmented based on end-users, which include Power & Water Utilities (Transmission & Distribution), Industrial (Manufacturing, Metals, Mining, Cement), Commercial (Buildings, Data Centers, Malls, Airports), Residential, and Oil, Gas & Petrochemicals. Each end-user category has distinct requirements and applications for disconnect switches.

The Power & Water Utilities segment is the leading end-user in the market, driven by the ongoing expansion and modernization of electrical grids across the GCC region. The increasing demand for reliable power supply and the integration of renewable energy sources necessitate the use of advanced disconnect switches. Utilities require robust and efficient solutions to manage electrical distribution effectively, making this segment a key driver of market growth.

The GCC Disconnect Switches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., Eaton Corporation plc, General Electric Company, Mitsubishi Electric Corporation, Legrand SA, LS Electric Co., Ltd. (Formerly LSIS), Lucy Electric, Alfanar Company, Saudi Cable Company, Gulf Cable & Electrical Industries Co. K.S.C.P., Bahra Electric, Riyadh Cables Group Company, Emirates Electrical Engineering LLC (EEEL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC disconnect switches market appears promising, driven by technological advancements and a shift towards sustainable energy solutions in future. As smart grid technologies gain traction, the integration of IoT in switchgear solutions will enhance operational efficiency and reliability. Additionally, the ongoing urbanization and infrastructure development will create a robust demand for innovative disconnect switches, ensuring safety and compliance in electrical systems across the region.

| Segment | Sub-Segments |

|---|---|

| By Type (Fused, Non-Fused, Load Break, Isolator/Disconnectors) | Fused Disconnect Switches Non-Fused Disconnect Switches Load Break Disconnect Switches Isolator / Earthing & Maintenance Disconnectors |

| By End-User (Utilities, Industrial, Commercial, Residential, Oil & Gas / Petrochemicals) | Power & Water Utilities (Transmission & Distribution) Industrial (Manufacturing, Metals, Mining, Cement) Commercial (Buildings, Data Centers, Malls, Airports) Residential Oil, Gas & Petrochemicals |

| By Voltage Rating (Low Voltage, Medium Voltage, High Voltage) | Low Voltage Disconnect Switches (<1 kV) Medium Voltage Disconnect Switches (1–36 kV) High Voltage Disconnect Switches (>36 kV) |

| By Application (Power Generation, Transmission, Distribution, Renewable & Distributed Energy) | Power Generation (Conventional Thermal & Nuclear) Transmission Substations Distribution Networks Solar PV, Wind and Other Renewable Plants Backup Power, C&I Microgrids and EV Infrastructure |

| By Mounting / Installation (Panel Mounted, DIN-Rail / Enclosed, Outdoor Pole/Structure Mounted) | Panel Mounted Disconnect Switches DIN-Rail / Enclosed Disconnect Switches Outdoor Pole / Structure Mounted Disconnect Switches |

| By Installation Environment (Indoor, Outdoor) | Indoor Disconnect Switches (LV Panels, Switchboards, MCCs) Outdoor Disconnect Switches (Substations, Ring Main Units, Pole-Mounted) |

| By Country (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Disconnect Switches | 120 | Homeowners, Electrical Contractors |

| Commercial Electrical Systems | 90 | Facility Managers, Electrical Engineers |

| Industrial Applications | 80 | Plant Managers, Safety Officers |

| Renewable Energy Integration | 60 | Project Developers, Energy Consultants |

| Utility Infrastructure | 100 | Utility Managers, Regulatory Affairs Specialists |

The GCC Disconnect Switches Market is valued at approximately USD 1.1 billion, driven by the increasing demand for reliable electrical infrastructure, particularly in utilities and industrial sectors, along with investments in renewable energy and smart energy management.