Region:Middle East

Author(s):Rebecca

Product Code:KRAD2811

Pages:99

Published On:November 2025

By Type:The market is segmented into various types, including Language Courses, Cultural Exchange Programs, Professional Development Workshops, Study Abroad Programs, Internships and Work Experience, Educational Conferences and Seminars, Volunteering & Service Learning Programs, University Pathway Programs, and Others. Among these,Study Abroad Programsare particularly dominant due to the increasing number of students seeking international exposure and quality education. The trend towards globalization and the desire for cultural immersion are driving factors for this sub-segment. Recent developments also show a rise in hybrid and short-term exchange programs, which cater to both undergraduate and postgraduate students seeking flexible learning experiences.

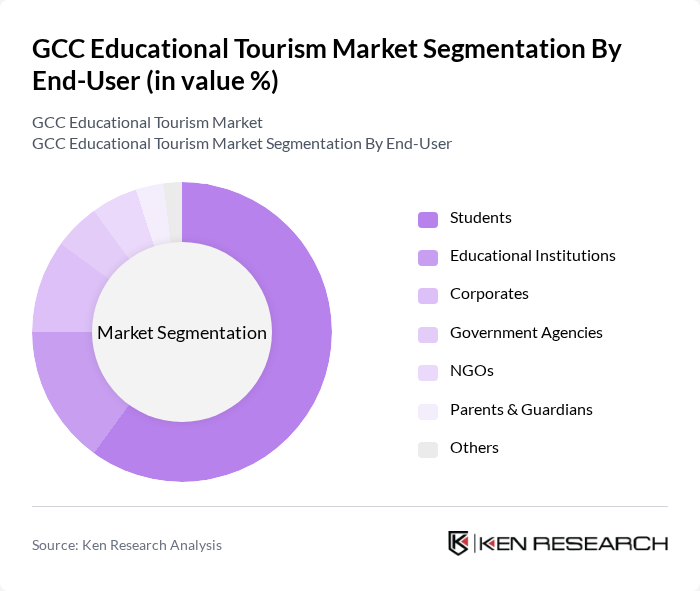

By End-User:The end-user segmentation includes Students, Educational Institutions, Corporates, Government Agencies, NGOs, Parents & Guardians, and Others. TheStudentssegment is the most significant, driven by the increasing number of individuals pursuing higher education abroad. The growing awareness of the benefits of international education and the desire for global career opportunities are key factors contributing to the dominance of this segment. There is also notable growth in demand from postgraduate students and young professionals seeking specialized skills and international credentials.

The GCC Educational Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar University, King Saud University, American University of Sharjah, University of Bahrain, Khalifa University, University of Sharjah, Saudi Arabian Cultural Mission, Abu Dhabi University, Gulf University for Science and Technology, Gulf University, Imam Abdulrahman Bin Faisal University, Sultan Qaboos University, University of Nizwa, Al Ain University, University of Jeddah, Education Zone (UAE), Intelligent Partners (UAE), Qadri International Education Consultancy (UAE), ProEd DMCC (UAE), Meridean Overseas (UAE), Stratix Consultants (UAE), Futures Abroad (UAE), Education Resources Network (ERN) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC educational tourism market appears promising, driven by increasing investments in educational infrastructure and a growing emphasis on international partnerships. As governments continue to enhance their educational offerings, the region is likely to attract a larger pool of international students. Additionally, the integration of technology in education and the rise of hybrid learning models will further enhance the appeal of GCC institutions. This evolving landscape presents significant opportunities for growth and innovation in educational tourism.

| Segment | Sub-Segments |

|---|---|

| By Type | Language Courses Cultural Exchange Programs Professional Development Workshops Study Abroad Programs Internships and Work Experience Educational Conferences and Seminars Volunteering & Service Learning Programs University Pathway Programs Others |

| By End-User | Students Educational Institutions Corporates Government Agencies NGOs Parents & Guardians Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Oman Kuwait Bahrain |

| By Duration of Programs | Short-term Programs (up to 4 weeks) Long-term Programs (semester/year) Summer Programs Semester Abroad Gap Year Programs Others |

| By Mode of Delivery | In-person Learning Online Learning Hybrid Learning Virtual Exchange Programs Others |

| By Target Audience | High School Students University Students Working Professionals Academic Researchers Others |

| By Funding Source | Self-funded Scholarships Government Grants Corporate Sponsorships NGO Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Student Preferences | 120 | Students, Parents, Educational Consultants |

| Educational Institutions' Perspectives | 60 | University Administrators, Program Coordinators |

| Travel Agencies Specializing in Educational Tours | 50 | Travel Agents, Tour Operators |

| Government Tourism Boards Insights | 40 | Policy Makers, Tourism Development Officers |

| Market Trends and Challenges | 45 | Industry Experts, Market Analysts |

The GCC Educational Tourism Market is valued at approximately USD 9.3 billion, reflecting significant growth driven by increasing demand for quality education and cultural exchange opportunities, alongside strategic investments in educational infrastructure across the region.