Region:Middle East

Author(s):Dev

Product Code:KRAC3348

Pages:84

Published On:October 2025

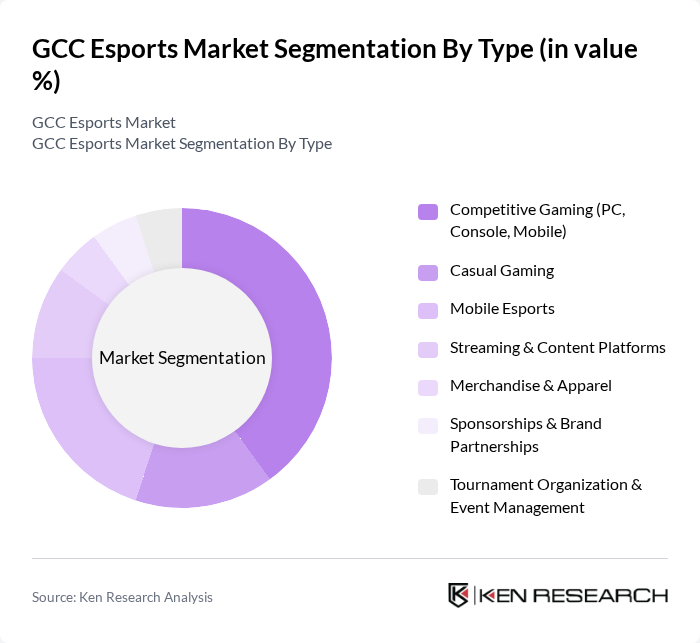

By Type:The market is segmented into various types, including competitive gaming, casual gaming, mobile esports, streaming and content platforms, merchandise and apparel, sponsorships and brand partnerships, and tournament organization and event management. Among these,competitive gaminghas emerged as the leading segment, driven by the increasing number of professional tournaments and the growing popularity of esports titles. The rise of streaming platforms and mobile esports has also contributed significantly to the visibility and engagement of competitive gaming, with mobile esports rapidly expanding due to widespread smartphone adoption and accessible internet connectivity .

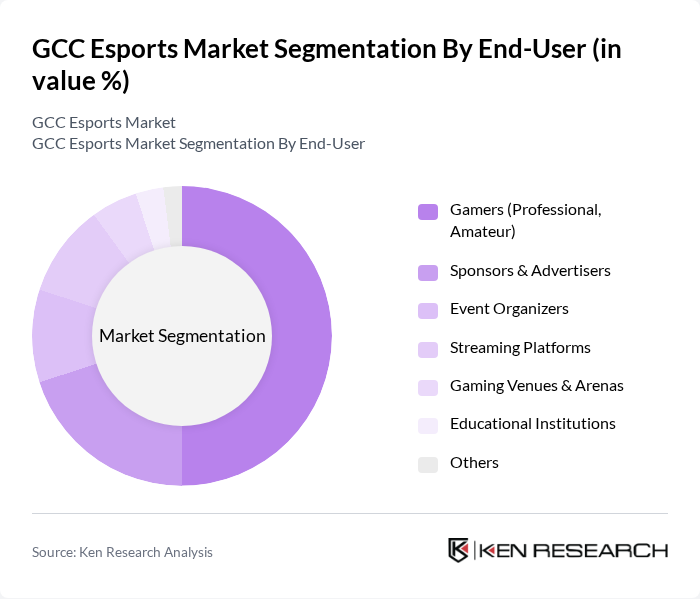

By End-User:The end-user segmentation includes gamers (both professional and amateur), sponsors and advertisers, event organizers, streaming platforms, gaming venues and arenas, educational institutions, and others. The segment ofgamers, particularly professional gamers, dominates the market due to the increasing number of esports tournaments and the growing interest in competitive gaming careers. This trend is further supported by the rise of streaming platforms that provide exposure and revenue opportunities for gamers, as well as the involvement of sponsors and advertisers seeking to engage with a young, digitally active audience .

The GCC Esports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gamers8 (Saudi Esports Federation), ESL Gaming, Riot Games, Nigma Galaxy, Team Falcons, Qlash MENA, VSlash Esports, Geekay Esports, MENA Esports, G2 Esports, Natus Vincere, Fnatic, FaZe Clan, StageOne, and Epic Games contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC esports market appears promising, driven by technological advancements and increasing acceptance of gaming as a legitimate sport. With the rise of mobile gaming and the integration of virtual reality, the market is set to attract a broader audience. Additionally, the growing interest from educational institutions in esports programs will likely foster new talent, ensuring a steady pipeline of skilled players and professionals to support the industry's expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Competitive Gaming (PC, Console, Mobile) Casual Gaming Mobile Esports Streaming & Content Platforms Merchandise & Apparel Sponsorships & Brand Partnerships Tournament Organization & Event Management |

| By End-User | Gamers (Professional, Amateur) Sponsors & Advertisers Event Organizers Streaming Platforms Gaming Venues & Arenas Educational Institutions Others |

| By Distribution Channel | Online Platforms (Streaming, Social Media) Retail Stores (Gaming Merchandise) Esports Events (Live, Hybrid) Direct Sales (Team Merchandise, Tickets) Others |

| By Game Genre | First-Person Shooters (FPS) Multiplayer Online Battle Arena (MOBA) Sports Simulation (e.g., FIFA, NBA2K) Strategy Games (RTS, Turn-based) Battle Royale Fighting Games Others |

| By Age Group | Under 18 24 34 and Above Others |

| By Revenue Model | Sponsorship & Advertising Subscription-Based Free-to-Play (with in-app purchases) Pay-to-Play (Entry Fees, Tickets) Merchandise Sales Media Rights Others |

| By Geographic Presence | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Esports Event Organizers | 50 | Event Managers, Marketing Directors |

| Gaming Enthusiasts | 120 | Casual Gamers, Competitive Players |

| Game Developers | 40 | Product Managers, Game Designers |

| Corporate Sponsors | 40 | Brand Managers, Sponsorship Coordinators |

| Streaming Platforms | 45 | Content Managers, Analytics Specialists |

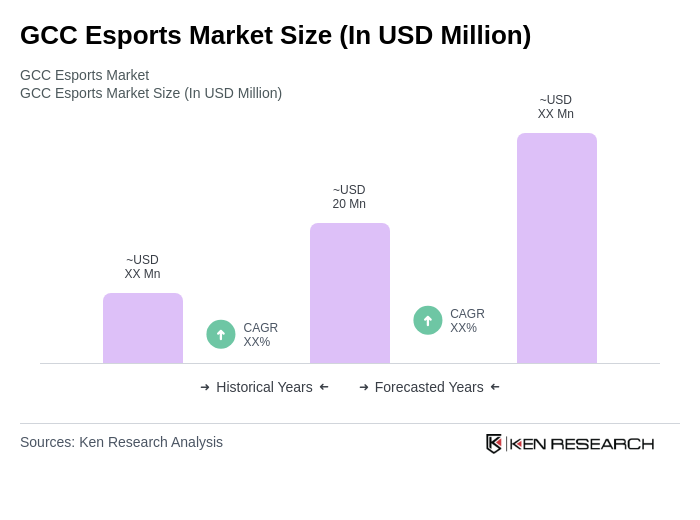

The GCC Esports Market is valued at approximately USD 20 million, reflecting significant growth driven by competitive gaming, mobile gaming popularity, and investments in esports infrastructure and events across the region.