Region:Middle East

Author(s):Rebecca

Product Code:KRAA9373

Pages:100

Published On:November 2025

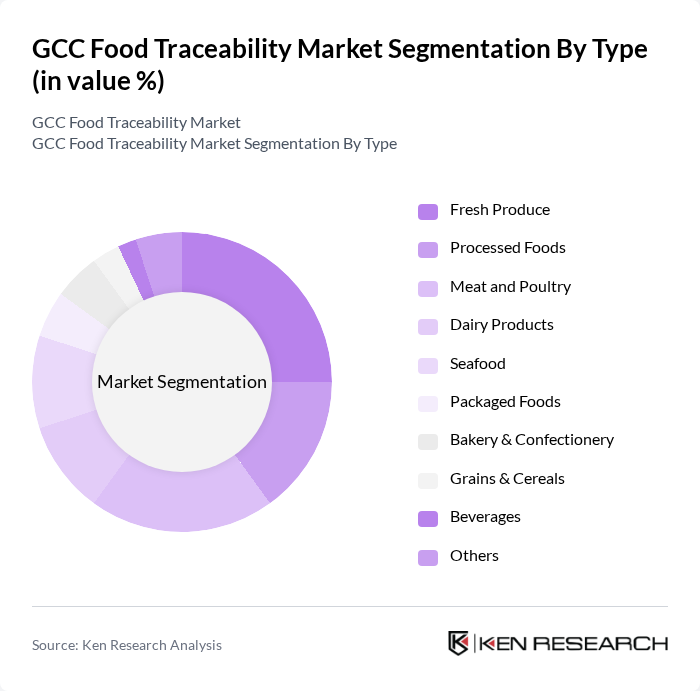

By Type:The market is segmented into Fresh Produce, Processed Foods, Meat and Poultry, Dairy Products, Seafood, Packaged Foods, Bakery & Confectionery, Grains & Cereals, Beverages, and Others.Fresh ProduceandMeat and Poultryremain the leading segments, reflecting heightened consumer health consciousness, preference for organic and locally sourced products, and the higher risk profile of these categories for foodborne incidents. Traceability adoption in these segments is further accelerated by regulatory focus and the need for rapid recall management .

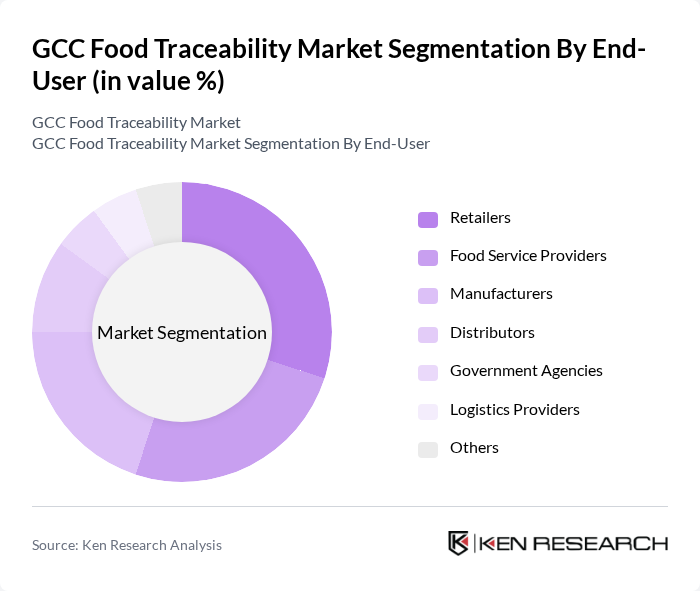

By End-User:End-user segmentation includes Retailers, Food Service Providers, Manufacturers, Distributors, Government Agencies, Logistics Providers, and Others.RetailersandFood Service Providersare the dominant segments, driven by consumer demand for transparency, regulatory compliance, and the need for efficient recall management. Manufacturers also represent a significant share, as they are required to implement traceability solutions to meet regulatory standards and maintain brand reputation .

The GCC Food Traceability Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, SAP, Oracle, SGS, Intertek, FoodLogiQ, Trace One, ripe.io, Telesense, Clear Labs, Ecolab, Aglive, VeChain, Provenance, Zest Labs, Mojix, TE-FOOD, TraceX Technologies, HarvestMark (Div. of Trimble), Decernis contribute to innovation, geographic expansion, and service delivery in this space.

The GCC food traceability market is poised for significant transformation as consumer expectations for transparency and safety continue to rise. In future, advancements in technology, particularly in blockchain and IoT, will facilitate more efficient tracking of food products. Additionally, the increasing integration of sustainability practices will drive demand for organic and locally sourced products. As regulatory frameworks evolve, businesses that embrace these changes will likely gain a competitive edge, fostering innovation and enhancing consumer trust in food safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Processed Foods Meat and Poultry Dairy Products Seafood Packaged Foods Bakery & Confectionery Grains & Cereals Beverages Others |

| By End-User | Retailers Food Service Providers Manufacturers Distributors Government Agencies Logistics Providers Others |

| By Product Category | Organic Foods Conventional Foods Specialty Foods Halal Foods Others |

| By Technology | RFID Technology Barcode & QR Codes Blockchain Technology IoT Solutions Cloud-Based Traceability Platforms Enterprise Resource Planning (ERP) Laboratory Information Management Systems (LIMS) Warehouse Management Systems (WMS) Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales E-commerce Grocery Platforms Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Policy Support | Government Initiatives Subsidies for Technology Adoption Tax Incentives Regulatory Compliance Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Producers | 100 | Operations Managers, Quality Assurance Officers |

| Food Distributors | 60 | Supply Chain Managers, Logistics Coordinators |

| Retailers | 70 | Store Managers, Procurement Specialists |

| Technology Providers | 50 | Product Development Managers, Sales Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

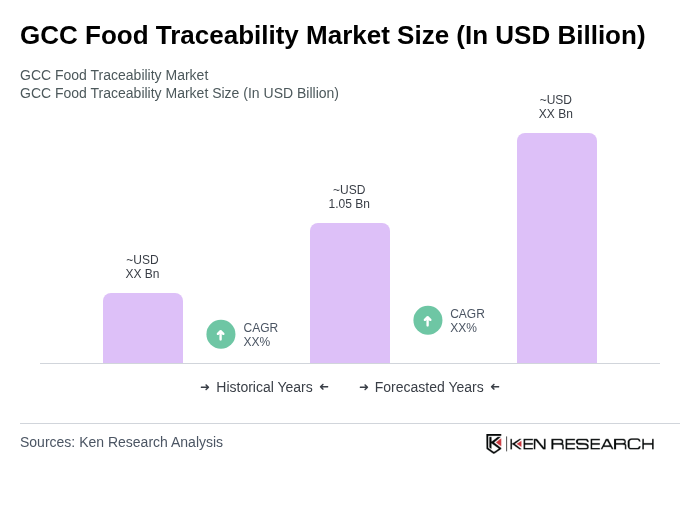

The GCC Food Traceability Market is valued at approximately USD 1.05 billion, reflecting significant growth driven by consumer demand for transparency, stringent food safety regulations, and the adoption of advanced technologies like blockchain and IoT.