Region:Middle East

Author(s):Shubham

Product Code:KRAD5555

Pages:97

Published On:December 2025

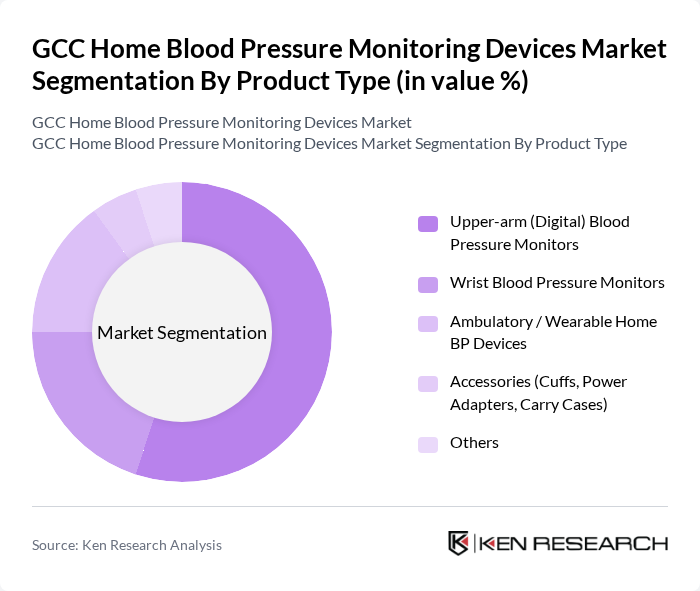

By Product Type:The product type segmentation includes various categories of blood pressure monitors that cater to different consumer needs. The dominant sub-segment in this category is the Upper-arm (Digital) Blood Pressure Monitors, which are preferred for their accuracy and ease of use. Consumers tend to favor these devices for home monitoring due to their reliability and the ability to store multiple readings, making them ideal for tracking health over time. Other segments, such as Wrist Blood Pressure Monitors and Ambulatory/Wearable Home BP Devices, are also gaining traction but do not yet match the popularity of upper-arm monitors.

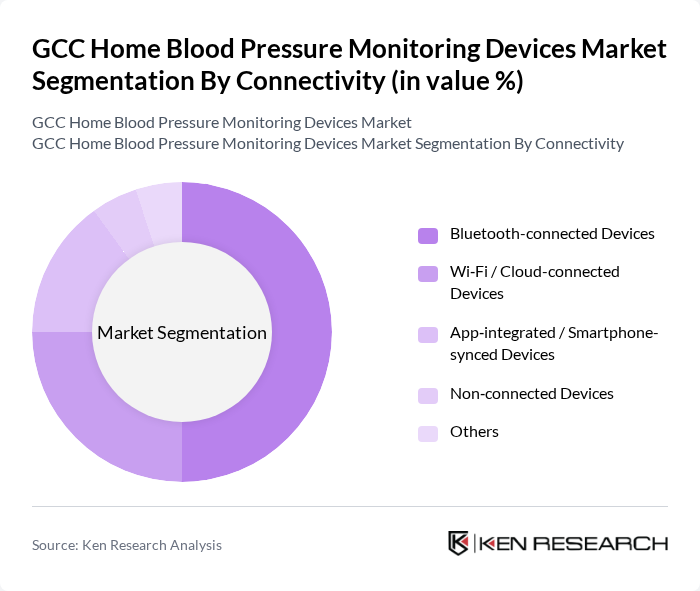

By Connectivity:The connectivity segmentation highlights the technological advancements in blood pressure monitoring devices. Bluetooth-connected Devices lead this segment, as they allow users to sync their readings with smartphones and health apps, enhancing user engagement and data tracking. The growing trend of health monitoring through mobile applications has significantly contributed to the popularity of Bluetooth-connected devices. Wi-Fi/Cloud-connected Devices are also emerging, but the convenience and accessibility of Bluetooth technology make it the preferred choice among consumers.

The GCC Home Blood Pressure Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omron Healthcare, Inc., Koninklijke Philips N.V. (Philips Healthcare), A&D Company, Limited (A&D Medical), Beurer GmbH, Panasonic Healthcare Co., Ltd., Microlife Corporation, Rossmax International Ltd., Yuwell (Jiangsu Yuyue Medical Equipment & Supply Co., Ltd.), iHealth Labs, Inc., Qardio, Inc., Withings SA, Welch Allyn, Inc. (Hillrom / Baxter), Bionime Corporation, Citizen Systems Japan Co., Ltd., Edan Instruments, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC home blood pressure monitoring devices market appears promising, driven by technological innovations and increasing health consciousness among consumers. As telehealth services expand, more individuals will seek remote monitoring solutions, enhancing device adoption. Additionally, the integration of artificial intelligence in health monitoring will likely improve accuracy and user engagement. These trends indicate a shift towards more personalized healthcare, positioning the market for sustained growth in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Upper-arm (Digital) Blood Pressure Monitors Wrist Blood Pressure Monitors Ambulatory / Wearable Home BP Devices Accessories (Cuffs, Power Adapters, Carry Cases) Others |

| By Connectivity | Bluetooth-connected Devices Wi?Fi / Cloud-connected Devices App?integrated / Smartphone-synced Devices Non?connected Devices Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drugstores Hypermarkets & Supermarkets E?commerce & Online Marketplaces Medical Device Distributors Others |

| By End User | Home-use Patients / Individuals Home Healthcare & Telehealth Providers Primary Care Clinics & Polyclinics Corporate Wellness & Occupational Health Programs Others |

| By Country (GCC) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Cardiologists, General Practitioners, Nurses |

| Patients Using Home Monitors | 140 | Hypertensive Patients, Elderly Individuals |

| Caregivers and Family Members | 100 | Caregivers, Family Health Advocates |

| Retail and Distribution Channels | 80 | Pharmacy Managers, Medical Device Distributors |

| Health Insurance Providers | 70 | Health Insurance Analysts, Policy Makers |

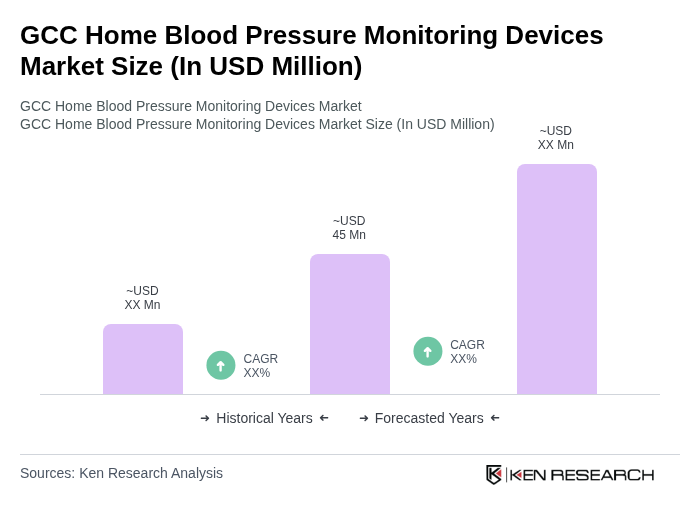

The GCC Home Blood Pressure Monitoring Devices Market is valued at approximately USD 45 million, reflecting a significant growth trend driven by increasing hypertension prevalence and rising health awareness among consumers in the region.