Region:Middle East

Author(s):Shubham

Product Code:KRAA8835

Pages:88

Published On:November 2025

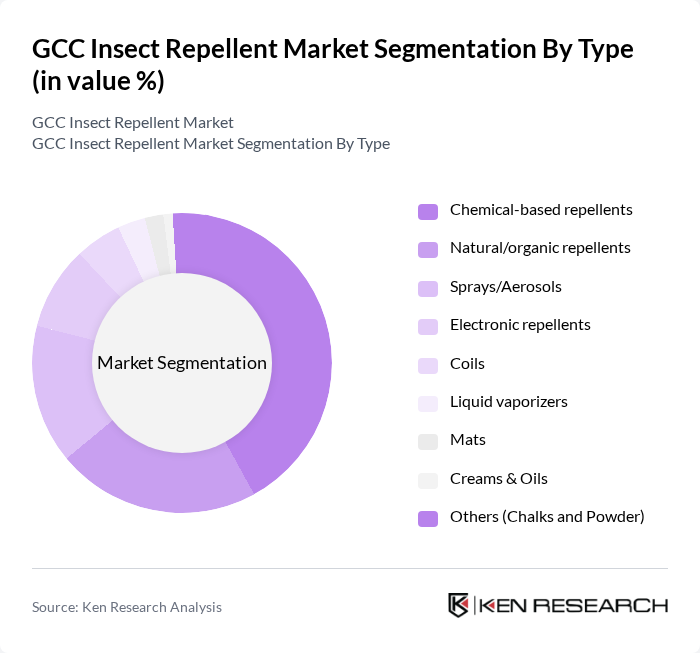

By Type:The market is segmented into various types of insect repellents, including chemical-based repellents, natural/organic repellents, electronic repellents, coils, liquid vaporizers, sprays/aerosols, mats, creams & oils, and others such as chalks and powder. Among these, spray-based repellents dominate the market due to their effectiveness and widespread availability. Consumers often prefer these products for their quick action against insects, particularly in regions with high insect populations. The demand for herbal and odor-free spray formulations continues to grow, driven by consumer preference for products that reduce the risk of skin irritations from synthetic chemicals.

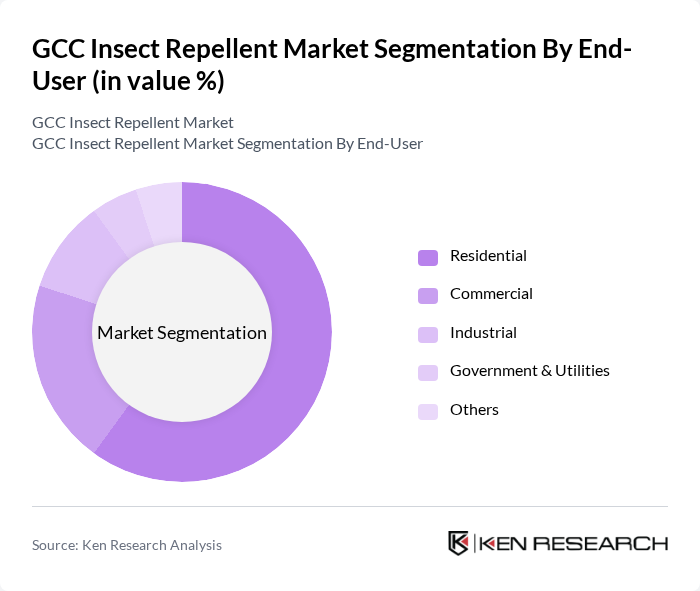

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment leads the market, driven by increasing consumer awareness regarding health risks associated with insect bites. Homeowners are increasingly investing in insect repellents to protect their families, especially in urban areas where insect populations are higher.

The GCC Insect Repellent Market is characterized by a dynamic mix of regional and international players. Leading participants such as SC Johnson & Son, Inc., Reckitt Benckiser Group plc, Bayer AG, Spectrum Brands Holdings, Inc., Godrej Consumer Products Ltd., Avon Products, Inc., The Coleman Company, Inc., Thermacell Repellents, Inc., Sawyer Products, Inc., 3M Company, Mosquito Magnet (Woodstream Corporation), Repel (Spectrum Brands), Off! (SC Johnson), EcoSMART Technologies, Inc., Jungle Formula (Omega Pharma), Midas Hygiene Industries Pvt. Ltd., Dabur International Ltd., Al-Futtaim Health (UAE distributor), Al-Dawaa Pharmacies (KSA distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC insect repellent market is poised for significant evolution, driven by increasing consumer demand for eco-friendly products and innovative packaging solutions. As awareness of environmental issues grows, companies are likely to invest in developing natural and organic repellents, aligning with consumer preferences. Additionally, the rise of e-commerce platforms is expected to enhance product accessibility, allowing brands to reach untapped markets and cater to a broader audience, ultimately shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical-based repellents Natural/organic repellents Electronic repellents Coils Liquid vaporizers Sprays/Aerosols Mats Creams & Oils Others (Chalks and Powder) |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online retail Supermarkets/Hypermarkets Pharmacies Specialty stores Outdoor & Camping Stores Others |

| By Packaging Type | Spray bottles Wipes Lotions Coils packaging Vaporizers packaging Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman |

| By Consumer Age Group | Children Adults Seniors Others |

| By Price Range | Budget Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | General Consumers, Outdoor Enthusiasts |

| Distribution Channel Analysis | 80 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trend Evaluation | 60 | Market Analysts, Industry Experts |

The GCC Insect Repellent Market is valued at approximately USD 1.3 billion, driven by increasing awareness of health risks associated with insect bites and the rising incidence of vector-borne diseases in the region.