Region:Asia

Author(s):Dev

Product Code:KRAC1313

Pages:99

Published On:December 2025

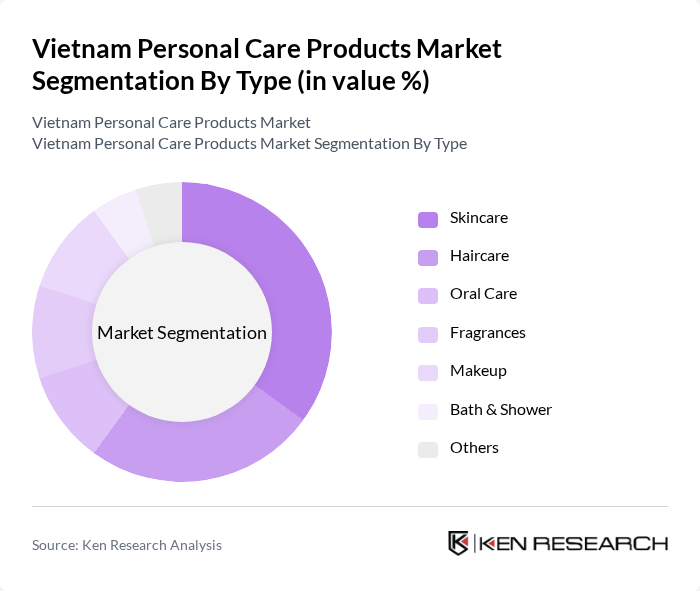

By Type:The personal care products market is segmented into various types, including skincare, haircare, oral care, fragrances, makeup, bath & shower, and others. Among these, skincare products dominate the market due to the increasing awareness of skin health and the rising demand for anti-aging and moisturizing products. Consumers are increasingly seeking products that offer multifunctional benefits, such as sun protection and hydration, which further drives the growth of this segment.

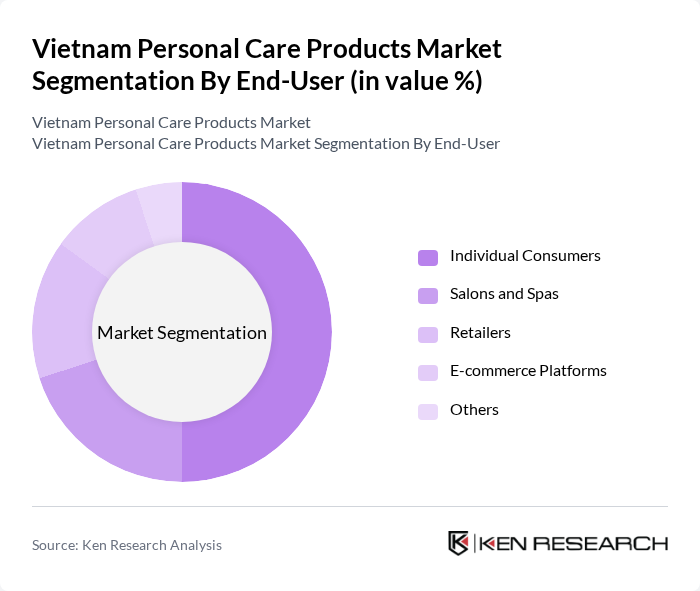

By End-User:The end-user segmentation includes individual consumers, salons and spas, retailers, e-commerce platforms, and others. Individual consumers represent the largest segment, driven by the growing trend of personal grooming and self-care. The rise of e-commerce platforms has also significantly influenced consumer purchasing behavior, making personal care products more accessible to a broader audience.

The Vietnam Personal Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Vietnam, Procter & Gamble Vietnam, L'Oréal Vietnam, Johnson & Johnson Vietnam, Oriflame Vietnam, Amway Vietnam, Beiersdorf Vietnam, Shiseido Vietnam, Kao Corporation Vietnam, Avon Vietnam, Mary Kay Vietnam, Natura Vietnam, Pigeon Vietnam, The Body Shop Vietnam, and Himalaya Herbals Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam personal care products market appears promising, driven by increasing consumer awareness of health and sustainability. The demand for natural and organic products is expected to rise, with revenue from this segment projected to reach approximately USD 250 million in future. Additionally, the growth of e-commerce platforms will continue to reshape consumer purchasing behaviors, allowing brands to reach a broader audience. Innovations in product formulations and packaging will also play a crucial role in attracting environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Haircare Oral Care Fragrances Makeup Bath & Shower Others |

| By End-User | Individual Consumers Salons and Spas Retailers E-commerce Platforms Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Pharmacies Others |

| By Price Range | Premium Mid-range Economy Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Gender | Male Female Unisex Others |

| By Product Formulation | Organic Conventional Natural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 150 | Women aged 18-45, Skincare Enthusiasts |

| Haircare Product Consumers | 100 | Men and Women aged 20-50, Salon Professionals |

| Cosmetics Buyers | 120 | Young Adults aged 18-30, Beauty Influencers |

| Natural/Organic Product Users | 80 | Health-Conscious Consumers, Eco-Friendly Advocates |

| Online Shoppers of Personal Care | 90 | Frequent Online Shoppers, E-commerce Users |

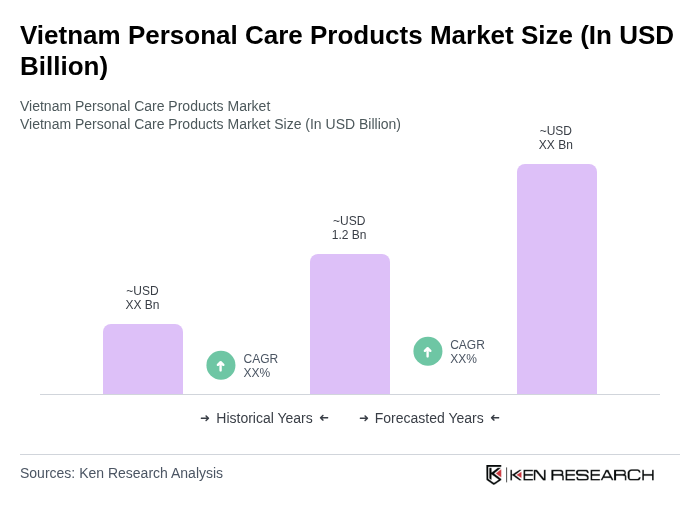

The Vietnam Personal Care Products Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by rising disposable incomes and urbanization, which enhance consumer demand for multifunctional and climate-adapted products.