Region:Middle East

Author(s):Rebecca

Product Code:KRAA9253

Pages:80

Published On:November 2025

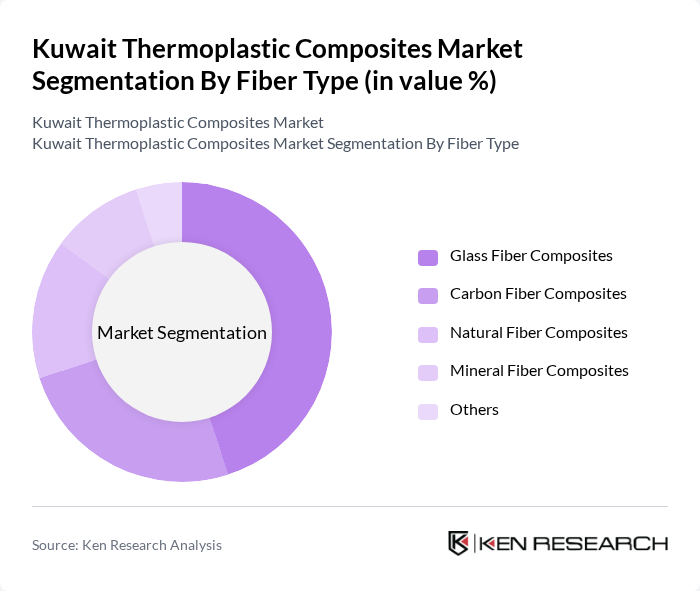

By Fiber Type:The fiber type segmentation includes various materials used in thermoplastic composites, each offering unique properties and applications. The subsegments are Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Mineral Fiber Composites, and Others. Among these, Glass Fiber Composites dominate the market due to their excellent strength-to-weight ratio, cost-effectiveness, and versatility in applications ranging from automotive to construction. The increasing demand for lightweight and durable materials in these sectors drives the preference for glass fiber composites, making them the leading subsegment.

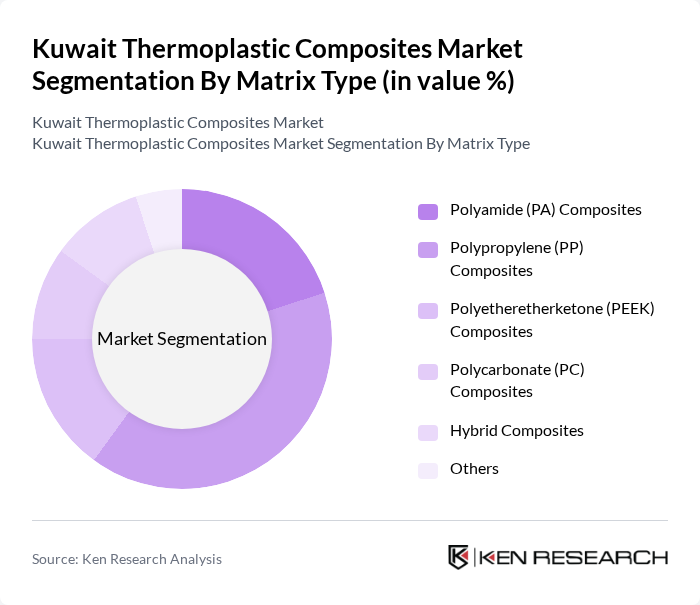

By Matrix Type:The matrix type segmentation encompasses the various polymer matrices used in thermoplastic composites, including Polyamide (PA) Composites, Polypropylene (PP) Composites, Polyetheretherketone (PEEK) Composites, Polycarbonate (PC) Composites, Hybrid Composites, and Others. Polypropylene (PP) Composites are currently the leading subsegment due to their favorable properties such as low density, chemical resistance, and ease of processing. The growing automotive and consumer goods sectors are increasingly adopting PP composites for their lightweight and cost-effective solutions, further solidifying their market leadership.

The Kuwait Thermoplastic Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Kuwait Petroleum Corporation, Alghanim Industries, Gulf Plastic Industries, KAPCO (Kuwait Aviation Fuelling Company), Kuwait Fiber Glass Manufacturing & Trading Co., National Industries Group, Western Composite Industrial Company, Smithline Reinforced Composites, Premier Composite Technologies, Lloyds Composite Industries LLC, Saad Othman Co., Al Sanna Composites LLC, Gulf Group, Al-Bahar Group, KGL Holding, Al-Muhalab Group, Al-Sayer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait thermoplastic composites market appears promising, driven by increasing investments in research and development and a growing emphasis on sustainability. As industries seek to reduce their carbon footprint, the demand for eco-friendly materials is expected to rise. Additionally, advancements in smart technologies will likely lead to innovative applications, enhancing the functionality of thermoplastic composites. This evolving landscape presents significant opportunities for market players to capitalize on emerging trends and expand their product offerings.

| Segment | Sub-Segments |

|---|---|

| By Fiber Type | Glass Fiber Composites Carbon Fiber Composites Natural Fiber Composites Mineral Fiber Composites Others |

| By Matrix Type | Polyamide (PA) Composites Polypropylene (PP) Composites Polyetheretherketone (PEEK) Composites Polycarbonate (PC) Composites Hybrid Composites Others |

| By Product Type | Short Fiber Thermoplastics Long Fiber Thermoplastics Continuous Fiber Thermoplastics Others |

| By Application | Automotive Aerospace & Defense Construction Electronics & Electrical Consumer Goods Others |

| By Manufacturing Process | Injection Molding Compression Molding Thermoforming Pultrusion Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| By Performance Characteristics | High-Temperature Resistance Impact Resistance Chemical Resistance Flame Retardancy Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, R&D Engineers |

| Aerospace Component Manufacturing | 80 | Quality Assurance Managers, Design Engineers |

| Construction Material Suppliers | 70 | Procurement Managers, Project Engineers |

| Consumer Goods Packaging | 50 | Marketing Managers, Product Development Specialists |

| Research Institutions and Academia | 40 | Research Scientists, Professors in Material Science |

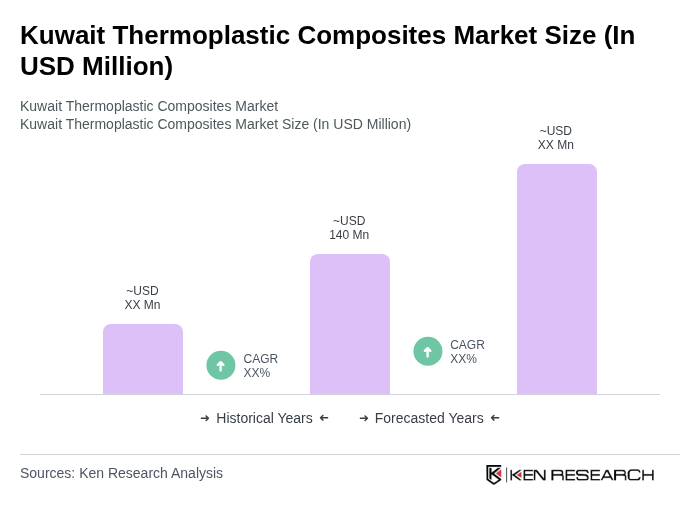

The Kuwait Thermoplastic Composites Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for lightweight and high-performance materials across various sectors, including automotive and construction.