Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7313

Pages:97

Published On:October 2025

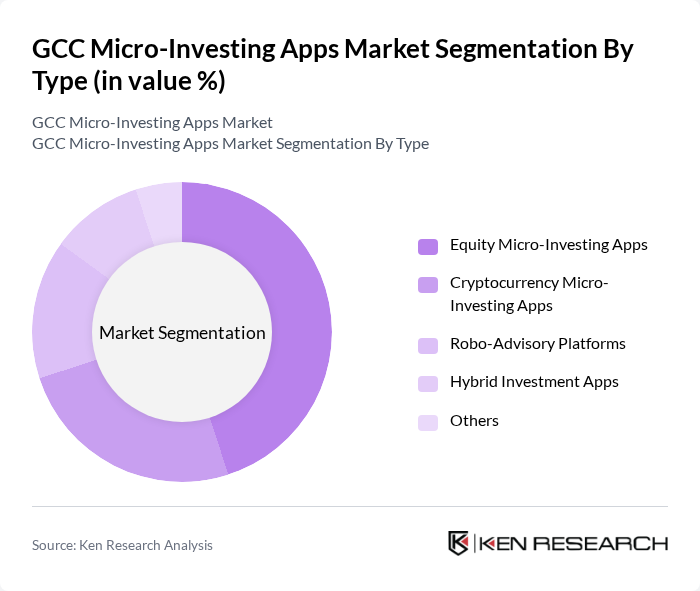

By Type:The market is segmented into various types of micro-investing apps, including Equity Micro-Investing Apps, Cryptocurrency Micro-Investing Apps, Robo-Advisory Platforms, Hybrid Investment Apps, and Others. Among these, Equity Micro-Investing Apps dominate the market due to their popularity among individual investors seeking to build wealth through stock investments. The ease of use and accessibility of these platforms have attracted a significant user base, particularly among millennials and Gen Z, who are increasingly interested in stock market participation.

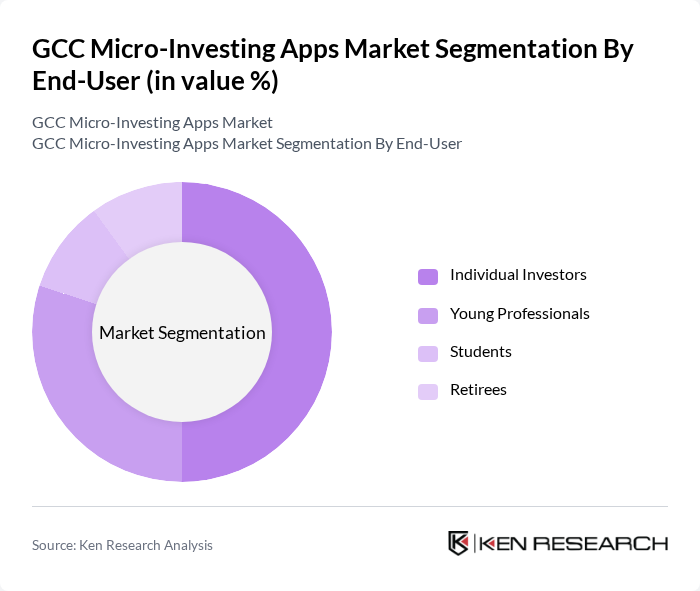

By End-User:The end-user segmentation includes Individual Investors, Young Professionals, Students, and Retirees. Individual Investors represent the largest segment, driven by the increasing number of people looking to invest small amounts of money. This trend is particularly strong among young professionals who are keen to grow their savings and are more inclined to use technology for financial management. The convenience and low barriers to entry offered by micro-investing apps make them appealing to this demographic.

The GCC Micro-Investing Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Acorns, Stash, Robinhood, Betterment, Wealthfront, M1 Finance, SoFi Invest, Cash App, Round, Stockpile, Ellevest, E*TRADE, Charles Schwab, TD Ameritrade, and Fidelity Investments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC micro-investing apps market appears promising, driven by technological advancements and changing consumer behaviors. As financial literacy initiatives gain traction, more individuals are expected to engage with investment platforms. Additionally, the integration of artificial intelligence and machine learning will enhance user experience, providing personalized investment strategies. The focus on sustainable investing will also shape product offerings, aligning with global trends towards responsible finance and appealing to socially conscious investors.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Micro-Investing Apps Cryptocurrency Micro-Investing Apps Robo-Advisory Platforms Hybrid Investment Apps Others |

| By End-User | Individual Investors Young Professionals Students Retirees |

| By Investment Amount | Low-Investment Apps (Under $100) Medium-Investment Apps ($100 - $1,000) High-Investment Apps (Above $1,000) |

| By User Experience | Beginner-Friendly Apps Advanced Trading Platforms |

| By Geographic Focus | GCC-Wide Apps Country-Specific Apps |

| By Marketing Strategy | Social Media-Focused Apps Influencer-Driven Apps |

| By Customer Support | /7 Support Apps Limited Support Hours Apps Community-Driven Support Apps |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Micro-Investing App Users | 150 | Millennials, Gen Z Investors |

| Financial Advisors | 100 | Investment Consultants, Wealth Managers |

| Regulatory Bodies | 50 | Financial Regulators, Compliance Officers |

| Tech Developers in Fintech | 80 | Software Engineers, Product Managers |

| Potential Investors | 120 | First-time Investors, Young Professionals |

The GCC Micro-Investing Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased smartphone penetration and a rising interest in digital financial services among younger demographics.