Region:Middle East

Author(s):Dev

Product Code:KRAB7248

Pages:84

Published On:October 2025

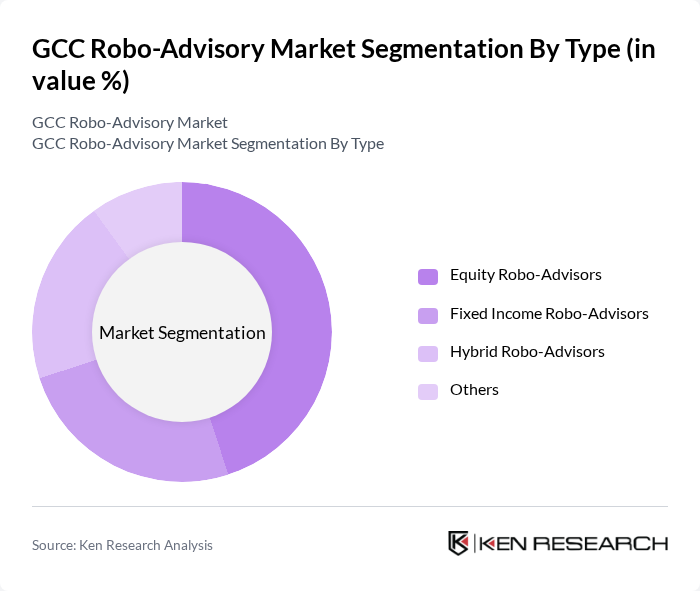

By Type:The market is segmented into various types of robo-advisors, including Equity Robo-Advisors, Fixed Income Robo-Advisors, Hybrid Robo-Advisors, and Others. Among these, Equity Robo-Advisors are currently leading the market due to their ability to provide diversified investment portfolios that appeal to a wide range of investors. The growing interest in stock market investments, particularly among millennials, has further fueled the demand for equity-based solutions.

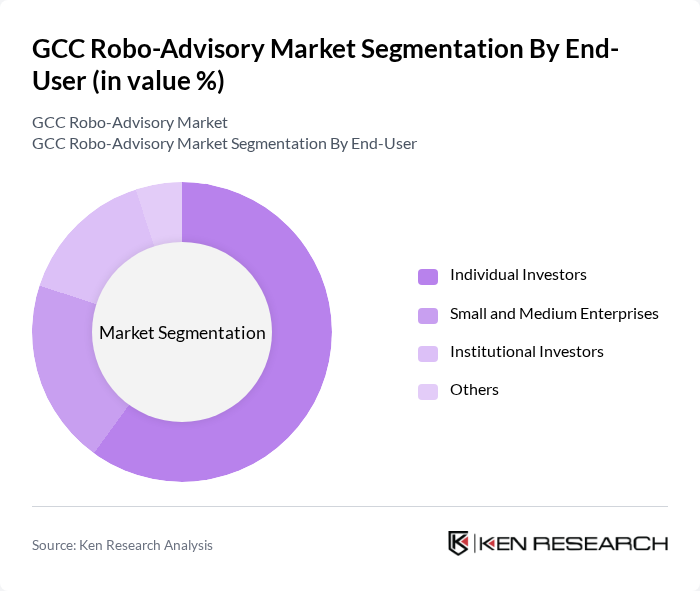

By End-User:The end-user segmentation includes Individual Investors, Small and Medium Enterprises, Institutional Investors, and Others. Individual Investors dominate the market, driven by the increasing number of retail investors seeking affordable and efficient investment solutions. The rise of digital platforms has made it easier for individuals to access financial markets, leading to a surge in demand for robo-advisory services tailored to personal investment goals.

The GCC Robo-Advisory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wealthfront, Betterment, M1 Finance, Acorns, Robinhood, Stash, SoFi Invest, Charles Schwab Intelligent Portfolios, Vanguard Personal Advisor Services, Ally Invest, Personal Capital, E*TRADE Core Portfolios, Fidelity Go, Ellevest, Wealthsimple contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC robo-advisory market appears promising, driven by technological advancements and increasing financial literacy among younger investors. As the region's population continues to grow, the demand for automated investment solutions is expected to rise. Additionally, regulatory frameworks are likely to evolve, providing clearer guidelines for robo-advisors, which will enhance consumer trust. The integration of AI and machine learning will further personalize investment strategies, making them more appealing to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Robo-Advisors Fixed Income Robo-Advisors Hybrid Robo-Advisors Others |

| By End-User | Individual Investors Small and Medium Enterprises Institutional Investors Others |

| By Investment Strategy | Passive Investment Strategies Active Investment Strategies Tactical Asset Allocation Others |

| By Service Model | Full-Service Robo-Advisors Limited-Service Robo-Advisors Hybrid Models Others |

| By Customer Segment | Millennials Gen X Baby Boomers Others |

| By Geographic Focus | Domestic Investors International Investors Expatriate Investors Others |

| By Pricing Model | Percentage of Assets Under Management Flat Fee Structure Performance-Based Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High Net-Worth Individuals | 150 | Wealth Managers, Financial Advisors |

| Millennial Investors | 100 | Young Professionals, Tech Enthusiasts |

| Institutional Investors | 80 | Portfolio Managers, Investment Analysts |

| Financial Technology Experts | 70 | Fintech Entrepreneurs, Industry Analysts |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The GCC Robo-Advisory Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services and a growing number of tech-savvy investors seeking low-cost investment solutions.