Region:Middle East

Author(s):Shubham

Product Code:KRAD5400

Pages:83

Published On:December 2025

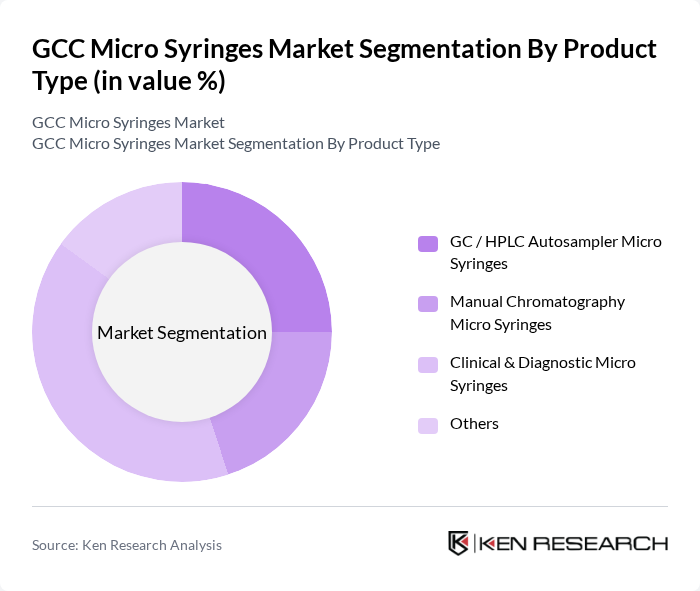

By Product Type:The product type segmentation includes various categories such as GC / HPLC Autosampler Micro Syringes, Manual Chromatography Micro Syringes, Clinical & Diagnostic Micro Syringes, and Others. This structure aligns with global market practice, where micro syringes are broadly used in chromatography (GC/HPLC autosamplers and manual injections) and in clinical or diagnostic workflows for precise liquid handling. Clinical & Diagnostic Micro Syringes account for a significant share in healthcare-focused demand in GCC due to their essential role in sample preparation, analyte transfer, and precise medication or reagent delivery in diagnostics and patient care, particularly in hospital laboratories and centralized reference labs that handle high test volumes for chronic and infectious diseases.

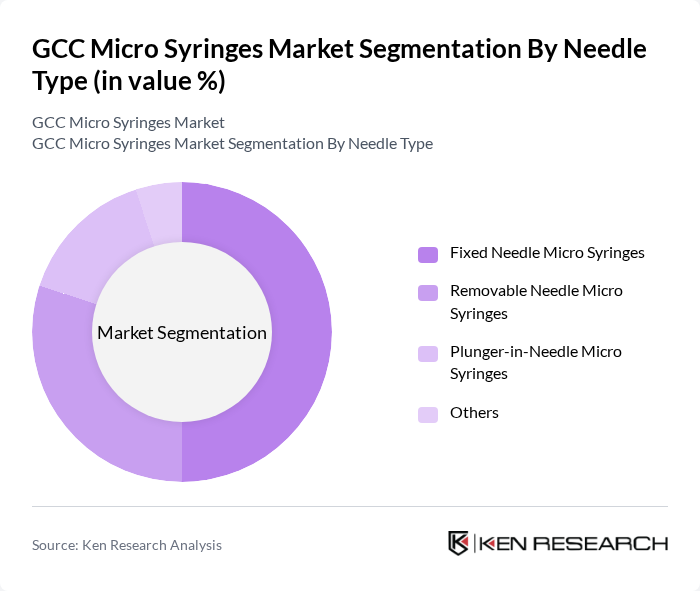

By Needle Type:The needle type segmentation encompasses Fixed Needle Micro Syringes, Removable Needle Micro Syringes, Plunger-in-Needle Micro Syringes, and Others. This categorization is consistent with leading manufacturers’ portfolios, which distinguish between integrated (fixed) needle syringes, interchangeable needle designs, and specialized plunger-in-needle formats for ultra-low dead volume and high-precision applications. Fixed Needle Micro Syringes dominate this segment in many clinical and routine analytical settings due to their ease of use, reduced dead volume, and reliability; their integrated design minimizes the risk of leakage and contamination and supports accurate dosing and repeatability, making them a preferred choice among healthcare and laboratory professionals for high-frequency, standardized workflows.

The GCC Micro Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamilton Company, SGE Analytical Science (Trajan Scientific and Medical), Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Shimadzu Corporation, Restek Corporation, Metrohm AG, PerkinElmer Inc., VICI AG International, DWK Life Sciences GmbH, Becton, Dickinson and Company, Terumo Corporation, Nipro Corporation, Medline Industries, LP, Local & Regional GCC Distributors (e.g., Al Mazroui Medical & Chemical Supplies LLC, Gulf Scientific Corporation) contribute to innovation, geographic expansion, and service delivery in this space by supplying micro syringes for GC, HPLC, spectroscopy, and clinical laboratory applications alongside broader syringe and needle portfolios.

The GCC micro syringes market is poised for significant growth, driven by the increasing adoption of advanced drug delivery systems and a focus on patient-centric healthcare solutions. As healthcare infrastructure improves, particularly in emerging markets, the demand for innovative micro syringe designs will rise. Additionally, collaborations between manufacturers and pharmaceutical companies are expected to enhance product offerings, ensuring that micro syringes meet evolving healthcare needs while adhering to regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Product Type | GC / HPLC Autosampler Micro Syringes Manual Chromatography Micro Syringes Clinical & Diagnostic Micro Syringes Others |

| By Needle Type | Fixed Needle Micro Syringes Removable Needle Micro Syringes Plunger-in-Needle Micro Syringes Others |

| By End-User | Hospital & Reference Laboratories Pharmaceutical & Biotechnology Companies CROs and Academic & Research Institutes Forensic & Environmental Testing Laboratories Others |

| By Volume Range | ? 10 ?L – 100 ?L – 500 ?L > 500 ?L |

| By Material | Glass Micro Syringes Plastic / Polymer Micro Syringes Stainless Steel Micro Syringes Others |

| By Distribution Channel | Direct Sales to End-Users Distributor / Dealer Network Online Medical & Laboratory E-commerce Platforms Others |

| By Country (GCC) | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 45 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Distributors | 40 | Sales Managers, Distribution Heads |

| Healthcare Professionals | 50 | Doctors, Nurses, Pharmacists |

| Medical Device Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions and Universities | 45 | Research Scientists, Academic Professors |

The GCC Micro Syringes Market is valued at approximately USD 55 million, reflecting a significant demand for precision in drug delivery systems and micro-volume fluid handling across various sectors, including pharmaceuticals and biotechnology.