Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1192

Pages:92

Published On:November 2025

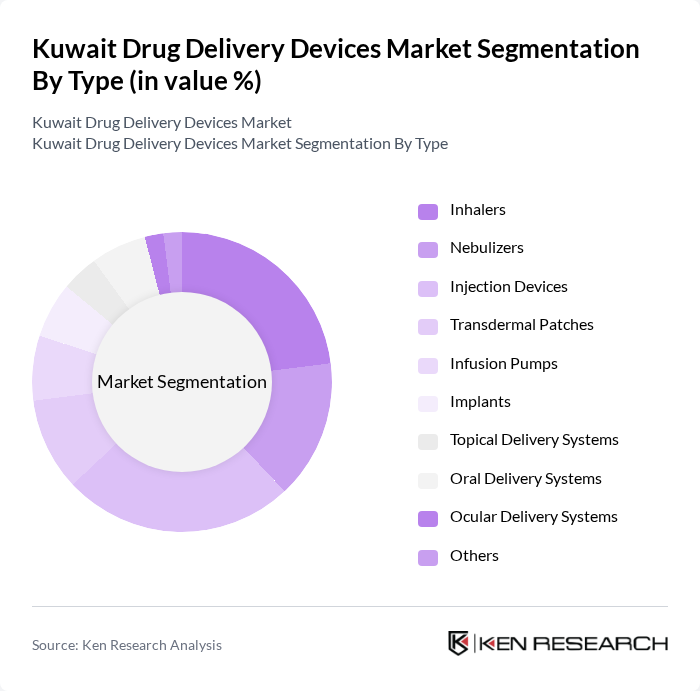

By Type:The drug delivery devices market can be segmented into various types, including inhalers, nebulizers, injection devices, transdermal patches, infusion pumps, implants, topical delivery systems, oral delivery systems, ocular delivery systems, and others. Among these, inhalers and injection devices are particularly prominent due to their widespread use in managing respiratory and chronic conditions. The increasing demand for self-administration and connected devices, such as wearable injectors and smart inhalers, is also driving growth in these segments.

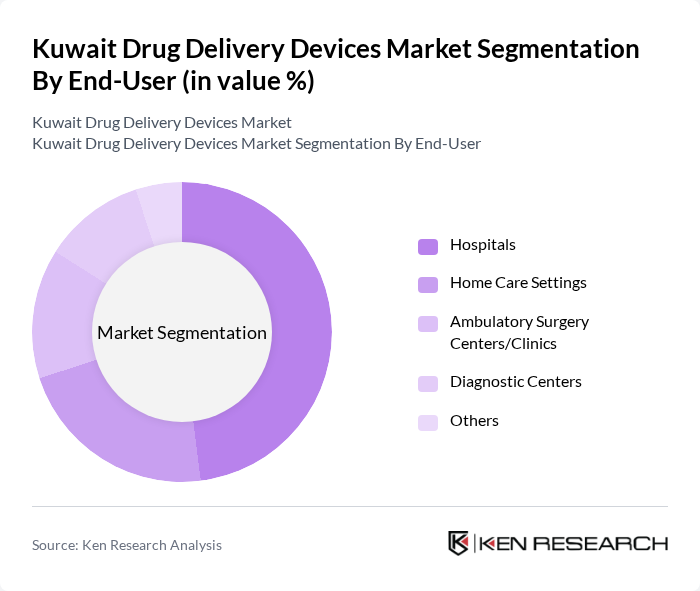

By End-User:The end-user segmentation includes hospitals, home care settings, ambulatory surgery centers/clinics, diagnostic centers, and others. Hospitals are the leading end-user segment, driven by the high volume of patients requiring drug delivery devices for various treatments. The increasing trend towards home healthcare and remote patient monitoring is also notable, as patients prefer receiving care in the comfort of their homes, which is boosting the demand for home care settings and connected drug delivery devices.

The Kuwait Drug Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Medtronic plc, Becton, Dickinson and Company, Novartis AG, Sanofi S.A., Abbott Laboratories, Roche Holding AG, Merck & Co., Inc., GlaxoSmithKline plc, Amgen Inc., Eli Lilly and Company, AstraZeneca plc, Gilead Sciences, Inc., Teva Pharmaceutical Industries Ltd., Bayer AG, BD (Becton, Dickinson and Company), UniQure N.V., SiBiono GeneTech Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drug delivery devices market in Kuwait appears promising, driven by technological advancements and a growing focus on patient-centric solutions. As healthcare providers increasingly adopt digital health technologies, the integration of telemedicine and remote monitoring will enhance patient engagement and adherence. Furthermore, the ongoing investment in healthcare infrastructure is expected to facilitate the introduction of innovative drug delivery systems, ultimately improving health outcomes and accessibility for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Inhalers Nebulizers Injection Devices Transdermal Patches Infusion Pumps Implants Topical Delivery Systems Oral Delivery Systems Ocular Delivery Systems Others |

| By End-User | Hospitals Home Care Settings Ambulatory Surgery Centers/Clinics Diagnostic Centers Others |

| By Application | Oncology Infectious Diseases Respiratory Diseases Central Nervous System Disorders Diabetes Cardiovascular Diseases Autoimmune Diseases Others |

| By Distribution Channel | Direct Supply to Hospitals and Healthcare Institutions Pharmaceutical and Medical Device Distributors Regional Healthcare Supply Chain Networks Private Clinics and Labs Online Pharmacies Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Al Jahra Governorate Others |

| By Technology | Smart Drug Delivery Systems Nanotechnology-based Devices Biologics Delivery Systems Conventional Drug Delivery Systems Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retailers | 100 | Pharmacy Managers, Retail Pharmacists |

| Healthcare Providers | 90 | General Practitioners, Specialists |

| Medical Device Manufacturers | 60 | Product Managers, Sales Directors |

| Patient Advocacy Groups | 50 | Patient Representatives, Healthcare Advocates |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

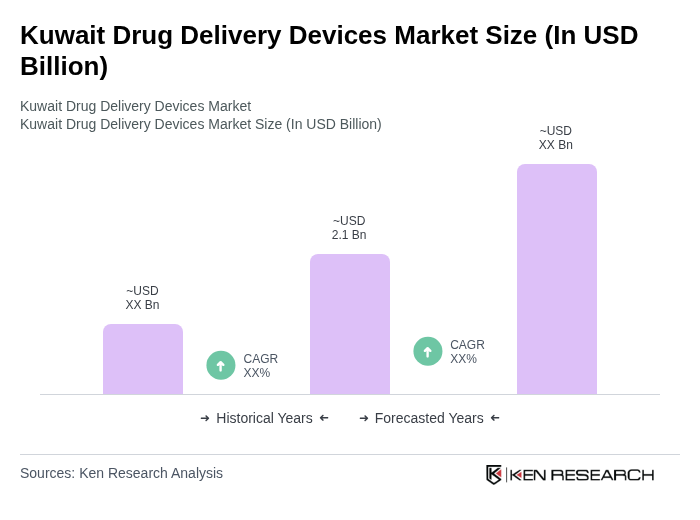

The Kuwait Drug Delivery Devices Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases and advancements in drug delivery technologies.