Region:Middle East

Author(s):Shubham

Product Code:KRAC8976

Pages:88

Published On:November 2025

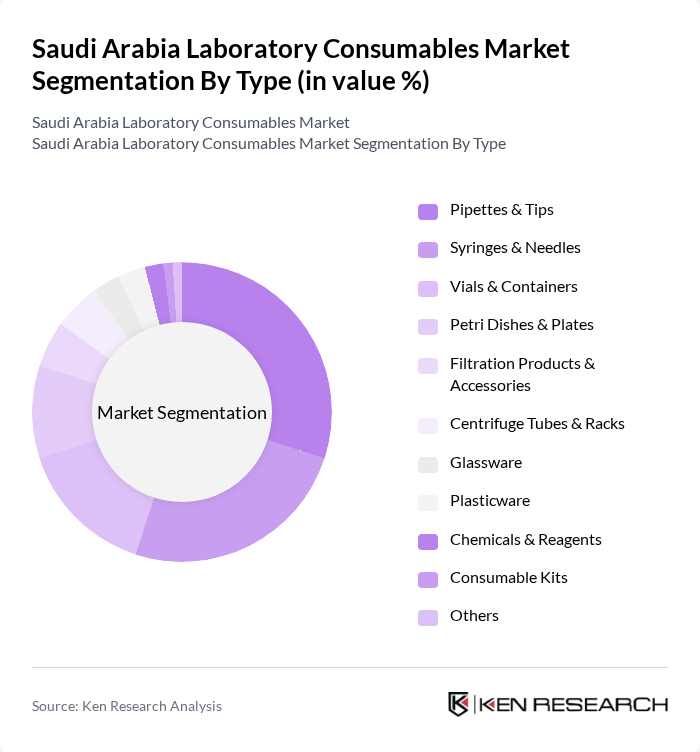

By Type:The laboratory consumables market is segmented into various types, including Pipettes & Tips, Syringes & Needles, Vials & Containers, Petri Dishes & Plates, Filtration Products & Accessories, Centrifuge Tubes & Racks, Glassware, Plasticware, Chemicals & Reagents, Consumable Kits, and Others. Among these, Pipettes & Tips and Syringes & Needles are the leading subsegments due to their essential roles in laboratory procedures and diagnostics. The increasing number of clinical tests and research activities drives the demand for these consumables, making them critical for laboratory operations.

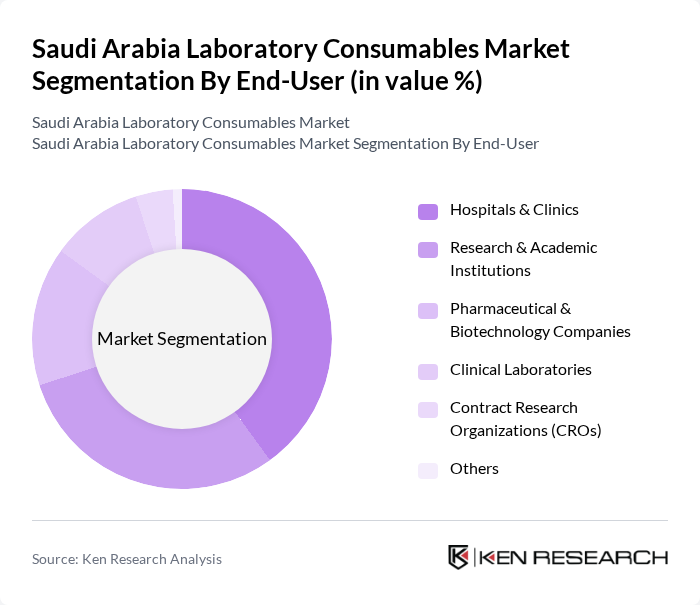

By End-User:The end-user segmentation includes Hospitals & Clinics, Research & Academic Institutions, Pharmaceutical & Biotechnology Companies, Clinical Laboratories, Contract Research Organizations (CROs), and Others. Hospitals & Clinics and Research & Academic Institutions are the dominant segments, driven by the increasing number of diagnostic tests and research initiatives. The growing focus on healthcare quality and research advancements significantly boosts the demand for laboratory consumables in these sectors.

The Saudi Arabia Laboratory Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, Avantor (VWR International), Sartorius AG, Bio-Rad Laboratories, Eppendorf AG, PerkinElmer, Inc., Beckman Coulter, Inc., F. Hoffmann-La Roche AG, Sigma-Aldrich (Merck Group), Abbott Laboratories, Siemens Healthineers, Illumina, Inc., QIAGEN N.V., Al-Dawaa Pharmacies, Al Hayat Pharmaceuticals, Arabian Medical Products Manufacturing Company (ENAYAH), Al Jeel Medical & Trading Co., Gulf Medical Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia laboratory consumables market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the government continues to prioritize healthcare improvements, the demand for high-quality laboratory consumables is expected to rise. Additionally, the integration of digital technologies and automation in laboratories will enhance operational efficiency, further stimulating market growth. The focus on personalized medicine will also create new avenues for innovation and product development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pipettes & Tips Syringes & Needles Vials & Containers Petri Dishes & Plates Filtration Products & Accessories Centrifuge Tubes & Racks Glassware Plasticware Chemicals & Reagents Consumable Kits Others |

| By End-User | Hospitals & Clinics Research & Academic Institutions Pharmaceutical & Biotechnology Companies Clinical Laboratories Contract Research Organizations (CROs) Others |

| By Application | Clinical Diagnostics Life Science Research Environmental Testing Food Safety Testing Forensic Testing Academic Research Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Lifecycle Stage | New Products Mature Products Declining Products Others |

| By Packaging Type | Bulk Packaging Retail Packaging Customized Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, Quality Control Supervisors |

| Research Institutions | 80 | Principal Investigators, Research Coordinators |

| Pharmaceutical Companies | 60 | Procurement Managers, R&D Directors |

| Educational Institutions | 50 | Laboratory Instructors, Department Heads |

| Government Research Facilities | 40 | Facility Managers, Compliance Officers |

The Saudi Arabia Laboratory Consumables Market is valued at approximately USD 115 million, reflecting a significant growth driven by increased demand for laboratory testing and diagnostics, particularly due to rising chronic diseases and government healthcare initiatives.