Region:Middle East

Author(s):Rebecca

Product Code:KRAD2729

Pages:80

Published On:November 2025

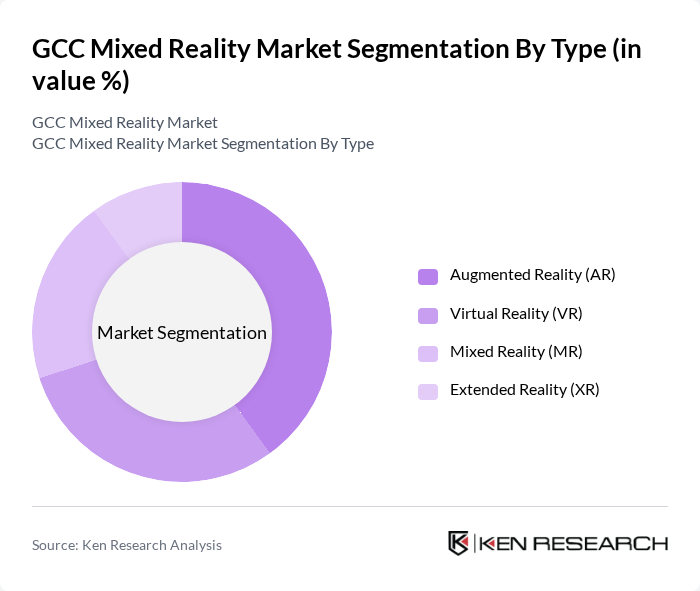

By Type:The market is segmented into Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), and Extended Reality (XR). Each segment addresses distinct consumer and industry needs: AR and VR are most prominent, widely used in gaming, training, healthcare, and marketing, while MR and XR are gaining traction for industrial design, simulation, and collaborative applications .

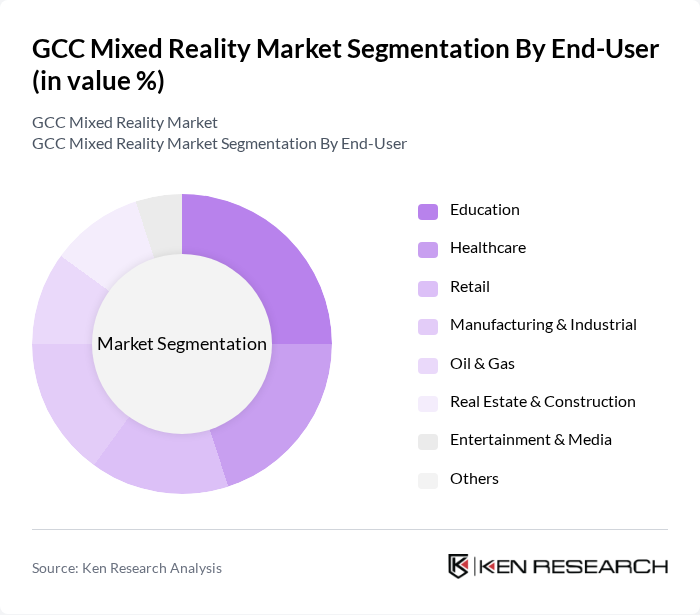

By End-User:The end-user segmentation includes Education, Healthcare, Retail, Manufacturing & Industrial, Oil & Gas, Real Estate & Construction, Entertainment & Media, and Others. Education and healthcare are rapidly expanding segments due to immersive training and simulation applications, while retail and real estate leverage MR for customer engagement and visualization. Manufacturing and oil & gas sectors utilize MR for remote assistance, safety training, and operational efficiency .

The GCC Mixed Reality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Magic Leap, Inc., Meta Platforms, Inc. (Oculus VR), HTC Corporation (VIVE), PTC Inc., Unity Technologies, Niantic, Inc., Snap Inc., Varjo Technologies Oy, Epson Corporation, Sony Interactive Entertainment, Google LLC, Qualcomm Technologies, Inc., Autodesk, Inc., Lenovo Group Limited, Arvizio Inc., Vuzix Corporation, Virtuocity (Qatar), HyperSpace (UAE), and Midwam (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mixed reality market in the GCC appears promising, driven by technological advancements and increasing consumer interest. As 5G networks expand, connectivity will enhance the performance of AR/VR applications, facilitating real-time interactions. Additionally, the integration of mixed reality in sectors like healthcare and education is expected to grow, with investments projected to exceed $400 million in future. This convergence of technology and application will likely create a robust ecosystem for mixed reality solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Augmented Reality (AR) Virtual Reality (VR) Mixed Reality (MR) Extended Reality (XR) |

| By End-User | Education Healthcare Retail Manufacturing & Industrial Oil & Gas Real Estate & Construction Entertainment & Media Others |

| By Industry Vertical | Gaming & eSports Automotive & Transportation Real Estate Tourism & Hospitality Defense & Security Utilities & Smart Cities Others |

| By Technology | Hardware (Headsets, Sensors, Cameras, Displays) Software (Platforms, Applications, SDKs) Services (Integration, Consulting, Support) Others |

| By Application | Training and Simulation Marketing and Advertising Design and Prototyping Remote Collaboration Maintenance and Field Service Others |

| By Deployment Mode | Cloud-based On-premises Edge Computing Others |

| By Region | UAE Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Mixed Reality Applications | 60 | Healthcare Administrators, Medical Technology Managers |

| Education Sector Adoption of Mixed Reality | 50 | School Administrators, Curriculum Developers |

| Entertainment and Gaming Industry Insights | 45 | Game Developers, Marketing Managers |

| Corporate Training and Development | 40 | HR Managers, Training Coordinators |

| Retail Sector Mixed Reality Integration | 40 | Retail Managers, Customer Experience Managers |

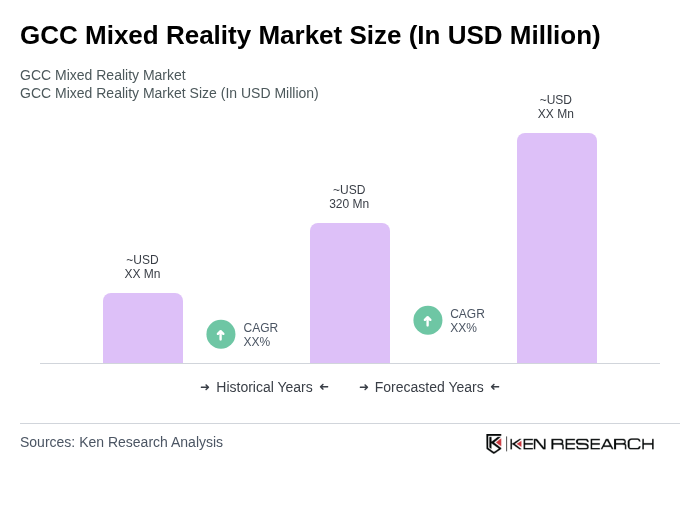

The GCC Mixed Reality Market is valued at approximately USD 320 million, driven by advancements in hardware and software technologies, as well as increasing adoption across various sectors such as gaming, healthcare, and education.