Region:Middle East

Author(s):Rebecca

Product Code:KRAA9225

Pages:95

Published On:November 2025

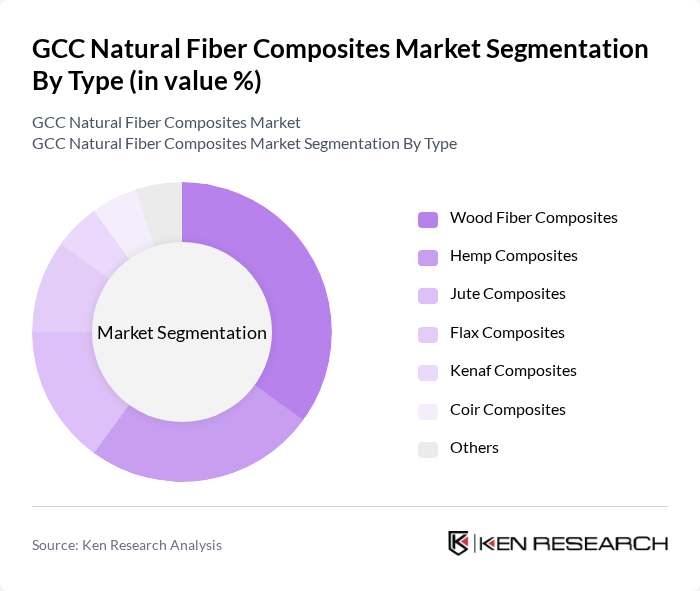

By Type:The market is segmented into various types of natural fiber composites, including Wood Fiber Composites, Hemp Composites, Jute Composites, Flax Composites, Kenaf Composites, Coir Composites, and Others. Among these, Wood Fiber Composites are leading due to their widespread application in construction and furniture manufacturing, driven by their strength and aesthetic appeal. Wood-plastic composites (WPC), combining wood fibers with thermoplastics, are especially popular in building and construction, favored for their strong mechanical properties, stability, natural look, and outdoor durability. Hemp Composites are gaining traction due to their lightweight and high strength-to-weight ratio, making them suitable for automotive applications. Kenaf composites are emerging as the second-fastest-growing segment due to their superior tensile strength and flexural strength, along with properties including low density, lightweight nature, high strength, flexibility, and biodegradability.

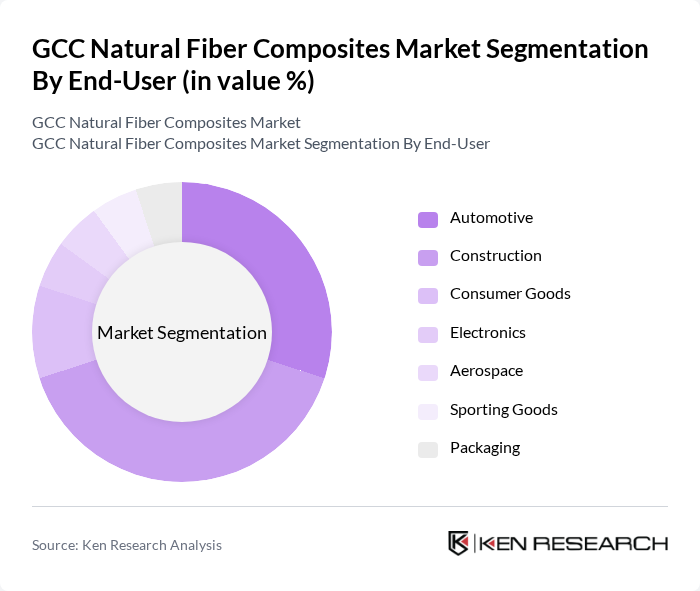

By End-User:The end-user segmentation includes Automotive, Construction, Consumer Goods, Electronics, Aerospace, Sporting Goods, Packaging, and Others. The Construction sector is the largest consumer of natural fiber composites, driven by the increasing demand for sustainable building materials and growing infrastructure development. The Automotive industry is also witnessing a rise in the use of these composites due to their lightweight properties, which contribute to fuel efficiency and reduced emissions. Natural fibers are increasingly substituting glass and carbon fibers in automotive applications due to low costs and improved sustainability.

The GCC Natural Fiber Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as FlexForm Technologies, Trex Company, Inc., Green Dot Bioplastics, BASF SE, UPM-Kymmene Corporation, Procotex Corporation, TECNARO GmbH, Bcomp Ltd., Polyvlies Franz Beyer GmbH, NatureWorks LLC, Biome Bioplastics, GreenFiber International, Jute Fiber Composites, BioComposite Solutions, Composites Evolution Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC natural fiber composites market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As technological advancements continue to lower production costs and improve material performance, the market is likely to expand. Additionally, the integration of natural fibers in various industries, particularly automotive and construction, will further enhance market penetration. The focus on sustainability and eco-friendly practices will remain a key driver of growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wood Fiber Composites Hemp Composites Jute Composites Flax Composites Kenaf Composites Coir Composites Others |

| By End-User | Automotive Construction Consumer Goods Electronics Aerospace Sporting Goods Packaging Others |

| By Application | Structural Components Interior Components Decking & Railing Insulation Materials Packaging Solutions Others |

| By Manufacturing Process | Compression Molding Injection Molding Extrusion Hand Lay-Up Others |

| By Fiber Source | Agricultural Residues Industrial Waste Forest Residues Recycled Fibers Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| By Policy Support | Subsidies for Natural Fiber Production Tax Incentives for Eco-Friendly Products Research Grants for Composite Innovations Public Procurement Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Applications | 100 | Project Managers, Materials Engineers |

| Automotive Industry Usage | 80 | Product Designers, Manufacturing Engineers |

| Consumer Goods Sector Insights | 70 | Brand Managers, Product Development Leads |

| Research & Development in Composites | 60 | R&D Managers, Innovation Directors |

| Sustainability Initiatives in Manufacturing | 90 | Sustainability Managers, Compliance Officers |

The GCC Natural Fiber Composites Market is valued at approximately USD 5.4 billion, reflecting a significant growth trend driven by the increasing demand for sustainable materials across various industries, including automotive and construction.