Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7907

Pages:92

Published On:December 2025

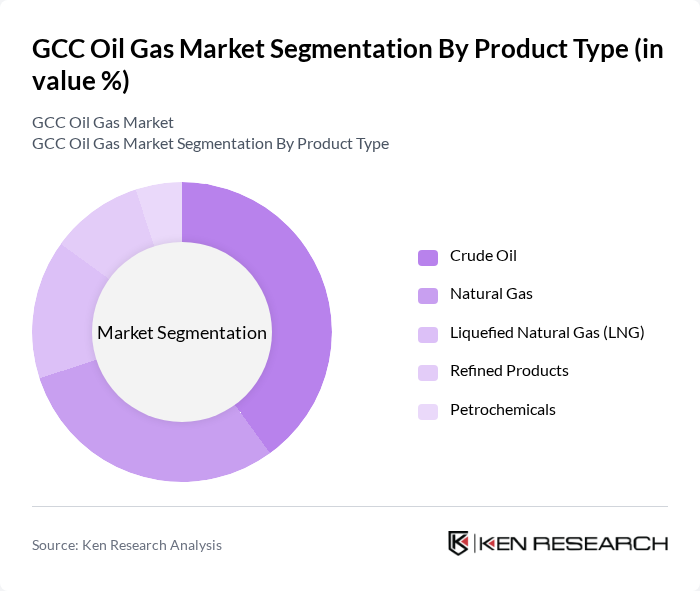

By Product Type:The product type segmentation includes various categories such as crude oil, natural gas, liquefied natural gas (LNG), refined products, and petrochemicals. Each of these subsegments plays a crucial role in the overall market dynamics, with crude oil and natural gas being the primary drivers due to their extensive use in energy production and industrial applications.

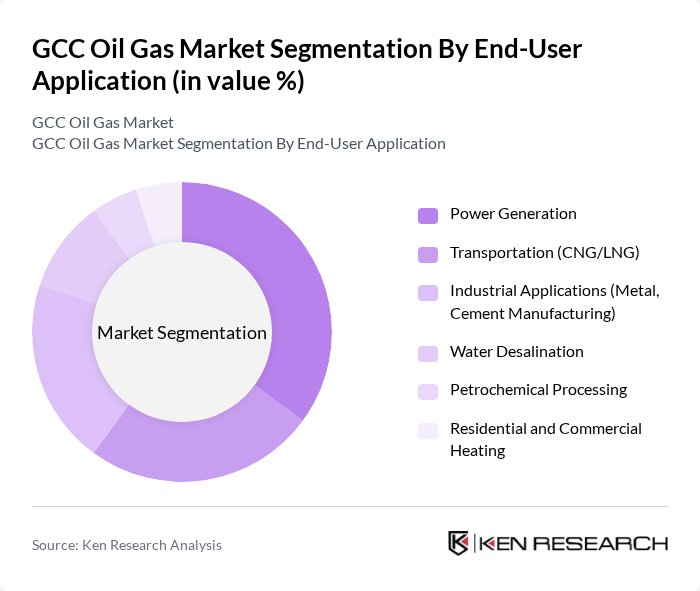

By End-User Application:The end-user application segmentation encompasses various sectors including power generation, transportation (CNG/LNG), industrial applications (metal, cement manufacturing), water desalination, petrochemical processing, and residential and commercial heating. Each application area utilizes oil and gas products differently, with power generation and industrial applications being the most significant consumers.

The GCC Oil Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Abu Dhabi National Oil Company (ADNOC), Qatar Energy, Kuwait Petroleum Corporation (KPC), Oman Oil Company (OOC), RasGas Company Limited, Bahrain Petroleum Company (Bapco), Sharjah National Oil Corporation (SNOC), Petrofac Limited, Schlumberger Limited, Halliburton Company, TotalEnergies SE, BP plc, Eni SpA, Saudi Arabian Oil Company (Saudi Aramco) Subsidiaries contribute to innovation, geographic expansion, and service delivery in this space.

The GCC oil and gas market is poised for transformation as it adapts to evolving energy landscapes and regulatory frameworks. With a focus on sustainability, the region is likely to see increased investments in renewable energy integration and digital technologies. Furthermore, strategic partnerships between GCC nations and global energy firms will enhance innovation and operational efficiency. As the market navigates challenges, the emphasis on energy diversification and technological advancements will shape its future trajectory, ensuring resilience and competitiveness in a changing global environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Refined Products Petrochemicals |

| By End-User Application | Power Generation Transportation (CNG/LNG) Industrial Applications (Metal, Cement Manufacturing) Water Desalination Petrochemical Processing Residential and Commercial Heating |

| By Country/Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| By Extraction Technology | Conventional Extraction Unconventional Gas Production Enhanced Oil Recovery (EOR) Hydraulic Fracturing LNG Technology |

| By Value Chain Segment | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) |

| By Investment Source | Government Funding Private Sector Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support Mechanism | Regulatory Frameworks Tax Incentives and Subsidies Energy Transition Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 120 | Exploration Managers, Production Engineers |

| Midstream Transportation and Storage | 100 | Logistics Coordinators, Operations Managers |

| Downstream Refining and Marketing | 100 | Refinery Managers, Marketing Directors |

| Natural Gas Distribution | 80 | Gas Supply Managers, Regulatory Affairs Specialists |

| Renewable Energy Integration | 70 | Sustainability Officers, Project Developers |

The GCC Oil Gas Market is valued at approximately USD 1.2 trillion, driven by significant hydrocarbon reserves, rising global energy demand, and investments in infrastructure and technology. This valuation reflects a comprehensive analysis over the past five years.