Region:Middle East

Author(s):Rebecca

Product Code:KRAB8350

Pages:92

Published On:October 2025

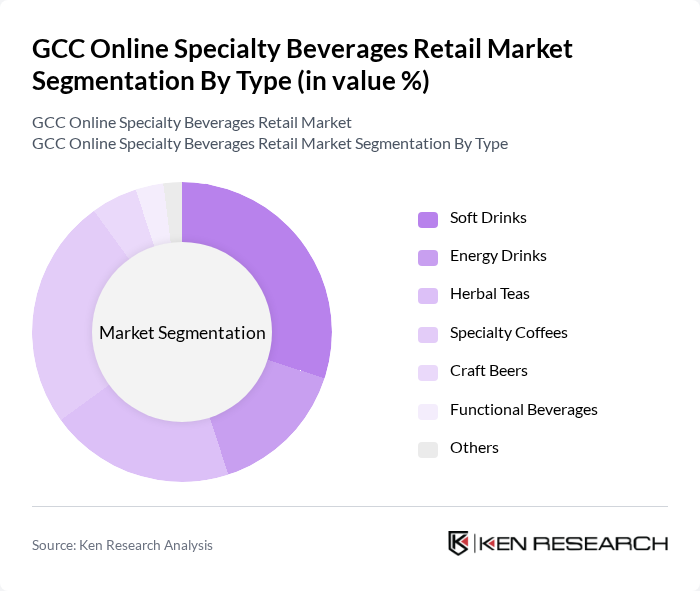

By Type:The market is segmented into various types of specialty beverages, including Soft Drinks, Energy Drinks, Herbal Teas, Specialty Coffees, Craft Beers, Functional Beverages, and Others. Among these, Soft Drinks and Specialty Coffees are particularly popular due to their wide appeal and innovative flavors. The increasing trend of health consciousness has also led to a rise in demand for Herbal Teas and Functional Beverages, which are perceived as healthier alternatives.

By End-User:The end-user segmentation includes Individual Consumers, Restaurants and Cafes, Retail Chains, and Online Marketplaces. Individual Consumers are the largest segment, driven by the growing trend of online shopping and the desire for unique beverage experiences. Restaurants and Cafes also play a significant role, as they increasingly offer specialty beverages to attract customers looking for premium options.

The GCC Online Specialty Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Water, PepsiCo, Coca-Cola, Nestlé, Red Bull, Monster Beverage Corporation, Almarai, Al Haramain, Rani Refreshments, Al Waha, Al Ain Beverages, Dubai Refreshments, Al Jazeera Beverage Company, Al Fawz Beverage Company, Al Qusais Beverages contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC online specialty beverages market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to focus on developing innovative, health-oriented products. Additionally, the integration of advanced e-commerce solutions will enhance customer experiences, making online shopping more accessible. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Drinks Energy Drinks Herbal Teas Specialty Coffees Craft Beers Functional Beverages Others |

| By End-User | Individual Consumers Restaurants and Cafes Retail Chains Online Marketplaces |

| By Distribution Channel | Direct-to-Consumer E-commerce Platforms Supermarkets and Hypermarkets Specialty Stores |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Cans Tetra Packs |

| By Flavor Profile | Fruity Spicy Herbal |

| By Occasion | Everyday Consumption Special Events Health and Wellness |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Specialty Beverage Retailers | 150 | Store Managers, Retail Buyers |

| Consumer Preferences in Specialty Beverages | 200 | General Consumers, Beverage Enthusiasts |

| Distribution Channel Insights | 100 | Distributors, Logistics Managers |

| Market Trends and Innovations | 80 | Industry Analysts, Product Developers |

| Regulatory Impact on Specialty Beverages | 70 | Compliance Officers, Regulatory Experts |

The GCC Online Specialty Beverages Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for unique and premium beverage options and the rise of e-commerce platforms.