Region:Middle East

Author(s):Rebecca

Product Code:KRAD7486

Pages:84

Published On:December 2025

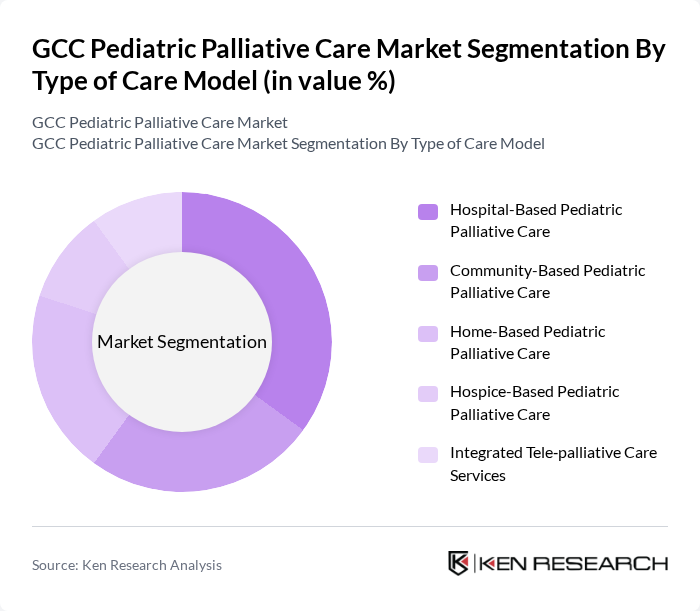

By Type of Care Model:The market is segmented into various care models, including Hospital-Based Pediatric Palliative Care, Community-Based Pediatric Palliative Care, Home-Based Pediatric Palliative Care, Hospice-Based Pediatric Palliative Care, and Integrated Tele-palliative Care Services. This segmentation aligns with global practice patterns, where hospital and specialist?center?based services remain the backbone of pediatric palliative care, complemented by expanding home and community services and emerging tele?palliative models to support continuity of care and symptom management outside hospital settings.

The Hospital-Based Pediatric Palliative Care segment is currently leading the market due to the availability of advanced medical facilities, pediatric subspecialists, and multidisciplinary support teams in tertiary and academic centers, consistent with global market trends where hospitals and clinics account for the largest share of pediatric palliative care delivery. Hospitals provide comprehensive care that includes pain and symptom management, psychological and spiritual support, and family counseling, which are essential for children with complex medical needs and high?intensity treatments. The trend towards integrated care models, where hospitals collaborate with community services, home care teams, and telehealth platforms, is also enhancing the effectiveness and reach of hospital-based care across the GCC.

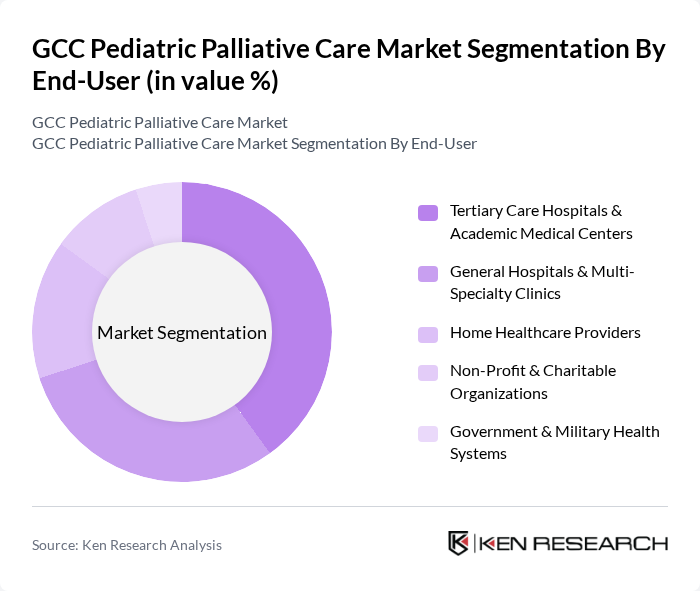

By End-User:The market is segmented by end-users, including Tertiary Care Hospitals & Academic Medical Centers, General Hospitals & Multi-Specialty Clinics, Home Healthcare Providers, Non-Profit & Charitable Organizations, and Government & Military Health Systems. This structure reflects the typical care ecosystem in which tertiary and academic centers anchor specialist pediatric palliative services, while government systems, charitable organizations, and home care providers support step?down, outreach, and community-based care.

Tertiary Care Hospitals & Academic Medical Centers dominate the end-user segment due to their capacity to provide specialized and comprehensive care for pediatric patients, mirroring global findings that hospitals and clinics remain the primary providers of pediatric palliative care services. These institutions often have the resources to implement advanced palliative care programs, run multidisciplinary teams, and conduct research and clinical trials, which enhances the quality of care and promotes evidence?based practice. The collaboration between academic centers and hospitals also fosters innovation in treatment approaches, integration of psychosocial and rehabilitative services, and training of specialized pediatric palliative care professionals, further solidifying their leadership in the market.

The GCC Pediatric Palliative Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jalila Children's Specialty Hospital (Dubai, UAE), King Faisal Specialist Hospital & Research Centre (Riyadh & Jeddah, Saudi Arabia), King Abdullah Specialist Children's Hospital, Ministry of National Guard Health Affairs (Riyadh, Saudi Arabia), Sidra Medicine (Doha, Qatar), Hamad Medical Corporation – Pediatric Palliative & Supportive Care Services (Qatar), Dubai Health Authority – Pediatric Palliative & Home Care Programs (UAE), Abu Dhabi Health Services Company (SEHA) – Pediatric & Home Care Services (UAE), Saudi German Health (Saudi German Hospitals Group, GCC Network), Ministry of Health, Saudi Arabia – National Palliative Care Program, Ministry of Health and Prevention, UAE – Palliative & Home Care Initiatives, Kuwait Ministry of Health – Pediatric & Palliative Care Services, Bahrain Ministry of Health – Oncology & Palliative Care Services, Oman Ministry of Health – Royal Hospital & National Palliative Care Services, NMC Health (NMC Royal & Specialty Hospitals, UAE), Mediclinic Middle East (Mediclinic City Hospital & Network, UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of pediatric palliative care in the GCC is poised for significant transformation, driven by advancements in healthcare technology and a growing emphasis on holistic care approaches. As telehealth services expand, families will gain better access to specialized care, regardless of geographical barriers. Additionally, the integration of mental health support into palliative care frameworks will enhance the overall well-being of children and their families, fostering a more comprehensive approach to managing chronic illnesses and improving quality of life.

| Segment | Sub-Segments |

|---|---|

| By Type of Care Model | Hospital-Based Pediatric Palliative Care Community-Based Pediatric Palliative Care Home-Based Pediatric Palliative Care Hospice-Based Pediatric Palliative Care Integrated Tele?palliative Care Services |

| By End-User | Tertiary Care Hospitals & Academic Medical Centers General Hospitals & Multi-Specialty Clinics Home Healthcare Providers Non?Profit & Charitable Organizations Government & Military Health Systems |

| By Service Type | Pain & Symptom Management Psychosocial & Mental Health Support Spiritual & Cultural Care Services Care Planning & Care Coordination Bereavement & Family Support Services |

| By Age Group | Neonates (0–28 days) Infants (1–12 months) Children (1–9 years) Adolescents (10–18 years) Young Adults with Pediatric-Onset Conditions |

| By Geographic Distribution | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain |

| By Funding Source | Public Healthcare & Government Funding Private Insurance & Corporate Schemes Out-of-Pocket Payments Philanthropy & Charitable Donations International Aid & NGO Grants |

| By Care Setting | Dedicated Pediatric Palliative Care Units General Pediatric Wards with Palliative Support Standalone Hospice & Long-Term Care Facilities Home & Community Settings Outpatient & Day-Care Palliative Clinics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric Hospitals and Clinics | 100 | Pediatricians, Palliative Care Coordinators |

| Family Caregivers of Pediatric Patients | 80 | Parents, Guardians, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Advisors |

| Non-Governmental Organizations (NGOs) | 60 | Program Directors, Outreach Coordinators |

| Healthcare Administrators | 70 | Hospital Administrators, Financial Officers |

The GCC Pediatric Palliative Care Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing awareness, rising incidences of chronic illnesses among children, and advancements in healthcare services across the region.