Region:Middle East

Author(s):Dev

Product Code:KRAA8323

Pages:96

Published On:November 2025

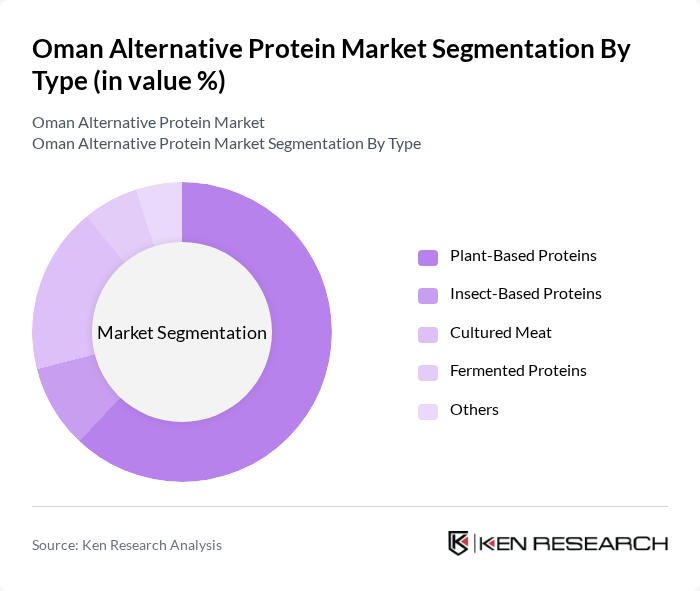

By Type:The alternative protein market in Oman is segmented into plant-based proteins, insect-based proteins, cultured meat, and fermented proteins. Plant-based proteins are gaining the most traction, supported by consumer preference for sustainable and health-focused diets, the rise of veganism and flexitarianism, and the increasing availability of pea, soy, and rice protein products. Insect-based proteins are emerging, valued for their high nutritional profile and low environmental impact, but remain in the early adoption phase. Cultured meat and fermented proteins are in the nascent stage, with pilot projects and regulatory frameworks under development .

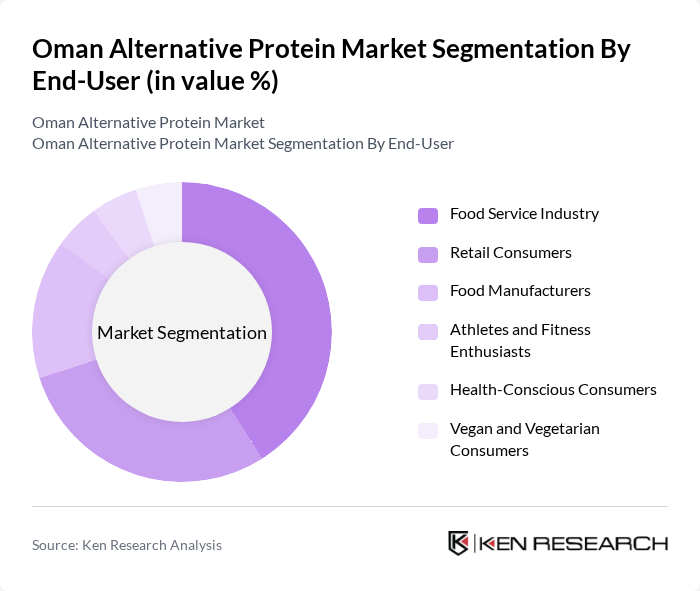

By End-User:The end-user segmentation of the alternative protein market includes the food service industry, retail consumers, food manufacturers, athletes and fitness enthusiasts, health-conscious consumers, and vegan and vegetarian consumers. The food service industry leads, driven by the integration of alternative proteins into restaurant menus and catering services. Retail consumers are increasingly seeking out plant-based and alternative protein products for health and sustainability reasons, while food manufacturers are innovating with new formulations to meet evolving consumer preferences .

The Oman Alternative Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Food Investment Holding Co., A’Salam Poultry (for alternative/cultured poultry initiatives), Archer Daniels Midland Company, Cargill Incorporated, Calysta Inc., Puris, Axiom Foods, Inc., Royal DSM, Lallemand Inc., Ingredion, Green Protein LLC (Oman), MycoTechnology, Plantible Foods, Oatly, and Quorn Foods contribute to innovation, geographic expansion, and service delivery in this space .

The future of the alternative protein market in Oman appears promising, driven by increasing health consciousness and government initiatives. As consumer preferences shift towards sustainable and healthier food options, the market is expected to witness significant growth. Innovations in production technologies and collaborations with local farmers will likely enhance product availability and affordability. Additionally, educational campaigns aimed at raising awareness about the benefits of alternative proteins will play a vital role in expanding the consumer base and driving market acceptance.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Proteins Pea Protein Soy Protein Rice Protein Hemp Protein Pumpkin Seed Protein Other Plant Proteins Insect-Based Proteins Cricket Protein Mealworm Protein Other Insect Proteins Cultured Meat Beef Poultry Seafood Other Cultured Meat Fermented Proteins Mycoprotein Algae Protein Other Fermented Proteins Others |

| By End-User | Food Service Industry Retail Consumers Food Manufacturers Athletes and Fitness Enthusiasts Health-Conscious Consumers Vegan and Vegetarian Consumers Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies Direct Sales Specialty Stores Others |

| By Application | Meat Alternatives Dairy Alternatives Snacks and Convenience Foods Nutrition & Health Supplements Animal Feed Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Choices Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Alternative Proteins | 120 | Health-conscious Consumers, Food Enthusiasts |

| Retailer Insights on Alternative Protein Sales | 80 | Store Managers, Product Buyers |

| Producer Perspectives on Market Challenges | 50 | Farm Owners, Production Managers |

| Nutritionist Views on Alternative Protein Benefits | 40 | Registered Dietitians, Health Coaches |

| Distribution Channel Effectiveness | 45 | Logistics Managers, Supply Chain Coordinators |

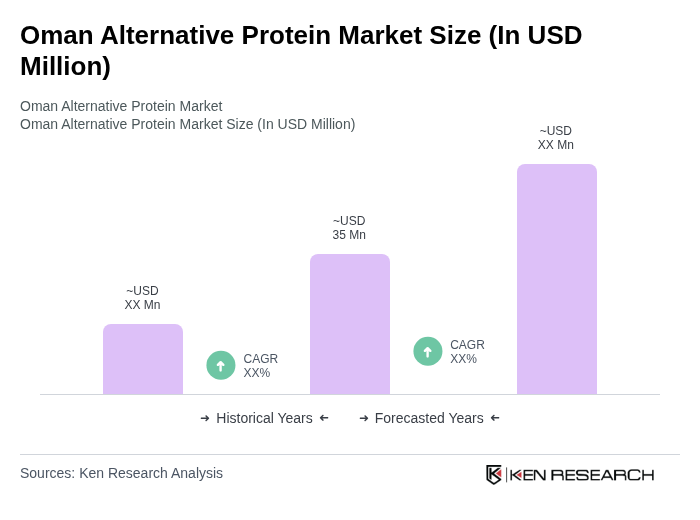

The Oman Alternative Protein Market is valued at approximately USD 35 million, reflecting a growing interest in health and sustainability among consumers, alongside government initiatives aimed at enhancing food security and promoting alternative protein sources.