Region:Global

Author(s):Shubham

Product Code:KRAD2625

Pages:94

Published On:January 2026

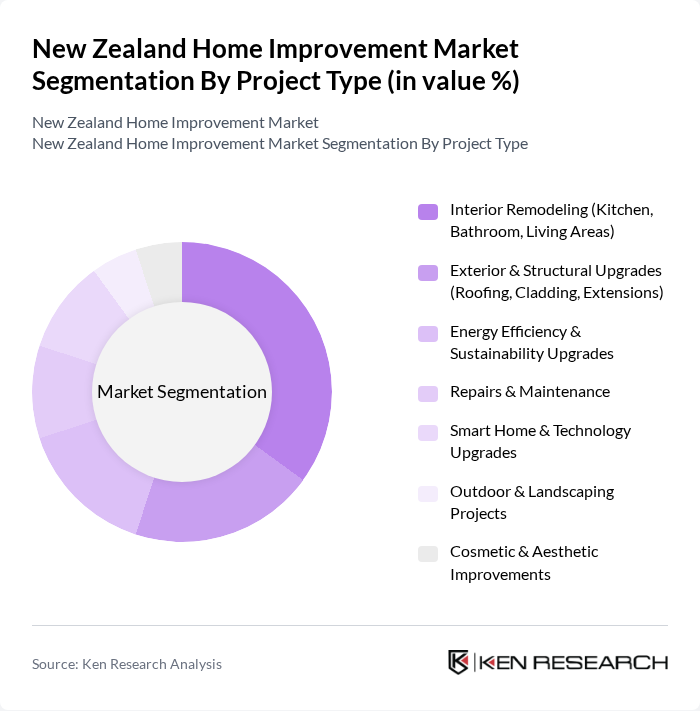

By Project Type:The project type segmentation includes various categories such as interior remodeling, exterior upgrades, energy efficiency improvements, repairs, smart home upgrades, outdoor projects, and cosmetic enhancements. This reflects the mix of renovation and remodeling work observed across the New Zealand interior design and renovation markets. Among these, interior remodeling, particularly kitchen and bathroom renovations, dominates the market due to the high return on investment and strong homeowner preference for modern, functional, and open-plan spaces. The trend towards open-plan living, integrated indoor–outdoor areas, and the incorporation of smart appliances, lighting, and environmental controls in home design further supports growth in this segment.

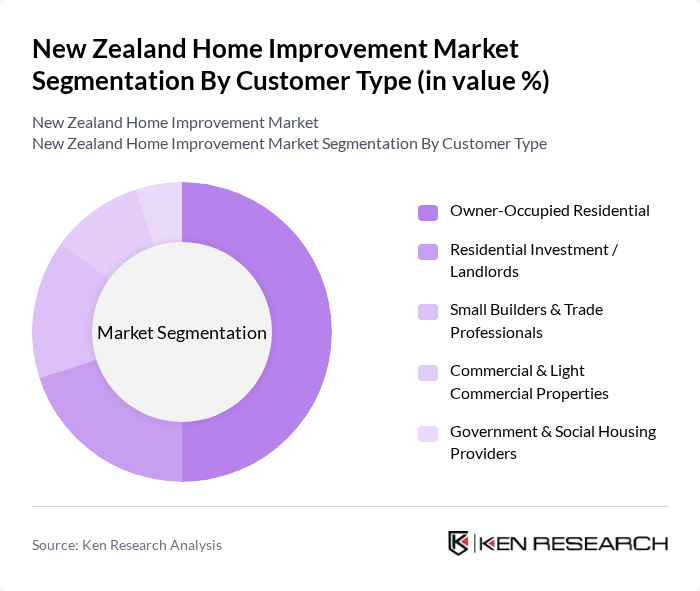

By Customer Type:The customer type segmentation encompasses owner-occupied residential, residential investment, small builders, commercial properties, and government housing providers. The owner-occupied residential segment is the largest, consistent with the predominance of homeowners in renovation and interior design spending in New Zealand. It is driven by homeowners investing in renovations to increase property value, improve thermal comfort, and enhance living conditions, including adaptations for working from home. This trend is supported by an active housing market, the availability of renovation finance through mortgage top-ups, and a growing emphasis on home personalization and lifestyle-focused upgrades, making this segment a key focus for retailers, trades, and design professionals in the market.

The New Zealand Home Improvement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bunnings Warehouse, Mitre 10, PlaceMakers, The Warehouse Group, Resene, DuluxGroup, Carter Holt Harvey, Plumbing World, ITM (Independent Timber Merchants Co-operative), Firth Industries, GIB (Winstone Wallboards), Fletcher Building, APL Window Solutions (Aluminium Profiles Ltd), Steel & Tube Holdings, HPM Legrand New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand home improvement market is poised for continued growth, driven by increasing consumer interest in sustainable living and smart home technologies. As more homeowners prioritize eco-friendly renovations, the demand for green building materials and energy-efficient solutions is expected to rise. Additionally, the expansion of e-commerce platforms will likely enhance accessibility to home improvement products, further stimulating market activity. With a focus on innovation and sustainability, the industry is set to adapt to evolving consumer preferences and technological advancements in the future.

| Segment | Sub-Segments |

|---|---|

| By Project Type | Interior Remodeling (Kitchen, Bathroom, Living Areas) Exterior & Structural Upgrades (Roofing, Cladding, Extensions) Energy Efficiency & Sustainability Upgrades Repairs & Maintenance Smart Home & Technology Upgrades Outdoor & Landscaping Projects Cosmetic & Aesthetic Improvements |

| By Customer Type | Owner-Occupied Residential Residential Investment / Landlords Small Builders & Trade Professionals Commercial & Light Commercial Properties Government & Social Housing Providers |

| By Region | North Island – Auckland North Island – Wellington North Island – Other Regions South Island – Christchurch South Island – Other Regions |

| By Product Category | Building Materials & Structural Components Paints, Coatings & Surface Finishes Tools, Hardware & Fastenings Kitchen, Bathroom & Plumbing Fixtures Flooring, Tiles & Wall Coverings Outdoor, Garden & Landscaping Products |

| By Service Type | Design & Planning Services Installation & Construction Services Repairs, Maintenance & Handyman Services Project Management & Turnkey Solutions |

| By Distribution Channel | Big-Box Home Improvement & DIY Stores Trade & Specialist Merchants Online & Omnichannel Retail Direct-to-Consumer from Manufacturers Independent Hardware & Local Stores |

| By Project Execution Mode | DIY (Do-It-Yourself) DIFM (Do-It-For-Me / Professionally Installed) Hybrid (DIY + Professional Support) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Renovation Projects | 120 | Homeowners, DIY Enthusiasts |

| Retailer Insights | 80 | Store Managers, Sales Representatives |

| Contractor Perspectives | 60 | General Contractors, Specialty Tradespeople |

| Supplier Feedback | 40 | Product Managers, Supply Chain Coordinators |

| Consumer Behavior Analysis | 100 | Recent Renovators, Home Improvement Shoppers |

The New Zealand Home Improvement Market is valued at approximately USD 4.8 billion. This valuation reflects a comprehensive analysis of the interior design, renovation, and DIY hardware retail segments, indicating robust growth driven by increased consumer spending and property ownership.