Region:Middle East

Author(s):Rebecca

Product Code:KRAB7531

Pages:85

Published On:October 2025

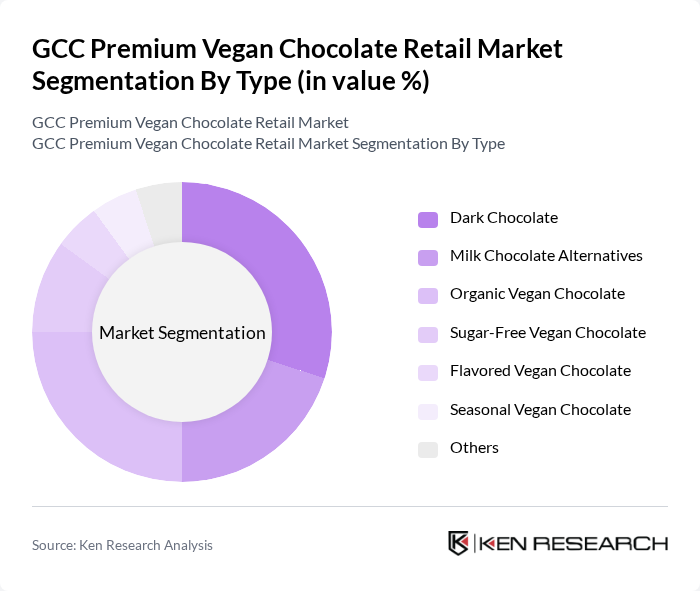

By Type:The market is segmented into various types of vegan chocolates, including Dark Chocolate, Milk Chocolate Alternatives, Organic Vegan Chocolate, Sugar-Free Vegan Chocolate, Flavored Vegan Chocolate, Seasonal Vegan Chocolate, and Others. Among these, Dark Chocolate and Organic Vegan Chocolate are particularly popular due to their perceived health benefits and rich flavors. The trend towards organic and natural ingredients has significantly influenced consumer preferences, leading to a surge in demand for these subsegments.

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Health and Wellness Stores, and Online Shoppers. Retail Consumers dominate the market, driven by the increasing availability of premium vegan chocolates in supermarkets and specialty stores. The growing trend of health-conscious eating among consumers has led to a significant rise in demand from this segment, as more individuals seek indulgent yet healthier chocolate options.

The GCC Premium Vegan Chocolate Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Green & Black's, Alter Eco, Enjoy Life Foods, Hu Chocolate, Theo Chocolate, Endangered Species Chocolate, Divine Chocolate, Vego Chocolate, Ombar Chocolate, Loving Earth, Pana Chocolate, Cacao Barry, Taza Chocolate, Nibmor, Chococo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC premium vegan chocolate market appears promising, driven by increasing health awareness and ethical consumption trends. As more consumers embrace plant-based diets, the demand for innovative vegan chocolate products is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing brands to reach a broader audience. Companies that invest in sustainable practices and effective marketing strategies will likely thrive in this evolving landscape, capitalizing on the growing consumer interest in premium vegan offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate Alternatives Organic Vegan Chocolate Sugar-Free Vegan Chocolate Flavored Vegan Chocolate Seasonal Vegan Chocolate Others |

| By End-User | Retail Consumers Food Service Industry Health and Wellness Stores Online Shoppers |

| By Sales Channel | Supermarkets and Hypermarkets Specialty Stores E-commerce Platforms Direct-to-Consumer Sales |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Flavor Profile | Classic Exotic Spicy |

| By Distribution Mode | Direct Distribution Indirect Distribution Online Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Vegan Chocolate Retailers | 100 | Store Managers, Category Buyers |

| Health Food Stores | 80 | Owners, Product Managers |

| Online Vegan Chocolate Retailers | 70 | E-commerce Managers, Marketing Directors |

| Consumer Focus Groups | 50 | Health-Conscious Consumers, Vegan Diet Followers |

| Nutrition and Wellness Experts | 40 | Dietitians, Health Coaches |

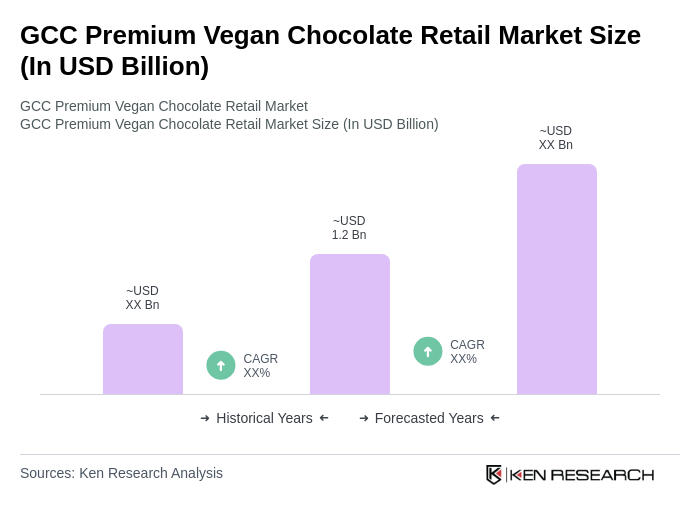

The GCC Premium Vegan Chocolate Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for healthier and ethical food options, as well as a rising awareness of veganism and plant-based diets.