Region:Middle East

Author(s):Shubham

Product Code:KRAD5470

Pages:99

Published On:December 2025

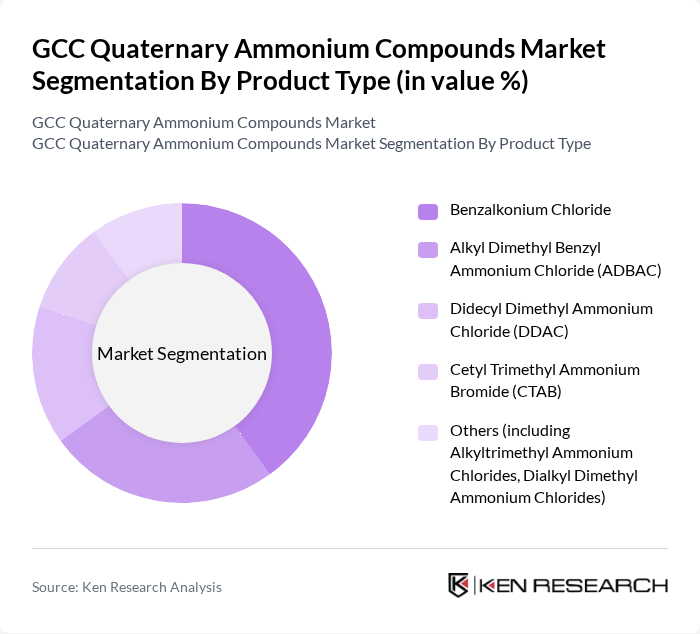

By Product Type:The product type segmentation includes various quaternary ammonium compounds that serve different functions in multiple industries. The leading sub-segment is Benzalkonium Chloride, which is widely used for its disinfectant and biocidal properties in surface cleaners, hard?surface disinfectants, and hand sanitizers. Other notable sub-segments include Alkyl Dimethyl Benzyl Ammonium Chloride (ADBAC) and Didecyl Dimethyl Ammonium Chloride (DDAC), which are also gaining traction due to their effectiveness as active ingredients in disinfectants, fabric softeners, water treatment chemicals, and industrial biocides.

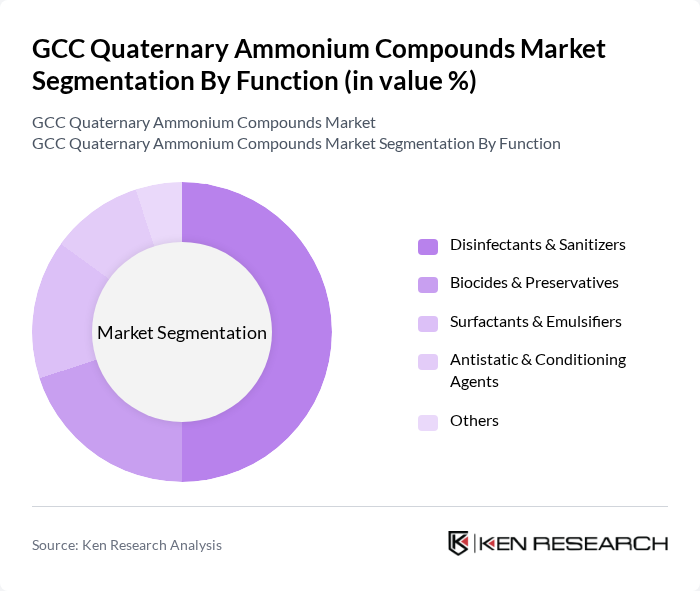

By Function:The function segmentation highlights the various roles that quaternary ammonium compounds play in different applications. Disinfectants and sanitizers are the most significant sub-segment, driven by heightened hygiene awareness in healthcare, food and beverage processing, institutional cleaning, and public facilities. Biocides and preservatives also hold a substantial share, particularly in the food and beverage, water treatment, oil and gas, and coatings industries, where quats are used to control microbial growth and extend product shelf life. Surfactants and emulsifiers are increasingly utilized in personal care and household products, including conditioners, fabric softeners, and skin?care formulations, benefiting from the conditioning and antistatic properties of cationic quaternary ammonium compounds.

The GCC Quaternary Ammonium Compounds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nouryon, Clariant AG, Evonik Industries AG, Solvay S.A., Huntsman Corporation, Stepan Company, Croda International Plc, Kao Corporation, Lonza Group AG, BASF SE, Dow Inc., Sasol Limited, Saudi Basic Industries Corporation (SABIC), Saudi Aramco (including SABIC affiliates for specialty chemicals), Gulf Chemicals and Industrial Oils Co. (GCIR) / Regional Blenders & Formulators contribute to innovation, geographic expansion, and service delivery in this space, supported by their global experience in surfactants, biocides, and specialty chemical formulations and their distribution networks across the Middle East.

The future of the GCC quaternary ammonium compounds market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As consumer preferences evolve, manufacturers are likely to focus on developing eco-friendly formulations that meet regulatory standards while addressing environmental concerns. Additionally, the expansion into emerging markets within the GCC will provide new growth avenues, allowing companies to leverage increasing demand for hygiene products and personal care items in these regions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Benzalkonium Chloride Alkyl Dimethyl Benzyl Ammonium Chloride (ADBAC) Didecyl Dimethyl Ammonium Chloride (DDAC) Cetyl Trimethyl Ammonium Bromide (CTAB) Others (including Alkyltrimethyl Ammonium Chlorides, Dialkyl Dimethyl Ammonium Chlorides) |

| By Function | Disinfectants & Sanitizers Biocides & Preservatives Surfactants & Emulsifiers Antistatic & Conditioning Agents Others |

| By Grade | Industrial Grade Pharmaceutical Grade Cosmetic/Personal Care Grade |

| By Application Sector | Healthcare Facilities & Hospitals Food & Beverage Processing Water & Wastewater Treatment Household & Institutional Cleaning Oil & Gas and Industrial Processing Agriculture & Animal Hygiene Personal Care & Cosmetics Others |

| By Distribution Channel | Direct Sales (B2B) Regional Distributors & Traders Online/Bulk E-Procurement Platforms Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By End-Use Industry | Healthcare & Pharmaceuticals Food & Beverage Water Treatment Personal Care & Cosmetics Agriculture & Animal Husbandry Industrial & Institutional Cleaning Textiles & Leather Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Disinfectant Usage | 120 | Facility Managers, Infection Control Officers |

| Agricultural Chemical Applications | 90 | Agronomists, Crop Protection Specialists |

| Industrial Cleaning Products | 85 | Procurement Managers, Operations Supervisors |

| Consumer Products Formulation | 110 | Product Development Managers, Chemists |

| Research and Development Insights | 80 | R&D Directors, Chemical Engineers |

The GCC Quaternary Ammonium Compounds Market is valued at approximately USD 0.20 billion, driven by increased demand for disinfectants and sanitizers across various sectors, particularly healthcare and food processing, especially following the COVID-19 pandemic.