Region:Middle East

Author(s):Rebecca

Product Code:KRAD2924

Pages:99

Published On:November 2025

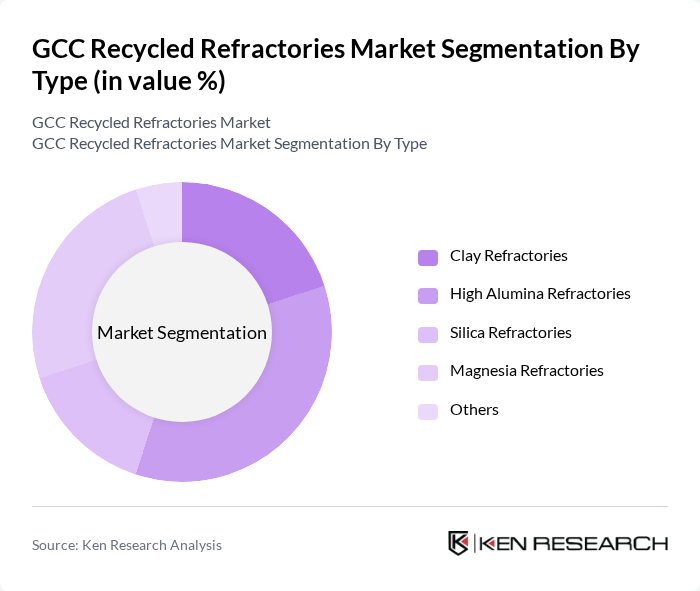

By Type:The market is segmented into various types of refractories, including Clay Refractories, High Alumina Refractories, Silica Refractories, Magnesia Refractories, and Others. Among these, High Alumina Refractories are currently leading the market due to their superior thermal stability and resistance to chemical corrosion, making them highly sought after in high-temperature applications. The demand for these materials is driven by their extensive use in the steel and cement industries, where performance and durability are critical.

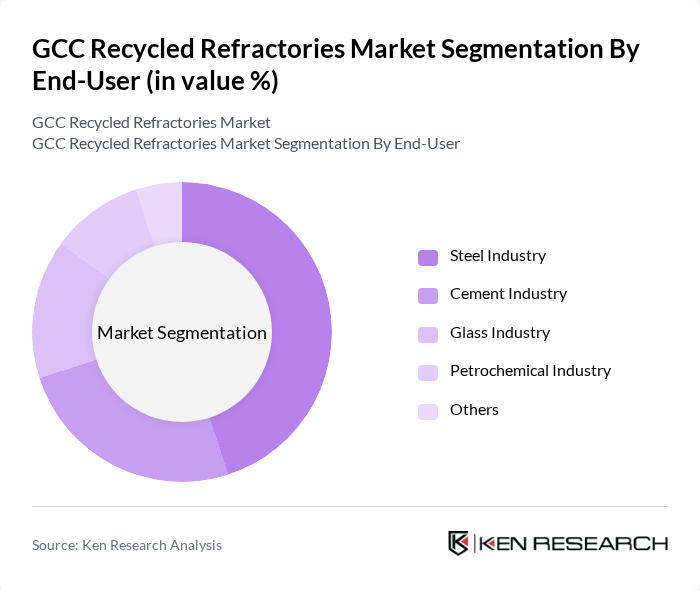

By End-User:The end-user segmentation includes the Steel Industry, Cement Industry, Glass Industry, Petrochemical Industry, and Others. The Steel Industry is the dominant segment, driven by the increasing demand for steel in construction and infrastructure projects. The need for high-performance refractories in steel production processes, which require materials that can withstand extreme temperatures and corrosive environments, further solidifies this segment's leadership in the market.

The GCC Recycled Refractories Market is characterized by a dynamic mix of regional and international players. Leading participants such as RHI Magnesita, Saint-Gobain Ceramics & Plastics, Vesuvius Middle East, Morgan Advanced Materials (Middle East), Calderys Middle East, HarbisonWalker International (HWI), Allied Mineral Products, Resco Products, Shinagawa Refractories, Imerys Refractory Minerals, SGL Carbon, Krosaki Harima Corporation, TFL (Thermal Ceramics), Magnesita Refractories, A.P. Green Refractories contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC recycled refractories market appears promising, driven by increasing sustainability initiatives and technological advancements. As industries continue to prioritize eco-friendly practices, the demand for recycled refractories is expected to rise significantly. Furthermore, the integration of automated recycling processes will enhance efficiency and reduce costs, making recycled materials more competitive. The focus on circular economy practices will also encourage collaboration among stakeholders, fostering innovation and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Clay Refractories High Alumina Refractories Silica Refractories Magnesia Refractories Others |

| By End-User | Steel Industry Cement Industry Glass Industry Petrochemical Industry Others |

| By Application | Furnace Linings Kiln Linings Crucibles Castables Others |

| By Source of Recycling | Post-Consumer Waste Post-Industrial Waste Manufacturing Scrap Others |

| By Geographical Distribution | GCC Countries Export Markets Others |

| By Product Form | Bricks Monolithics Precast Shapes Others |

| By Performance Characteristics | High-Temperature Resistance Thermal Shock Resistance Chemical Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Industry Refractory Users | 100 | Procurement Managers, Plant Engineers |

| Cement Manufacturing Refractory Applications | 80 | Operations Managers, Quality Control Supervisors |

| Glass Production Refractory Needs | 60 | Production Managers, R&D Specialists |

| Recycling Facility Operators | 50 | Facility Managers, Process Engineers |

| Environmental Compliance Officers | 70 | Regulatory Affairs Managers, Sustainability Coordinators |

The GCC Recycled Refractories Market is valued at approximately USD 495 million, reflecting a significant growth trend driven by the increasing demand for sustainable materials in industries such as steel, cement, and glass.