Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8982

Pages:95

Published On:November 2025

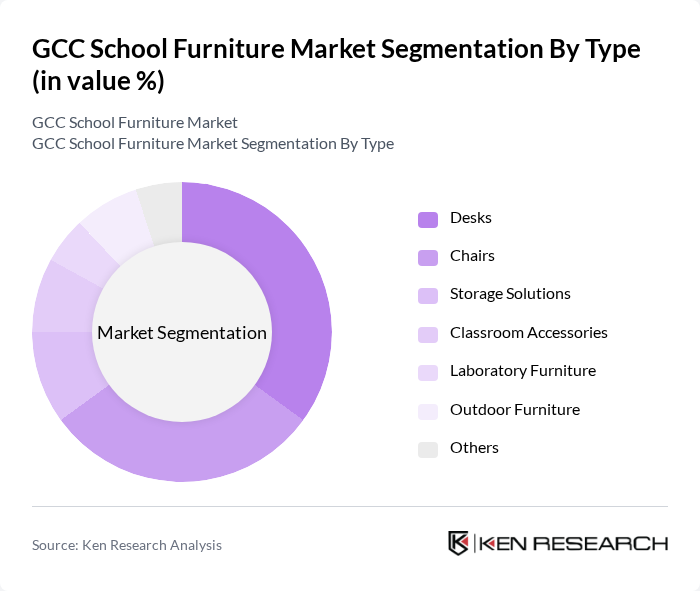

By Type:The market is segmented into various types of school furniture, including desks, chairs, storage solutions, classroom accessories, laboratory furniture, outdoor furniture, and others. Among these, desks and chairs are the most significant subsegments, driven by the essential need for basic classroom furniture. The increasing focus on ergonomic designs, modularity, and multifunctional furniture is also shaping consumer preferences, with schools seeking flexible solutions that support collaborative and technology-enabled learning environments .

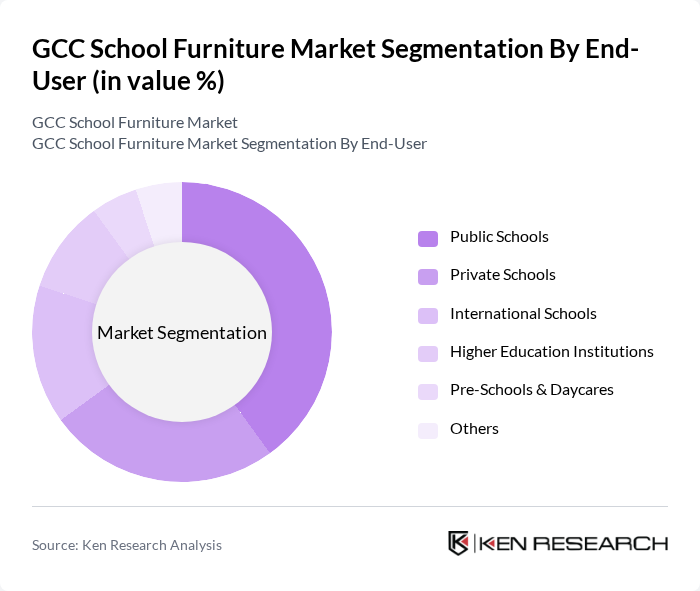

By End-User:The end-user segmentation includes public schools, private schools, international schools, higher education institutions, pre-schools & daycares, and others. Public schools represent the largest segment due to government funding and initiatives aimed at improving educational facilities. The increasing number of private and international schools also contributes to the demand for high-quality, innovative school furniture, with a growing emphasis on customized solutions for diverse learning needs .

The GCC School Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group (UAE), IKEA (Regional GCC operations), HNI Corporation, Steelcase Inc., Herman Miller (now MillerKnoll), Kinnarps, Haworth, Global Furniture Group, Mahmayi Office Furniture (UAE), Virco Manufacturing Corporation, Smith System, National Public Seating, OFIS (part of Easa Saleh Al Gurg Group, UAE), Scholar Craft, and BFM Seating contribute to innovation, geographic expansion, and service delivery in this space .

The future of the GCC school furniture market appears promising, driven by ongoing government investments and a growing emphasis on student well-being. As educational institutions increasingly adopt innovative furniture solutions, the market is likely to see a rise in demand for customizable and technology-integrated products. Additionally, the trend towards sustainability will continue to shape product offerings, encouraging manufacturers to explore eco-friendly materials and designs that align with modern educational needs and environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Desks Chairs Storage Solutions Classroom Accessories Laboratory Furniture Outdoor Furniture Others |

| By End-User | Public Schools Private Schools International Schools Higher Education Institutions Pre-Schools & Daycares Others |

| By Material | Wood Metal Plastic Composite Materials Others |

| By Design | Traditional Modern Customizable Ergonomic Modular & Flexible Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Region | United Arab Emirates Saudi Arabia Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public School Procurement | 100 | School Administrators, Procurement Officers |

| Private School Furniture Needs | 70 | Headmasters, Facility Managers |

| Furniture Manufacturers Insights | 50 | Product Managers, Sales Directors |

| Educational Policy Makers | 40 | Government Officials, Education Consultants |

| End-user Feedback from Teachers | 60 | Teachers, Curriculum Coordinators |

The GCC School Furniture Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased investments in educational infrastructure and rising student enrollment rates across the region.