Region:Asia

Author(s):Shubham

Product Code:KRAA8711

Pages:80

Published On:November 2025

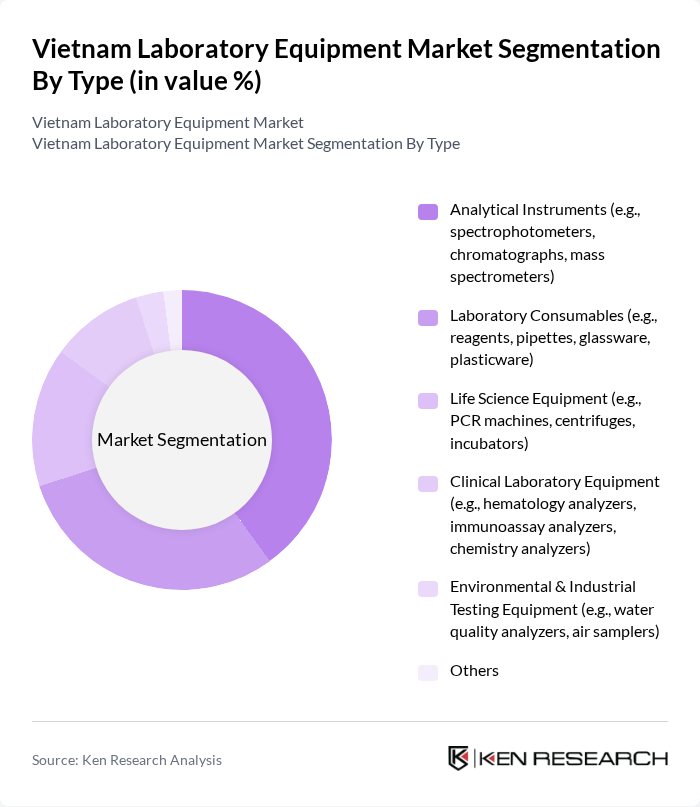

By Type:The laboratory equipment market is segmented into analytical instruments, laboratory consumables, life science equipment, clinical laboratory equipment, environmental and industrial testing equipment, and others. Analytical instruments and laboratory consumables represent the largest segments, driven by their essential roles in diagnostics, research, and routine testing. The demand for life science and clinical laboratory equipment is rising due to increased investment in biotechnology, molecular diagnostics, and hospital-based laboratory expansion. Environmental and industrial testing equipment is gaining traction as regulations on environmental monitoring and industrial safety become stricter .

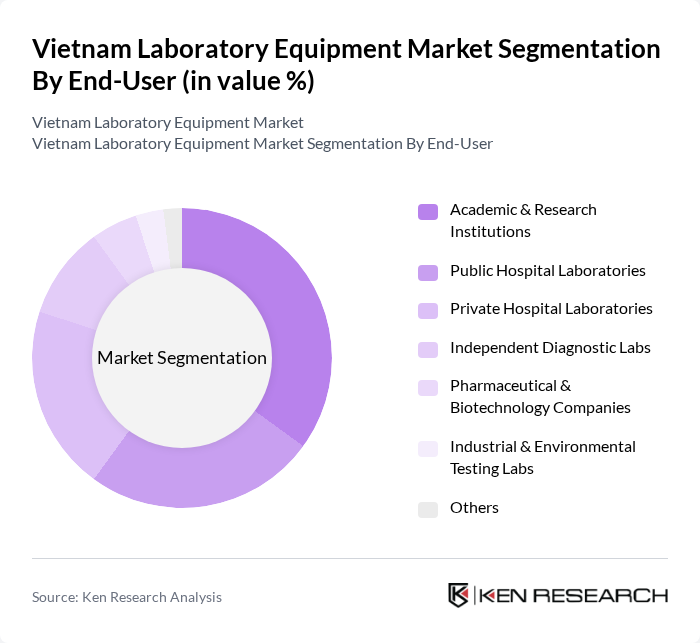

By End-User:The end-user segmentation includes academic and research institutions, public hospital laboratories, private hospital laboratories, independent diagnostic labs, pharmaceutical and biotechnology companies, industrial and environmental testing labs, and others. Academic and research institutions are the leading end-users, reflecting Vietnam’s strategic focus on scientific innovation and education. Public hospital laboratories hold a significant share due to government funding and widespread presence, while private hospital labs and independent diagnostics centers are rapidly expanding, driven by rising healthcare demand and the growth of private healthcare providers. Pharmaceutical and biotechnology companies, as well as industrial and environmental testing labs, are increasing their investments in laboratory infrastructure to support research, quality control, and regulatory compliance .

The Vietnam Laboratory Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Agilent Technologies, Merck Group, PerkinElmer, Eppendorf AG, Sartorius AG, Bio-Rad Laboratories, VWR International (Avantor), Shimadzu Corporation, Beckman Coulter, Mettler Toledo, Hitachi High-Tech Corporation, HORIBA, Ltd., Panasonic Healthcare (PHC Holdings Corporation), Labconco Corporation, Daiichi Medical Co., Ltd., Tan Viet My Medical Equipment JSC, Viet Nguyen Trading and Service Co., Ltd., Viet My Medical Equipment Co., Ltd., Kimteco Scientific Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam laboratory equipment market is poised for significant growth, driven by technological advancements and increasing investments in healthcare and R&D. As automation and AI integration become more prevalent, laboratories will enhance operational efficiency and data accuracy. Furthermore, the government's commitment to improving laboratory infrastructure will facilitate better access to modern equipment. These trends indicate a robust future for the market, with opportunities for innovation and collaboration with international research entities, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Analytical Instruments (e.g., spectrophotometers, chromatographs, mass spectrometers) Laboratory Consumables (e.g., reagents, pipettes, glassware, plasticware) Life Science Equipment (e.g., PCR machines, centrifuges, incubators) Clinical Laboratory Equipment (e.g., hematology analyzers, immunoassay analyzers, chemistry analyzers) Environmental & Industrial Testing Equipment (e.g., water quality analyzers, air samplers) Others |

| By End-User | Academic & Research Institutions Public Hospital Laboratories Private Hospital Laboratories Independent Diagnostic Labs Pharmaceutical & Biotechnology Companies Industrial & Environmental Testing Labs Others |

| By Application | Quality Control & Assurance Research & Development Clinical Diagnostics Environmental & Food Safety Testing Forensic Testing Others |

| By Distribution Channel | Direct Sales Online Sales Distributors & Resellers Others |

| By Region | Northern Vietnam (incl. Hanoi, Red River Delta) Central Vietnam (incl. North Central, South Central Coast, Central Highlands) Southern Vietnam (incl. Ho Chi Minh City, Mekong River Delta, Southeast) Others |

| By Technology | Traditional Laboratory Equipment Automated Laboratory Systems Digital & AI-Enabled Laboratory Solutions Point-of-Care Testing Devices Others |

| By Market Segment | Public Sector Laboratories Private Sector Laboratories Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Laboratories | 100 | Laboratory Managers, Quality Control Analysts |

| Academic Research Institutions | 60 | Research Scientists, Lab Technicians |

| Clinical Diagnostics Centers | 50 | Laboratory Directors, Procurement Specialists |

| Industrial Testing Facilities | 40 | Operations Managers, Equipment Buyers |

| Government Research Labs | 40 | Research Coordinators, Policy Makers |

The Vietnam Laboratory Equipment Market is valued at approximately USD 1.3 billion, reflecting strong demand for advanced laboratory technologies and significant investments in healthcare and research infrastructure.