Region:Middle East

Author(s):Rebecca

Product Code:KRAC8408

Pages:93

Published On:November 2025

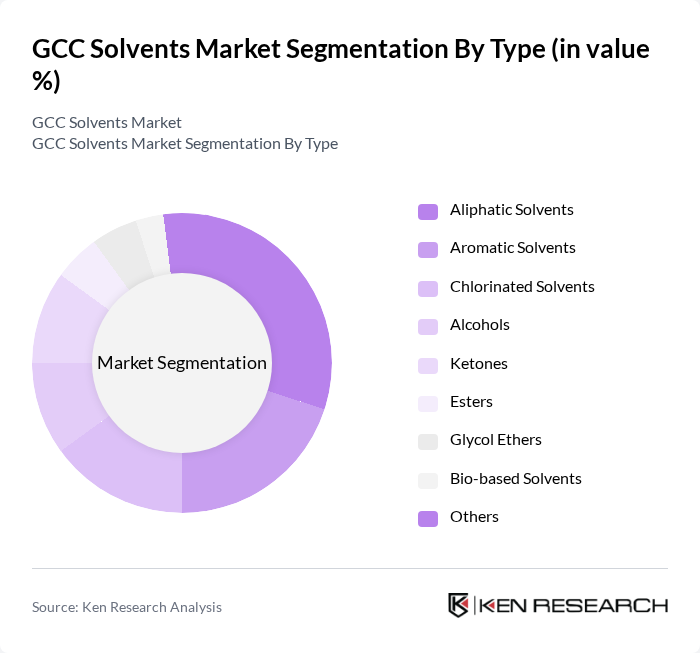

By Type:The market is segmented into Aliphatic Solvents, Aromatic Solvents, Chlorinated Solvents, Alcohols, Ketones, Esters, Glycol Ethers, Bio-based Solvents, and Others. Aliphatic Solvents remain the leading segment due to their extensive use in industrial cleaning, degreasing, and coatings, attributed to their effectiveness and relatively lower toxicity. The adoption of bio-based and green solvents is accelerating, driven by regulatory pressure and sustainability initiatives in the region.

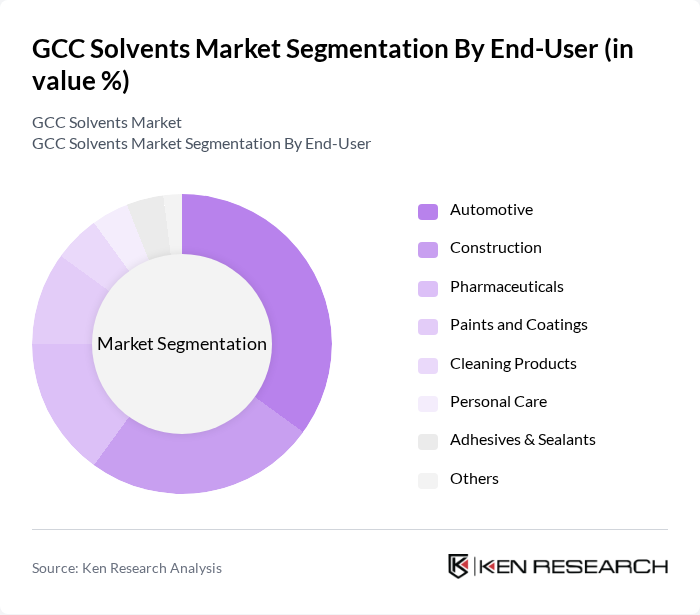

By End-User:The end-user segmentation includes Automotive, Construction, Pharmaceuticals, Paints and Coatings, Cleaning Products, Personal Care, Adhesives & Sealants, and Others. The Automotive sector is the largest consumer, driven by the demand for paints, coatings, and cleaning agents in vehicle manufacturing and maintenance. The construction and pharmaceutical sectors are also significant, supported by ongoing infrastructure projects and healthcare investments across the GCC.

The GCC Solvents Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Dow Chemical Company, ExxonMobil Chemical, Shell Chemicals, LyondellBasell Industries, Eastman Chemical Company, Huntsman Corporation, INEOS Group, Solvay S.A., Mitsubishi Chemical Corporation, Clariant AG, AkzoNobel N.V., Chevron Phillips Chemical Company, PPG Industries, Sasol Limited, Qatar Petrochemical Company (QAPCO), National Industrialization Company (Tasnee), Gulf Petrochemical Industries Company (GPIC), Abu Dhabi National Oil Company (ADNOC), Oman Oil Company (OQ) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC solvents market is poised for dynamic growth, driven by increasing industrial activities and a shift towards sustainable practices. As the automotive and construction sectors expand, the demand for solvents will rise correspondingly. Additionally, the pharmaceutical industry's growth will further bolster market dynamics. Companies are likely to invest in innovative, eco-friendly solvent solutions to meet regulatory requirements and consumer preferences, ensuring a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Aliphatic Solvents Aromatic Solvents Chlorinated Solvents Alcohols Ketones Esters Glycol Ethers Bio-based Solvents Others |

| By End-User | Automotive Construction Pharmaceuticals Paints and Coatings Cleaning Products Personal Care Adhesives & Sealants Others |

| By Application | Industrial Cleaning Paint Thinning Adhesives Coatings Extraction Processes Printing Inks Polymer Manufacturing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Geography | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Product Form | Liquid Solvents Solid Solvents Gaseous Solvents |

| By Regulatory Compliance | REACH Compliance OSHA Standards EPA Regulations GCC Regional Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Solvent Usage | 70 | Production Managers, Chemical Engineers |

| Solvent Applications in Coatings | 50 | Product Development Managers, Quality Control Analysts |

| Pharmaceutical Solvent Requirements | 40 | Regulatory Affairs Specialists, R&D Scientists |

| Environmental Compliance in Solvent Use | 40 | Environmental Managers, Compliance Officers |

| Market Trends in Specialty Solvents | 50 | Market Analysts, Business Development Executives |

The GCC Solvents Market is valued at approximately USD 3.8 billion, driven by increasing demand from various end-user industries such as automotive, construction, and pharmaceuticals, along with a growing trend towards eco-friendly and bio-based solvents.