Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7201

Pages:92

Published On:December 2025

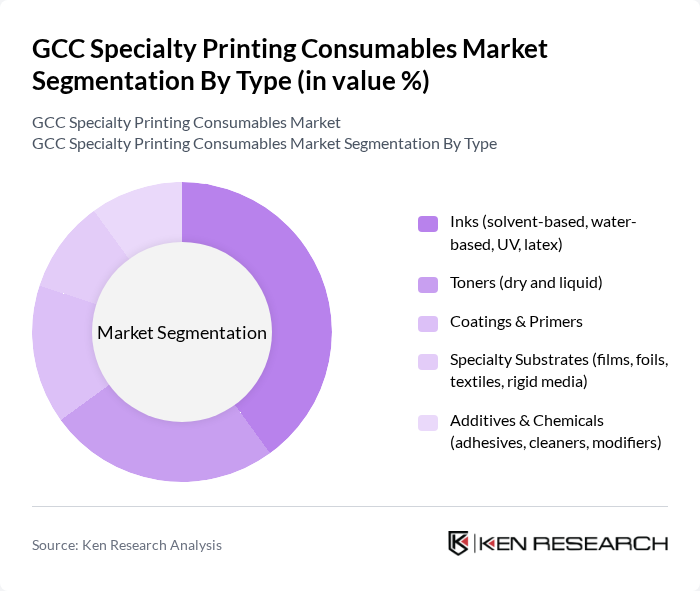

By Type:The market is segmented into various types, including inks, toners, coatings, specialty substrates, and additives. This structure is consistent with the global specialty printing consumables taxonomy, where inks, toners, specialty substrates, and chemicals/additives form the core product groups. Among these, inks, particularly water-based, UV-curable, latex, and low-migration formulations, are leading the market due to their versatility across packaging, textiles, signage, and industrial applications, as well as their improving environmental profile. The demand for toners is also significant, driven by the continued use of laser and digital electrophotographic printing in offices, professional service firms, and commercial print shops. Coatings and primers are essential for enhancing print quality, adhesion, scratch resistance, and outdoor durability in labels, flexible packaging, corrugated, and display graphics. Specialty substrates, including synthetic films, foils, textiles, and rigid media such as PVC boards, acrylics, and composites, cater to niche and high-value applications in industrial, décor, and large-format signage segments.

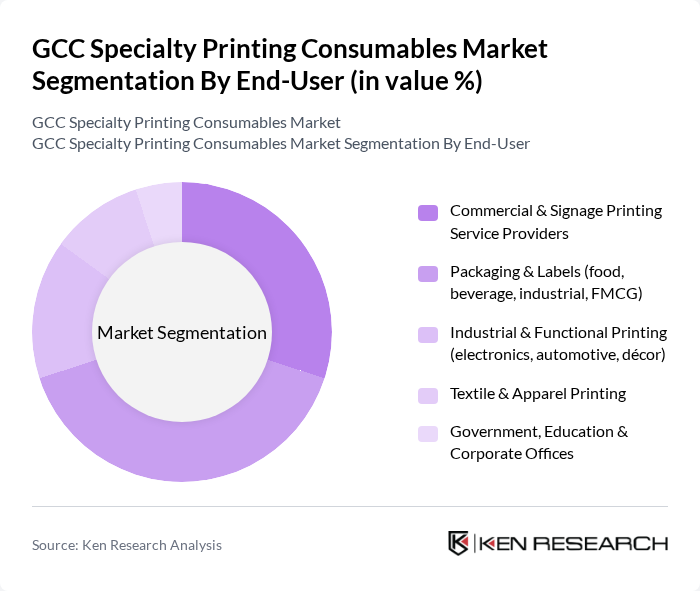

By End-User:The end-user segmentation includes commercial and signage printing service providers, packaging and labels, industrial and functional printing, textile and apparel printing, and government, education, and corporate offices. This segmentation aligns with the primary application clusters identified globally for specialty printing consumables, namely commercial printing and publishing, office and professional, packaging, and industrial/functional uses. The packaging and labels segment is the largest, driven by strong growth in food and beverage, personal care, pharmaceuticals, and FMCG sectors, which require visually appealing, compliant, and often variable-data packaging solutions, including flexible packaging, folding cartons, and pressure-sensitive labels. Commercial and signage printing services are also expanding, as brands and government agencies increasingly invest in high-quality indoor and outdoor signage, retail POS materials, exhibition graphics, and promotional print to support tourism, events, and retail development across the GCC.

The GCC Specialty Printing Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Canon Inc., Seiko Epson Corporation, Xerox Holdings Corporation, Ricoh Company, Ltd., Brother Industries, Ltd., Lexmark International, Inc., Fujifilm Holdings Corporation, DuPont de Nemours, Inc., Avery Dennison Corporation, Flint Group, Sun Chemical Corporation, Siegwerk Druckfarben AG & Co. KGaA, DIC Corporation, Nazdar Ink Technologies contribute to innovation, geographic expansion, and service delivery in this space, consistent with global listings of key specialty printing consumables and digital printing OEMs.

The future of the GCC specialty printing consumables market appears promising, driven by ongoing technological innovations and a shift towards sustainable practices. As businesses increasingly adopt digital printing technologies, the demand for specialized consumables is expected to rise. Additionally, the growing emphasis on eco-friendly materials will likely shape product development, encouraging manufacturers to invest in sustainable solutions. This evolving landscape presents opportunities for companies to differentiate themselves through innovation and sustainability, ensuring long-term growth in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Inks (solvent-based, water-based, UV, latex) Toners (dry and liquid) Coatings & Primers Specialty Substrates (films, foils, textiles, rigid media) Additives & Chemicals (adhesives, cleaners, modifiers) |

| By End-User | Commercial & Signage Printing Service Providers Packaging & Labels (food, beverage, industrial, FMCG) Industrial & Functional Printing (electronics, automotive, décor) Textile & Apparel Printing Government, Education & Corporate Offices |

| By Application | Digital Inkjet Printing (wide-format, UV, latex) Offset & Sheetfed Printing Flexographic Printing Gravure Printing Screen & 3D / Additive Printing |

| By Distribution Channel | Direct Sales (OEMs & ink manufacturers) Regional Distributors & Dealers Online B2B Platforms & E-commerce Retail & Trade Counters Managed Print Service Providers |

| By Geography | UAE Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Product Formulation | Water-based Solvent-based UV-curable & EB-curable Latex & Other Advanced Formulations |

| By Market Segment | Large Print Service Providers & Converters SMEs (print shops, label & packaging converters) In-house & Corporate Printing Units Specialty & Niche Applications (3D, functional, security) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Sector | 100 | Production Managers, Sales Directors |

| Packaging Industry | 80 | Procurement Managers, Quality Assurance Heads |

| Textile Printing Applications | 70 | Textile Designers, Operations Managers |

| Advertising and Marketing Firms | 90 | Creative Directors, Marketing Managers |

| Office Supplies and Stationery | 60 | Retail Managers, Supply Chain Coordinators |

The GCC Specialty Printing Consumables Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand for high-quality printing solutions across various sectors, including packaging, textiles, and signage.