Region:Middle East

Author(s):Rebecca

Product Code:KRAB7032

Pages:89

Published On:October 2025

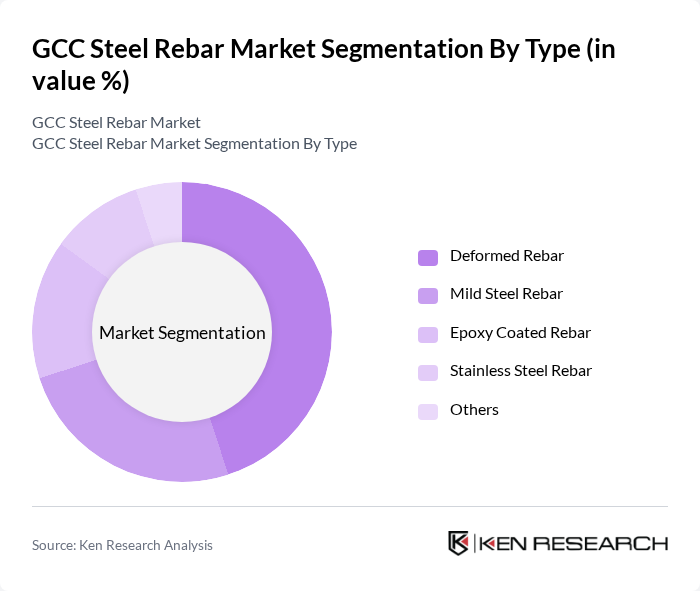

By Type:The market is segmented into various types of steel rebar, including Deformed Rebar, Mild Steel Rebar, Epoxy Coated Rebar, Stainless Steel Rebar, and Others. Each type serves different applications and has unique properties that cater to specific construction needs.

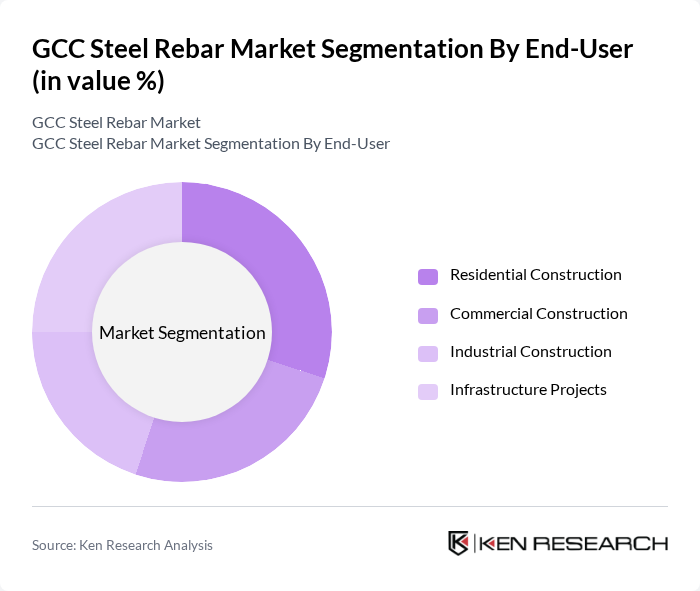

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, and Infrastructure Projects. Each segment reflects the diverse applications of steel rebar in various construction sectors.

The GCC Steel Rebar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Steel Industries, Qatar Steel Company, Al Ittefaq Steel Products Company, Saudi Iron and Steel Company (Hadeed), Oman United Steel Company, Gulf Steel Industries, AISI Steel, Universal Steel Company, Jindal Shadeed Iron & Steel LLC, Qatar National Cement Company, Al Rajhi Steel, SULB Company B.S.C., BRC Arabia, National Steel Company, Al-Falak Steel contribute to innovation, geographic expansion, and service delivery in this space.

The GCC steel rebar market is poised for significant transformation, driven by technological advancements and sustainability initiatives. As governments continue to prioritize infrastructure development, the demand for high-strength and eco-friendly rebar solutions is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and reduce costs. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Deformed Rebar Mild Steel Rebar Epoxy Coated Rebar Stainless Steel Rebar Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure Projects |

| By Application | Concrete Reinforcement Road Construction Bridge Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Government Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Infrastructure Developments | 80 | Construction Executives, Procurement Managers |

| Government Infrastructure Initiatives | 70 | Policy Makers, Urban Planners |

| Industrial Construction Projects | 60 | Operations Managers, Facility Planners |

| Steel Rebar Distribution Channels | 90 | Distributors, Supply Chain Managers |

The GCC Steel Rebar Market is valued at approximately USD 8.5 billion, driven by significant growth in the construction sector, urbanization, and government investments in infrastructure and housing projects across the region.