Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9063

Pages:91

Published On:November 2025

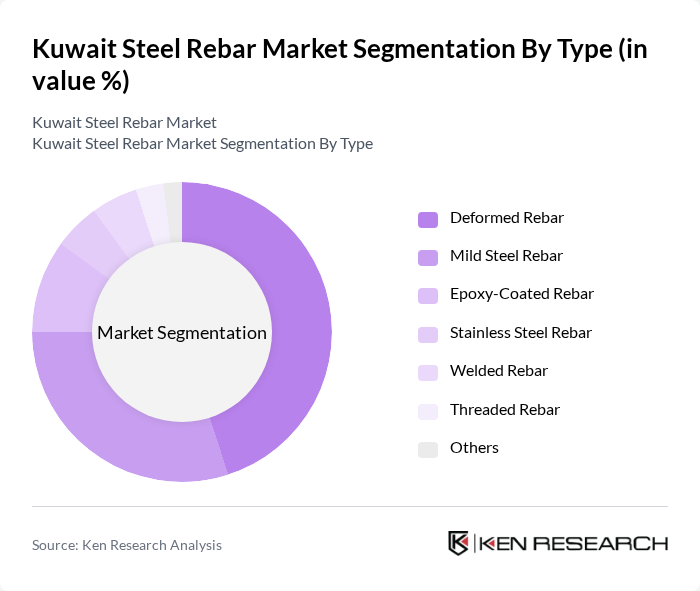

By Type:The market is segmented into various types of steel rebar, including Deformed Rebar, Mild Steel Rebar, Epoxy-Coated Rebar, Stainless Steel Rebar, Welded Rebar, Threaded Rebar, and Others. Among these, Deformed Rebar is the most dominant segment due to its superior tensile strength and resistance to corrosion, making it the preferred choice for construction projects. Mild Steel Rebar follows closely, favored for its cost-effectiveness and ease of use in various applications .

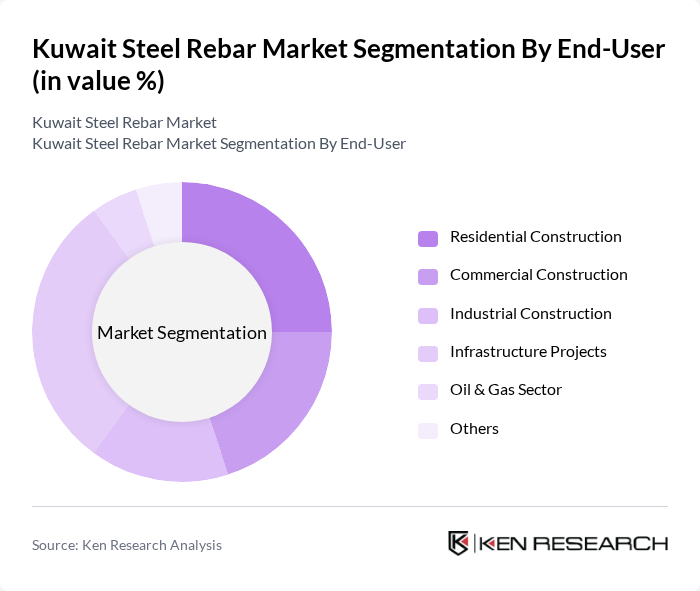

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Projects (Roads, Bridges, Ports, Airports), Oil & Gas Sector, and Others. The Infrastructure Projects segment is the leading end-user, driven by significant government investments in public works and urban development. Residential Construction is also a major contributor, reflecting the growing population and housing demand in Kuwait .

The Kuwait Steel Rebar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Steel (Kuwait Steel Manufacturing Company K.S.C.), United Steel Industrial Company (Kuwait Steel), Al Qatami Steel, Alghanim Industries (Steel Division), Al Jazeera Steel Products Co. (Oman, active in Kuwait market), Gulf Steel Industries (UAE, active in Kuwait market), Arabian Gulf Steel Industries (UAE, active in Kuwait market), Emirates Steel (UAE, active in Kuwait market), Rajhi Steel (Saudi Arabia, active in Kuwait market), Union Iron & Steel (UAE, active in Kuwait market), Watania Steel (Saudi Arabia, active in Kuwait market), Hamriyah Steel (UAE, active in Kuwait market), Jindal Shadeed Iron & Steel (Oman, active in Kuwait market), ArcelorMittal (active in GCC region), Al-Muhaidib Group (Saudi Arabia, active in Kuwait market) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait steel rebar market is poised for significant growth, driven by ongoing government investments in infrastructure and residential projects. As urbanization continues, the demand for high-strength rebar and eco-friendly materials is expected to rise. Additionally, advancements in production technologies will enhance efficiency and reduce costs. The market will likely see increased competition from alternative materials, necessitating innovation and adaptation among local producers to maintain market share and profitability in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Deformed Rebar Mild Steel Rebar Epoxy-Coated Rebar Stainless Steel Rebar Welded Rebar Threaded Rebar Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure Projects (Roads, Bridges, Ports, Airports) Oil & Gas Sector Others |

| By Application | Reinforced Concrete Structures Precast Concrete Products Foundations & Piling Road and Bridge Construction Tunnels & Metro Projects Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Al Asimah (Capital) Hawalli Farwaniya Ahmadi Jahra Mubarak Al-Kabeer Others |

| By Product Form | Cut and Bend Rebar Straight Rebar Coil Rebar Others |

| By Steel Grade | Grade 40 Grade 60 High Strength Steel (Grade 75 and above) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 60 | Project Managers, Site Engineers |

| Commercial Building Developments | 50 | Construction Supervisors, Architects |

| Infrastructure Projects (Bridges, Roads) | 40 | Government Officials, Civil Engineers |

| Rebar Manufacturing Sector | 40 | Production Managers, Quality Control Officers |

| Supply Chain and Distribution | 45 | Logistics Managers, Procurement Specialists |

The Kuwait Steel Rebar Market is valued at approximately USD 1.3 billion, driven by significant growth in the construction sector, which is supported by government investments in infrastructure and urban development projects.