Region:Middle East

Author(s):Rebecca

Product Code:KRAC2632

Pages:97

Published On:October 2025

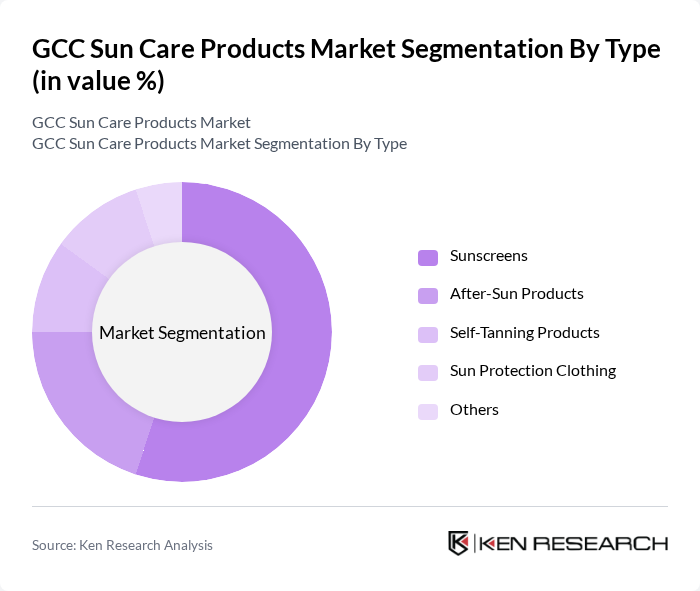

By Type:The market is segmented into various types, including Sunscreens, After-Sun Products, Self-Tanning Products, Sun Protection Clothing, and Others. **Sunscreens** dominate the market due to their essential role in protecting skin from harmful UV rays. The increasing awareness of skin cancer and other sun-related skin issues has led to a surge in sunscreen usage among consumers. **After-sun products** are also gaining traction as consumers seek to soothe and repair skin post-sun exposure. **Self-tanning products** are becoming popular among consumers looking for a bronzed look without sun exposure, while **sun protection clothing** is emerging as a fashionable and functional alternative for sun safety. The market also sees rising demand for products with added benefits such as antioxidants and natural ingredients .

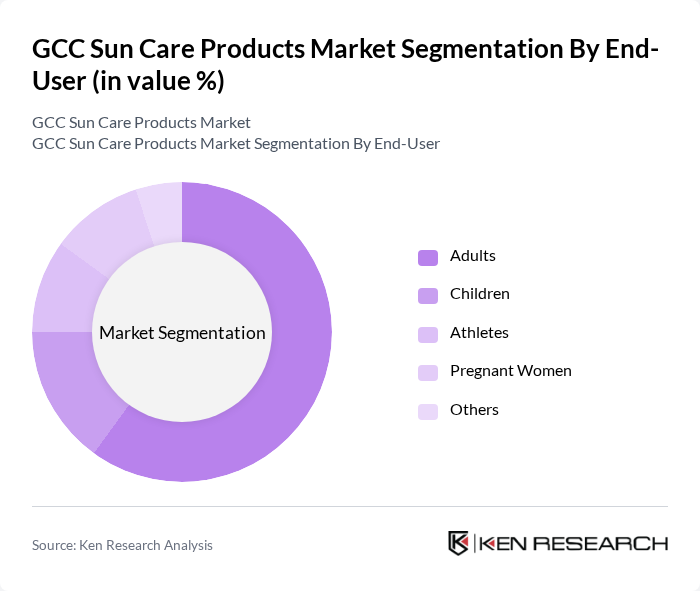

By End-User:The end-user segmentation includes Adults, Children, Athletes, Pregnant Women, and Others. **Adults** represent the largest segment, driven by heightened awareness of skin health and the increasing prevalence of skin-related issues. **Children’s products** are also in demand as parents prioritize sun safety for their kids. **Athletes** require specialized sun care products that offer long-lasting protection during outdoor activities, while **pregnant women** seek safe and effective options to protect their skin. The growing trend of outdoor activities, sports, and travel among all demographics further fuels the demand for sun care products .

The GCC Sun Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal S.A., Beiersdorf AG (NIVEA, Eucerin), Johnson & Johnson (Neutrogena, Aveeno), Unilever (Dove, Vaseline, Simple), Procter & Gamble Co. (Olay), Edgewell Personal Care (Banana Boat, Hawaiian Tropic), Shiseido Company, Limited, Estée Lauder Companies Inc. (Clinique), Coty Inc., Galderma S.A. (Cetaphil), La Roche-Posay (L'Oréal S.A.), Vichy Laboratories (L'Oréal S.A.), Bioderma Laboratories, Pierre Fabre Group (Avene), SunSense (Ego Pharmaceuticals) contribute to innovation, geographic expansion, and service delivery in this space .

The GCC sun care products market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As awareness of skin health continues to rise, brands are expected to innovate with multifunctional products that cater to diverse consumer needs. Additionally, the increasing integration of e-commerce platforms will facilitate broader market access, allowing brands to reach untapped demographics. Sustainability will also play a pivotal role, with companies focusing on eco-friendly practices to align with consumer values.

| Segment | Sub-Segments |

|---|---|

| By Type | Sunscreens After-Sun Products Self-Tanning Products Sun Protection Clothing Others |

| By End-User | Adults Children Athletes Pregnant Women Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Price Range | Premium Mid-range Budget |

| By Formulation | Creams & Lotions Gels Sprays Sticks Oils |

| By SPF Range | SPF 0-30 SPF 31-50 SPF Above 50 |

| By Ingredient Type | Chemical Filters Physical (Mineral) Filters Natural Ingredients |

| By Consumer Group | Men Women Kids |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Occasional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sun Care | 100 | General Consumers, Skincare Enthusiasts |

| Retail Insights on Sun Care Products | 60 | Store Managers, Category Buyers |

| Dermatological Perspectives on Sun Care | 40 | Dermatologists, Skincare Specialists |

| Brand Perception Studies | 80 | Marketing Managers, Brand Strategists |

| Distribution Channel Effectiveness | 50 | Logistics Managers, E-commerce Directors |

The GCC Sun Care Products Market is valued at approximately USD 1.1 billion, driven by increased awareness of skin health, rising disposable incomes, and high UV exposure in the region, necessitating effective sun protection solutions.