Region:Middle East

Author(s):Rebecca

Product Code:KRAE0937

Pages:89

Published On:December 2025

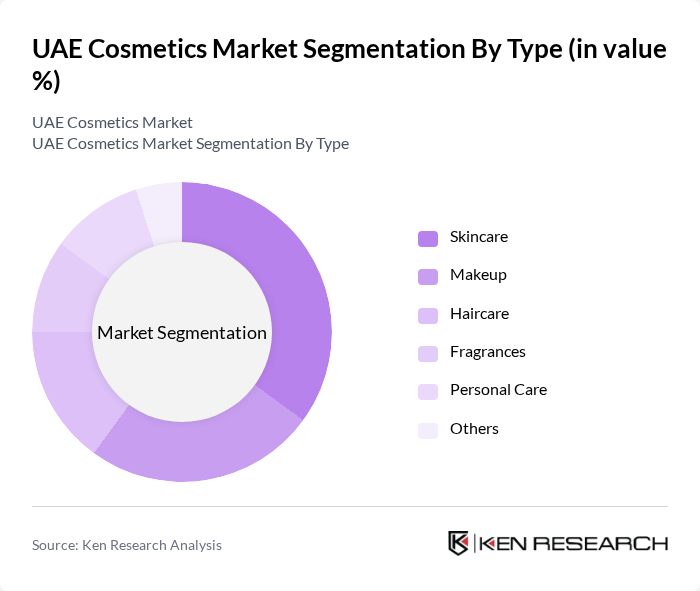

By Type:The cosmetics market is segmented into various types, including skincare, makeup, haircare, fragrances, personal care, and others. Among these, skincare products dominate the market due to increasing consumer awareness about skin health and the rising popularity of natural and organic ingredients. The demand for anti-aging and moisturizing products is particularly high, driven by a growing focus on personal grooming and wellness.

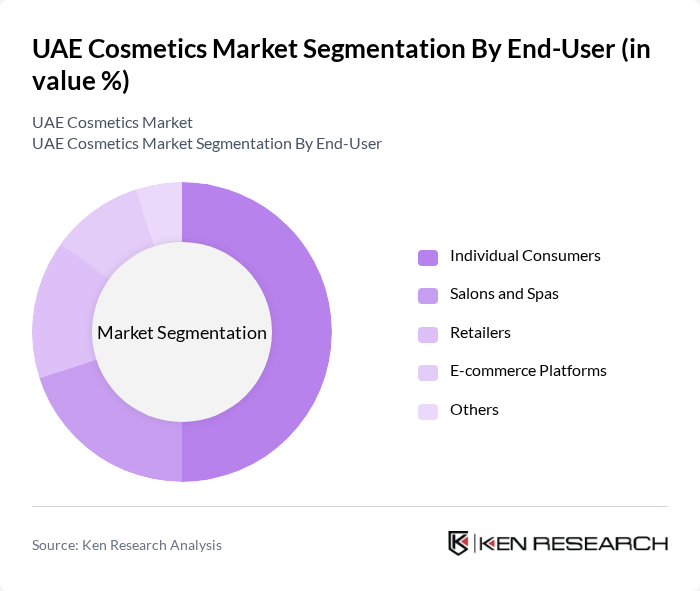

By End-User:The end-user segmentation includes individual consumers, salons and spas, retailers, e-commerce platforms, and others. Individual consumers represent the largest segment, driven by the increasing trend of personal grooming and beauty consciousness among the population. The rise of social media influencers and beauty bloggers has also significantly impacted consumer purchasing behavior, leading to higher sales in this segment.

The UAE Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Amouage, Huda Beauty, Fenty Beauty, Olay, L'Oréal Middle East, Estée Lauder Companies, Shiseido, Unilever, Procter & Gamble, Revlon, Maybelline, Nivea, The Body Shop, and Sephora contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cosmetics market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and clean beauty will likely shape product development, with brands prioritizing eco-friendly ingredients and packaging. Additionally, the rise of personalized beauty solutions, facilitated by data analytics and AI, will enhance customer engagement. As e-commerce continues to thrive, brands that adapt to these trends will be well-positioned to capture market share and meet the demands of a diverse consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Haircare Fragrances Personal Care Others |

| By End-User | Individual Consumers Salons and Spas Retailers E-commerce Platforms Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Specialty Stores Others |

| By Price Range | Premium Mid-range Budget Others |

| By Ingredient Type | Natural Synthetic Organic Others |

| By Age Group | Children Teenagers Adults Seniors Others |

| By Gender | Female Male Unisex Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 150 | Women aged 18-45, Skincare Enthusiasts |

| Makeup Consumers | 120 | Women aged 18-35, Makeup Artists, Influencers |

| Fragrance Buyers | 100 | Men and Women aged 25-50, Retail Customers |

| Natural/Organic Product Users | 80 | Health-conscious Consumers, Eco-friendly Advocates |

| Online Shoppers | 90 | Frequent Online Buyers, E-commerce Users |

The UAE cosmetics market is valued at approximately USD 395 million. This growth is driven by the country's status as a tourism hub, increasing consumer preferences for luxury products, and the rise of online retail channels.