Region:Middle East

Author(s):Shubham

Product Code:KRAC4236

Pages:83

Published On:October 2025

By Type:The market is segmented into various types of toasters, including Pop-Up Toasters, Toaster Ovens, Conveyor/Commercial Toasters, Smart Toasters, 2-Slice Toasters, 4-Slice Toasters, and Others (e.g., Sandwich Toasters, Specialty Toasters). Among these, Pop-Up Toasters hold the largest share due to their convenience and ease of use, making them a staple in most households. The increasing trend of quick breakfast solutions and the growing preference for compact, user-friendly appliances have led to higher demand for these products. Smart Toasters are gaining traction as consumers seek advanced features such as digital controls, customizable browning, and connectivity .

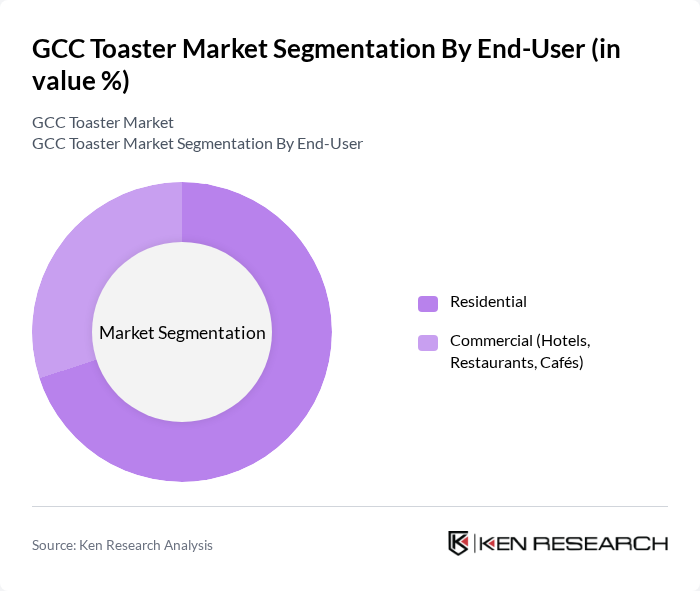

By End-User:The market is divided into Residential and Commercial segments. The Residential segment is the largest, driven by the growing number of households, the increasing trend of home cooking, and the popularity of convenient breakfast appliances. Consumers are investing in kitchen appliances that offer efficiency and ease of use, leading to a surge in demand for toasters. The Commercial segment, which includes hotels, restaurants, and cafés, is also significant as these establishments require high-capacity toasters to meet customer demands. The growth of the hospitality sector in the GCC further supports commercial toaster sales .

The GCC Toaster Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Domestic Appliances, Breville Group Limited, Cuisinart (Conair Corporation), Black+Decker (Stanley Black & Decker, Inc.), Hamilton Beach Brands Holding Company, Kenwood Limited (De'Longhi Group), Tefal (Groupe SEB), Morphy Richards, Panasonic Corporation, Smeg S.p.A., Oster (Newell Brands), Russell Hobbs (Spectrum Brands), De'Longhi S.p.A., West Bend (Focus Products Group International, LLC), Sharp Corporation, Nikai Group (UAE), Geepas (Western International Group, UAE), Aftron (Al-Futtaim Group, UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC toaster market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As smart home technology becomes more prevalent, integration of IoT features in toasters is expected to gain traction. Additionally, the rising focus on health-conscious cooking will likely influence product development, with manufacturers introducing toasters that promote healthier meal options. These trends indicate a dynamic market landscape that will adapt to consumer needs and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Pop-Up Toasters Toaster Ovens Conveyor/Commercial Toasters Smart Toasters Slice Toasters Slice Toasters Others (e.g., Sandwich Toasters, Specialty Toasters) |

| By End-User | Residential Commercial (Hotels, Restaurants, Cafés) |

| By Sales Channel | Online Retail Offline Retail (Hypermarkets, Supermarkets, Specialty Stores) Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Design | Classic Design Modern Design Retro Design |

| By Functionality | Basic Functionality Multi-Functionality (e.g., Defrost, Reheat, Bagel) Programmable/Smart Features |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Toasters | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Kitchen Appliances | 120 | Homeowners, Apartment Dwellers |

| Market Trends in Smart Appliances | 100 | Tech Enthusiasts, Early Adopters |

| Distribution Channels for Toasters | 80 | Distributors, Supply Chain Managers |

| Consumer Feedback on Toaster Features | 110 | Product Reviewers, Cooking Enthusiasts |

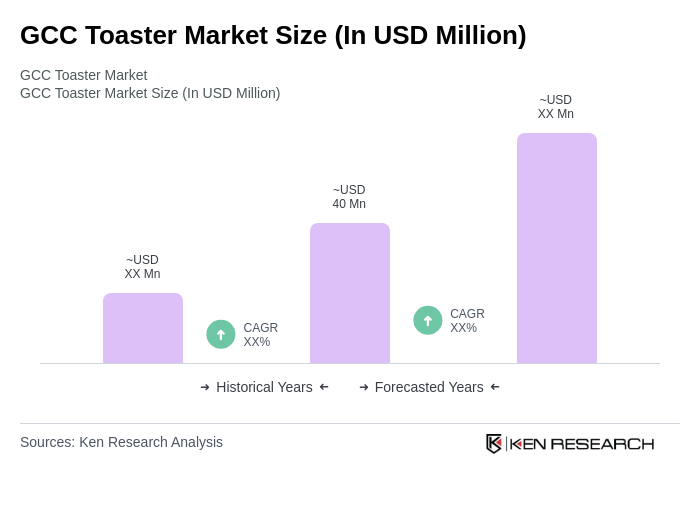

The GCC Toaster Market is valued at approximately USD 40 million, driven by increasing consumer demand for convenient kitchen appliances, urbanization, and a growing middle-class population in the region.