Region:Asia

Author(s):Rebecca

Product Code:KRAC4636

Pages:95

Published On:October 2025

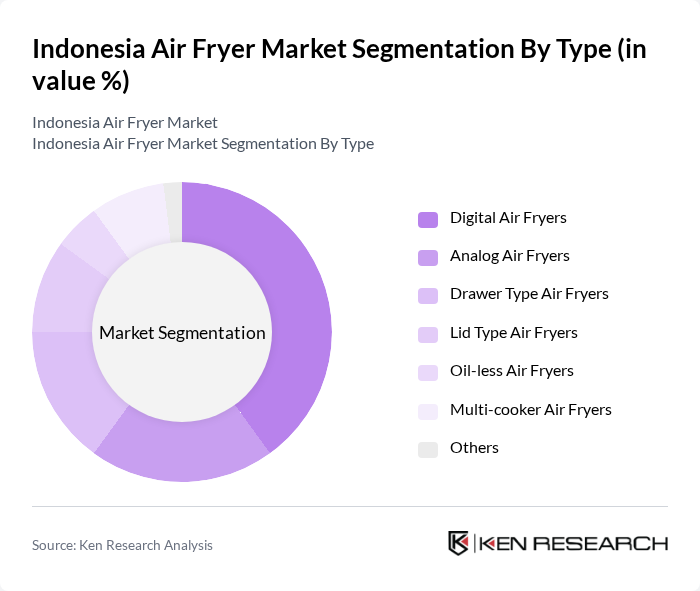

By Type:The air fryer market in Indonesia is segmented into Digital Air Fryers, Analog Air Fryers, Drawer Type Air Fryers, Lid Type Air Fryers, Oil-less Air Fryers, Multi-cooker Air Fryers, and Others. Digital Air Fryers are leading the market due to advanced features such as touch screen panels, quick preheating, and precise temperature control, which appeal to consumers seeking convenience and consistent cooking results. The growing preference for smart kitchen appliances and multifunctional capabilities further strengthens the position of digital models.

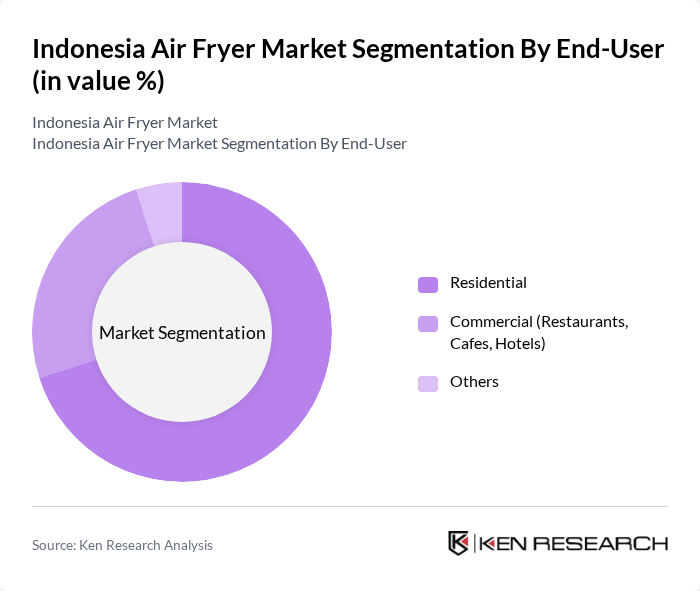

By End-User:The market is segmented into Residential, Commercial (Restaurants, Cafes, Hotels), and Others. The Residential segment dominates the market, driven by the increasing trend of home cooking, the rise in health-conscious consumers, and the integration of air fryers as a staple household appliance. Commercial adoption is growing in restaurants and hotels, where air fryers are valued for their energy efficiency and ability to deliver healthier menu options.

The Indonesia Air Fryer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Indonesia, Panasonic Gobel Indonesia, Sharp Electronics Indonesia, Tefal Indonesia, Maspion Group, Oxone Indonesia, Miyako Indonesia, Cosmos Indonesia, Electrolux Indonesia, LG Electronics Indonesia, Xiaomi Indonesia, Sanken Indonesia, Sanex Indonesia, Mito Indonesia, Hock Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia air fryer market appears promising, driven by increasing health awareness and technological advancements. As consumers continue to prioritize healthier cooking methods, the demand for air fryers is expected to rise. Additionally, the integration of smart technologies into kitchen appliances will likely attract tech-savvy consumers, further boosting market growth. Companies that adapt to these trends and invest in consumer education will be well-positioned to capitalize on emerging opportunities in this dynamic market.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Air Fryers Analog Air Fryers Drawer Type Air Fryers Lid Type Air Fryers Oil-less Air Fryers Multi-cooker Air Fryers Others |

| By End-User | Residential Commercial (Restaurants, Cafes, Hotels) Others |

| By Sales Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Specialty Stores, Supermarkets/Hypermarkets, Electronics Stores) Direct Sales Others |

| By Price Range | Budget (Below IDR 1.5 million) Mid-range (IDR 1.5–3 million) Premium (Above IDR 3 million) |

| By Brand | Local Brands International Brands Private Labels |

| By Product Features | Smart Features (App Connectivity, Voice Control) Non-stick Coating Capacity Variants (Small: <3L, Medium: 3–5L, Large: >5L) |

| By Distribution Mode | Direct Distribution Distributor Networks E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Air Fryers | 120 | Home Cooks, Health-Conscious Consumers |

| Retailer Feedback on Air Fryer Sales | 80 | Store Managers, Appliance Buyers |

| Manufacturer Perspectives on Market Trends | 60 | Product Managers, Sales Directors |

| Expert Opinions from Culinary Professionals | 40 | Chefs, Nutritionists |

| Market Analysts' Insights on Consumer Behavior | 50 | Market Researchers, Industry Analysts |

The Indonesia Air Fryer Market is valued at approximately USD 140 million, reflecting its status as a fast-growing segment within the broader household appliances sector, which is valued at USD 13.76 billion.