Region:Asia

Author(s):Shubham

Product Code:KRAA8645

Pages:98

Published On:November 2025

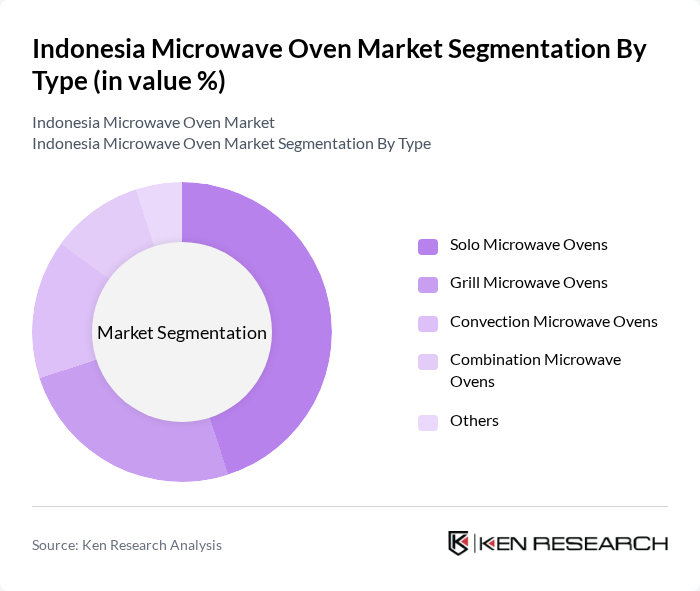

By Type:The market is segmented into Solo Microwave Ovens, Grill Microwave Ovens, Convection Microwave Ovens, Combination Microwave Ovens, and Others. Solo Microwave Ovens remain the most popular due to their cost-effectiveness and straightforward functionality, making them suitable for daily cooking tasks. Grill and Convection Microwave Ovens are increasingly favored as consumers seek appliances that offer greater versatility and advanced cooking features.

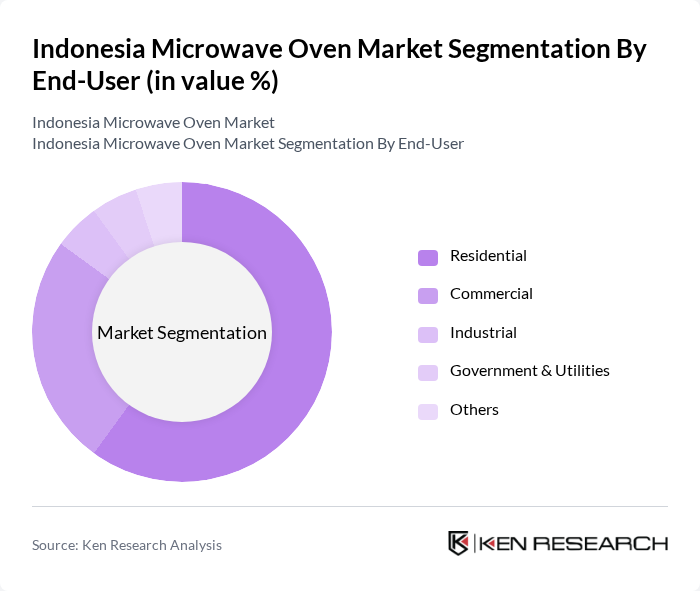

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment leads the market, supported by the rising number of households and a growing preference for home cooking. The Commercial segment is also prominent, driven by restaurants, cafes, and food service outlets adopting microwave ovens for rapid meal preparation and reheating.

The Indonesia Microwave Oven Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic, LG Electronics, Samsung Electronics, Sharp Corporation, Electrolux, Toshiba, Midea Group, Smeg, Haier, Philips, Whirlpool, Beko, Hisense, Cuckoo Electronics, Polytron, Sharp Indonesia, National Panasonic Indonesia, Samsung Indonesia, LG Indonesia, Midea Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microwave oven market in Indonesia appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart appliances is expected to rise, with smart microwave ovens projected to capture a significant market share. Additionally, the increasing focus on energy efficiency will likely lead to innovations in eco-friendly microwave designs, aligning with the growing consumer trend towards sustainability and responsible consumption.

| Segment | Sub-Segments |

|---|---|

| By Type | Solo Microwave Ovens Grill Microwave Ovens Convection Microwave Ovens Combination Microwave Ovens Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Price Range | Budget Mid-range Premium Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Features | Smart Features Energy-efficient Models Multi-functionality Others |

| By Application | Cooking Reheating Defrosting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Microwave Ovens | 100 | Store Managers, Sales Associates |

| Consumer Preferences and Buying Behavior | 120 | Household Decision Makers, Young Professionals |

| Market Trends in E-commerce | 100 | E-commerce Managers, Digital Marketing Specialists |

| Distribution Channel Insights | 80 | Logistics Coordinators, Supply Chain Managers |

| Product Features and Innovations | 70 | Product Development Managers, R&D Engineers |

The Indonesia Microwave Oven Market is valued at approximately USD 230 million, driven by urbanization, rising disposable incomes, and changing consumer lifestyles that favor convenience in meal preparation.