Region:Middle East

Author(s):Dev

Product Code:KRAC3355

Pages:91

Published On:October 2025

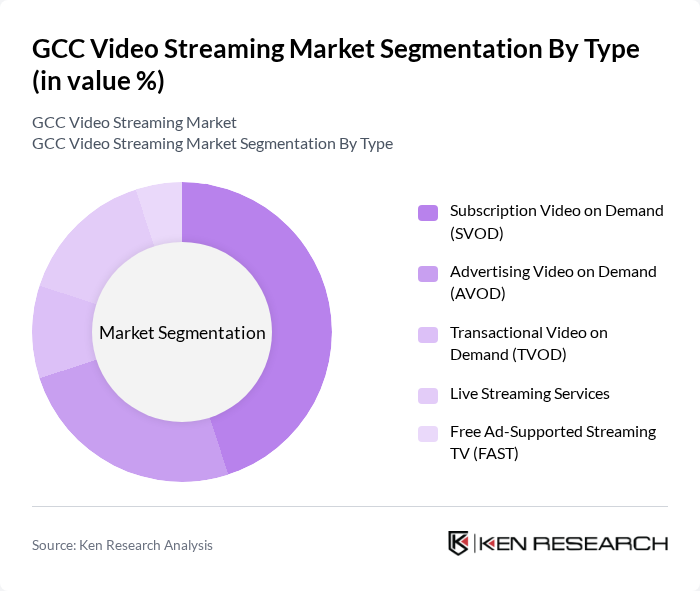

By Type:The video streaming market can be segmented into various types, including Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), Transactional Video on Demand (TVOD), Live Streaming Services, and Free Ad-Supported Streaming TV (FAST). Among these, Subscription Video on Demand (SVOD) has emerged as the leading segment, driven by consumer preferences for ad-free viewing experiences, exclusive content offerings, and the convenience of monthly or yearly subscription plans. The proliferation of platforms offering tailored and premium content, along with the region's high internet penetration and rising disposable income, has further propelled the growth of this segment .

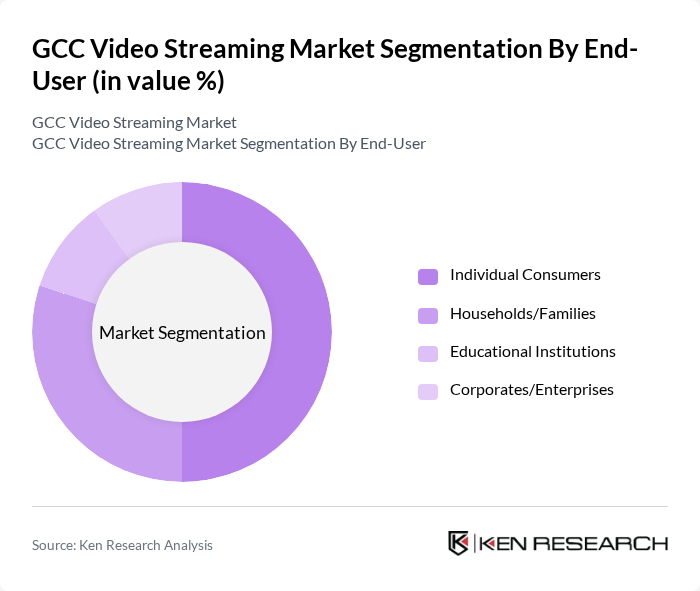

By End-User:The end-user segmentation includes Individual Consumers, Households/Families, Educational Institutions, and Corporates/Enterprises. Individual Consumers represent the largest segment, driven by the increasing trend of personalized content consumption and the convenience of accessing a wide range of entertainment options. Households/Families also contribute significantly, as streaming services cater to diverse viewing preferences within family units. Educational institutions and corporates are increasingly adopting streaming platforms for remote learning, training, and communication purposes .

The GCC Video Streaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, Inc., Amazon Prime Video, OSN Streaming, Shahid (MBC Group), Starzplay Arabia, Disney+, YouTube Premium, MBC Group, beIN Media Group, Apple TV+, Anghami, Eros Now, Viu (PCCW Media), TOD (beIN Media Group), Hulu, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC video streaming market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As mobile-first strategies gain traction, platforms will increasingly focus on enhancing user experience through personalized content recommendations and interactive features. The integration of AI and machine learning will further optimize content delivery, while the rise of original programming will attract diverse audiences. Overall, the market is expected to adapt dynamically to emerging trends, ensuring sustained engagement and revenue growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription Video on Demand (SVOD) Advertising Video on Demand (AVOD) Transactional Video on Demand (TVOD) Live Streaming Services Free Ad-Supported Streaming TV (FAST) |

| By End-User | Individual Consumers Households/Families Educational Institutions Corporates/Enterprises |

| By Content Genre | Movies TV Series & Shows Documentaries Sports & Live Events Kids & Animation Others |

| By Distribution Channel | Direct-to-Consumer (D2C) Platforms Third-Party Aggregators Telecom Operator Partnerships Smart TV App Stores Others |

| By Pricing Model | Monthly Subscription Annual Subscription Pay-Per-View (PPV) Freemium/Hybrid |

| By Device Type | Smart TVs Mobile Devices (Smartphones/Tablets) Laptops and Desktops Streaming Devices (e.g., Chromecast, Apple TV, Roku) Gaming Consoles |

| By User Demographics | Age Group Gender Income Level Nationality (Local/Expat) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Streaming Preferences | 120 | Regular Viewers, Occasional Users |

| Content Provider Insights | 80 | Content Managers, Licensing Executives |

| Advertising Effectiveness | 60 | Marketing Directors, Ad Sales Managers |

| Technology Adoption in Streaming | 50 | IT Managers, Platform Developers |

| Regulatory Impact Assessment | 40 | Policy Makers, Legal Advisors |

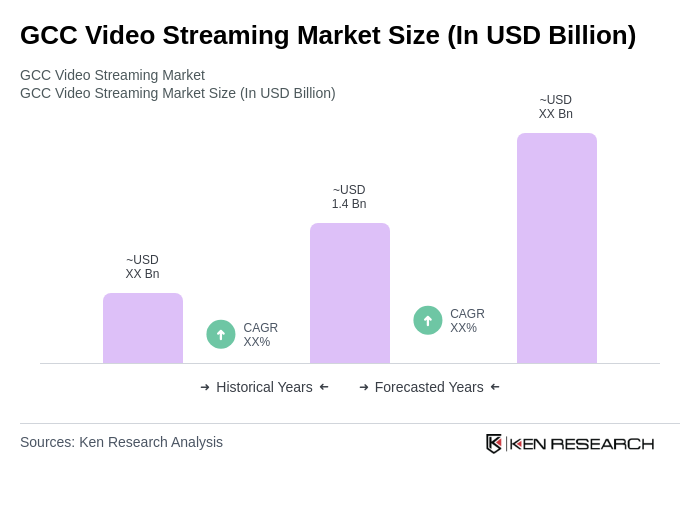

The GCC Video Streaming Market is valued at approximately USD 1.4 billion, driven by factors such as high-speed internet penetration, smart device proliferation, and a growing preference for on-demand content among consumers.